MSFT Shares Jump After Top- & Bottom-Line Beat, But Cloud Growth Slowed

Image Source: Pixabay

After a broadly ugly day, MSFT has brightened things up after hours with a top- and bottom-line beat, cloud performing better than expected, sending stocks higher.

Top- and Bottom-Line beat expectations

- Revenue was $52.9 billion (vs 51.03 bn exp) and increased 7% (up 10% in constant currency)

- Diluted earnings per share was $2.45 (vs $2.24 exp) and increased 10% (up 14% in constant currency)

“The world's most advanced AI models are coming together with the world's most universal user interface - natural language - to create a new era of computing,” said Satya Nadella, chairman and chief executive officer of Microsoft.

“Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.”

By segment, they also beat across the board with but revenue growth from Azure slowed to 27% (in line with expectations) from 31% in the prior quarter.

- Productivity and Business Processes revenue $17.52 billion, estimate $17.1 billion

- Intelligent Cloud revenue $22.08 billion, estimate $21.89 billion

- More Personal Computing revenue $13.26 billion, estimate $12.15 billion

- Microsoft Cloud revenue $28.5 billion, estimate $28.19 billion

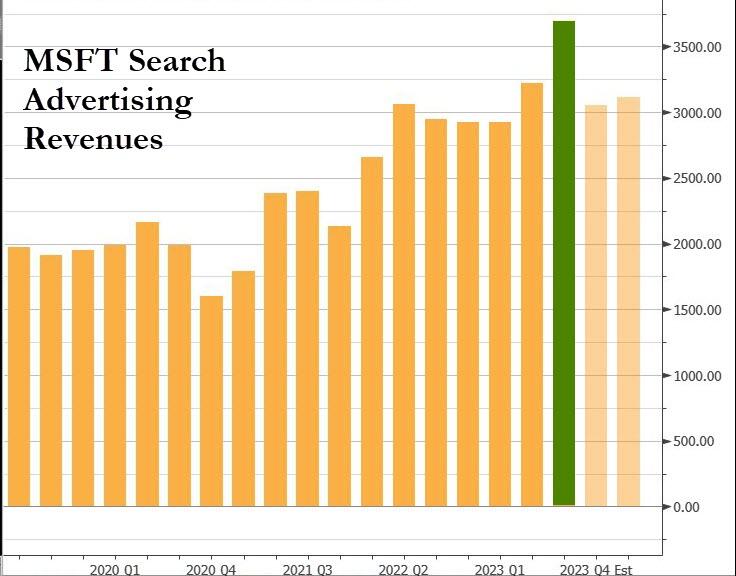

Notably, Search advertising revenue jumped 13% (on a constant currency basis), up dramatically as Bing integrated ChatGPT...

For now,. MSFT shares are soaring after hours.

(Click on image to enlarge)

Finally, we note that Microsoft has said that it will provide forward-looking guidance in connection with this quarterly earnings announcement on its earnings conference call and webcast.

So brace for some more volatility.

More By This Author:

ESG ETF Inflows Slow Quicker Than The Broader ETF Industry As "Greenwashing" Concerns Mount

US Home Price Growth Slowest In A Decade, San Francisco Crashes

Bed Bath & Beyond Files For Chapter 11 Bankruptcy

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more