China Plans $230 Billion Fiscal Stimulus Package As Slowdown Worsens

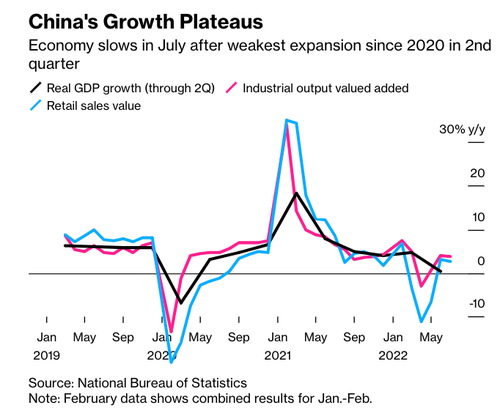

July's batch of macroeconomic data from China painted a troubling picture of slumping domestic demand, giving way to an unexpected interest rate cut earlier this week. Now there are more plans for stimulus in the form of fiscal, a move that Beijing could make to shore up its faltering economy, Bloomberg reported.

The China Securities Journal reported Thursday that local governments could issue an additional 1.55 trillion yuan ($229 billion) in special debt and bonds to drive infrastructure investment.

The third quarter "will be an important window for sales of additional local government special bonds," Zhang Yiqun, a member of the Society of Public Finance of China, said, quoted by Shanghai Securities News.

The newspaper also cited Luo Zhiheng, chief economist at Yuekai Securities, who noted the sale of the special bonds might also be brought forward and utilized in the fourth quarter of this year.

Even though Beijing has not officially announced this news, China's economic data from July shows a worsening industrial slowdown and slumping retail sales that resulted in an unexpected rate cut. Perhaps, Beijing is getting the message about the need to shore up its economy after the disastrous zero-Covid policy and property crunch.

Economists at Goldman Sachs are turning bearish on China. Maggie Wei lowered her gross domestic product growth estimate to 3% from 3.3%.

Taking into account the weaker-than-expected July data as well as near-term energy constraints, we cut our Q3 real GDP growth forecast from 17.5% (qoq annualized) to 14.0%, but lift our Q4 forecast from 4.0% (qoq annualized) to 5.0% on the assumption of easing energy constraints in Q4. These adjustments imply 3.5% yoy growth in Q3 and 3.3% yoy in Q4 (previously 4.3% and 3.8%, respectively). Our 2022 full-year forecast falls even further below consensus, to 3.0% (from 3.3% previously).

Nomura's Chief China Economist, Ting Lu, warned of the Covid Zero policy consequences and "deteriorating property sector, local governments' worsening fiscal conditions, and a likely slowdown in export growth."

The unexpected rate cut and news of the proposed fiscal stimulus package come as President Xi Jinping said Thursday that China is opening up its economy.

More By This Author:

Oil Surges On China "Reopening" Hopes As Goldman Says There Will Be No Iran Nuclear Deal

Initial Claims Drop From 10 Month High As Continuing Claims Keep Rising

FOMC Minutes: Anticipation For "Ongoing Rate Increases", But Risk Fed Could Tighten More Than Necessary

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more