Stellar Demand For 5Y Treasury Auction As Yield Despite Lowest Yield Since August

One day after a strong 2Y auction, moments ago the Treasury sold $43BN in an even stronger sale of 5Y paper.

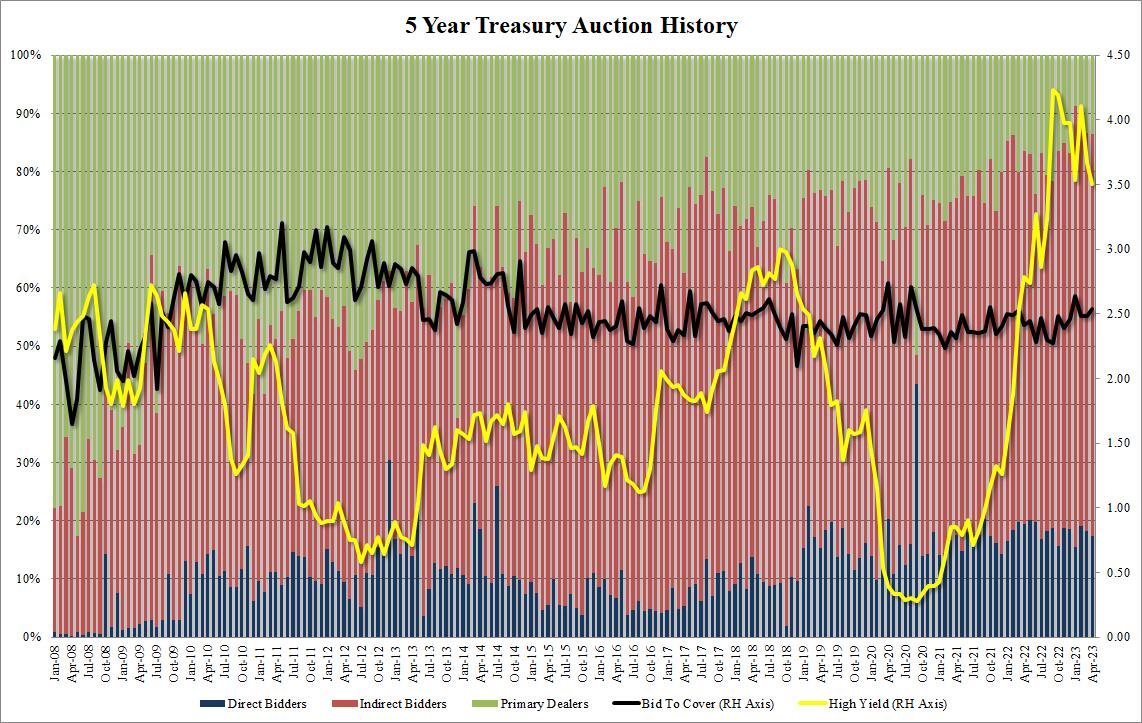

Stopping at a high yield of 3.500%, this was not only below last month's 3.665% but it was also the lowest 5Y yield since August 2022 when the tenor priced at 3.23%. It also stopped through the When Issued 3.506% by 0.6bps, the second straight stop through in a row.

The bid to cover was also solid, rising to 2.54, the highest since January and well above the 2.49 six-auction average.

The internals were also solid, with Indirects awarded 69.1% of the auction, the highest since February and above the recent average of 68.8%. And with Directs taking down 17.3%, or just under the recent average of 17.3%, Dealers were left with 13.6% of the auction, or right on top of the six-auction average.

Overall, this was a very solid auction and one which took place just as the 10Y hit session highs, thus providing buyers with at least a modest concession.

(Click on image to enlarge)

More By This Author:

MSFT Shares Jump After Top- & Bottom-Line Beat, But Cloud Growth Slowed

ESG ETF Inflows Slow Quicker Than The Broader ETF Industry As "Greenwashing" Concerns Mount

US Home Price Growth Slowest In A Decade, San Francisco Crashes

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more