Stocks Extend Losses, Yields Spike After "Recession" Comments From Fed's Barkin

Federal Reserve Bank of Richmond President Thomas Barkin says “getting inflation under control is going to be necessary to set up what we have the potential to do in the economy.”

Barkin warned that "The Fed must curb inflation even if this causes a recession", adding that The Fed "needs to raise rates into restrictive territory".

“I’ve convinced myself that not getting inflation under control is inconsistent with a thriving economy”

Barkin further added that “I’ve been supportive of front-loading".

The Richmond Fed president's comments echoe'd ECB's Schnabel's words of warning that "even if we entered a recession, it’s quite unlikely that inflationary pressures will abate by themselves," Schnabel said.

"The growth slowdown is then probably not sufficient to dampen inflation."

It appears the world's central bankers are rapidly realizing that a recession is needed to tamp down inflation... and in fact, even that may not do the trick - this is a supply issue, not a demand issue.

Translation: we need a depression to 'fight' Putin!

This prompted further weakness in stocks with Nasdaq down 2%...

(Click on image to enlarge)

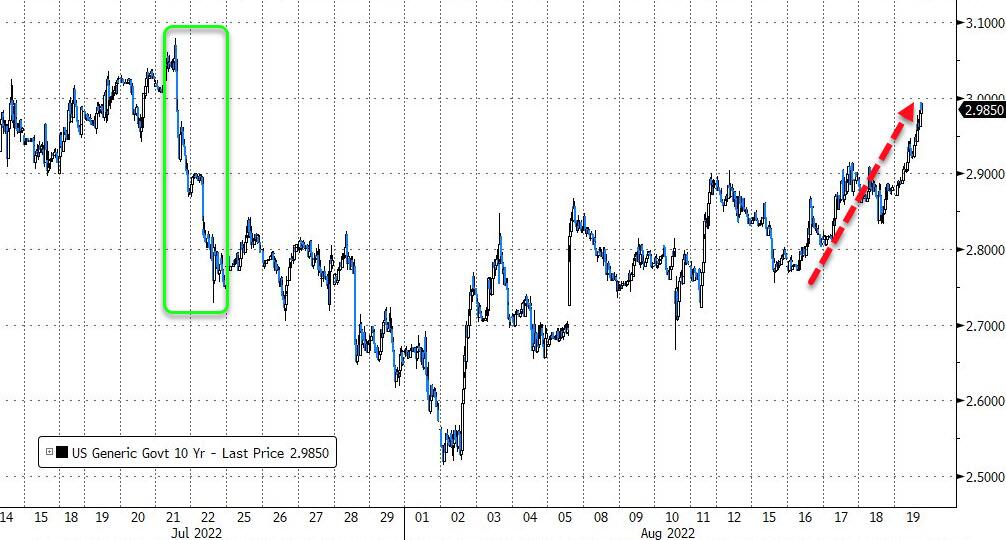

And yields spiking higher with 10Y inching closer to 3.00%...

(Click on image to enlarge)

...erasing all the price gains from the ECB/US-weak-data bond rally.

Is the scene being set for Powell to steal the jam out of the 'Fed Pivot' bulls' donut next week in J-Hole?

More By This Author:

GM Resumes Dividend, Hikes Buyback Authorization To $5 Billion

China Plans $230 Billion Fiscal Stimulus Package As Slowdown Worsens

Oil Surges On China "Reopening" Hopes As Goldman Says There Will Be No Iran Nuclear Deal

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more