Rising Yield Curve Means Rising Market

“Davidson” submits:

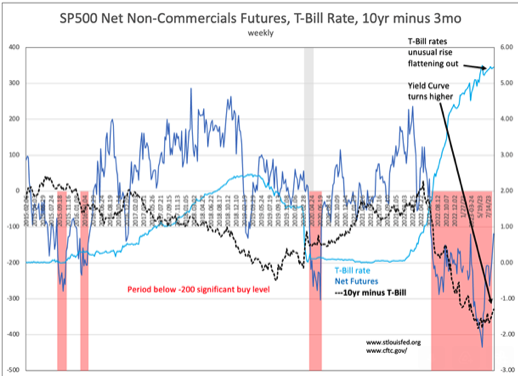

A rising Yield Curve is what we are seeing today. The turn higher began after hitting what appears to be the low point,-1.89%, on May 4, 2023. At Friday’s close, Aug 18, 2023, it reached 1.29% or 0.60% rise in ~3mos. This is as rapid a relief pace to pessimism as we saw the build in pessimism from Oct 2022. The SP500 Net Non-Commercial Futures chart provides the near term detail view weekly shift in pessimism with a -434.2 for the week of June 6th moving to -118.4 Aug 18th. Market psychology does shift that quickly and it is months after the shifts in the SP500 which made its low Oct 12th 3577.3(closing price). Market prices precede consensus market psychology not as so often declared the reverse.

The market history of a rising Yield Curve, SP500 vs 10yr Treasury minus T-Bill Rate, must be understood in the behavior of institutional investors, their use of algorithms, economic trends, corporate reports , insider trading and consensus perception. It is a complex picture at first glance but distills fairly quickly when one has parsed the better corporate management teams. The better management teams are always headed by skilled CEOs. It is these individuals who provide value-oriented buy signals that signal timely opportunities at historically low Pr/Sales ratios. It is the individual situations that provide the basis for building individual portfolios that make investing a process within a market of stocks. This is opposed to the consensus thinking that it is a stock market.

Consensus opinion is that investing is all about calling the bottom in the SP500 or some other asset class. For the dominant investors, institutional investors with too much capital to analyze the details, their focus is calling the major turns in the major asset classes. They claim the movement of the indices defines the economic trend. The consensus is so sure of itself that it has titled the top issues “The Magnificent 7”. This represents the current concentration of capital and the price movement of the SP500. In my opinion, investors should not buy into these issues. Investors need to look where the consensus is not.

Paying attention to market detail is a distant path from the consensus. Each issue makes its own market lows (and highs) unique to themselves. Each company has its own economics and corporate culture responding to the ebb and flow of supply/demand. It is the smaller companies together that reflect the Top-Down picture. Eventually, it is the combined economics occurring with the smaller firms that emerge to drive the indices. The greatest value for investors is where consensus opinion is most negative on a company with an excellent management team. Negative sentiment with exceptional management is always an exceptional investment opportunity for the patient. If markets enter a sharp panic taking all issues lower over a short period, the insider buying activity by excellent managements coalesces into a market-wide insider buy signal. If a down-turn is drawn out, then the insider buy signals occur only as each issue reaches appropriate levels for each management. Regardless, it is the insiders who have established performance histories who buy shares at historically low Pr/Sales ratios reveal themselves as superb value investors. They are in the best position to know what is possible with their product line in the economic climate. The pricing changes are often dramatic when the consensus shifts from extreme pessimism to speculative optimism. These price rises do not impact the major indices till they are significantly large enough which is always later in the cycle. The better position for investors is more often than not be contrarian to consensus.

The Yield Curve shifts in emerging since May 4th reveal a flat T-Bill rate as 10yr Treasury rates rise. Some investors are recognizing the risks of inflation in my opinion. These few are exiting at-risk 10yr fixed income positions seeking to counter inflation by owning equities expecting better returns i.e., industrial and commodity-related issues. This is occurring when other investors have instituted an unusual market hedge betting on a consensus forecast of an economic/equity decline leading to lower 5yr-10yr rates and inflation falling towards 2%. The history of M2 expansion and inflation’s rise does not support this thinking.

“In the long-term, the United States Inflation Rate is projected to trend around 2.50 percent in 2024 and 2.40 percent in 2025, according to our econometric models.”

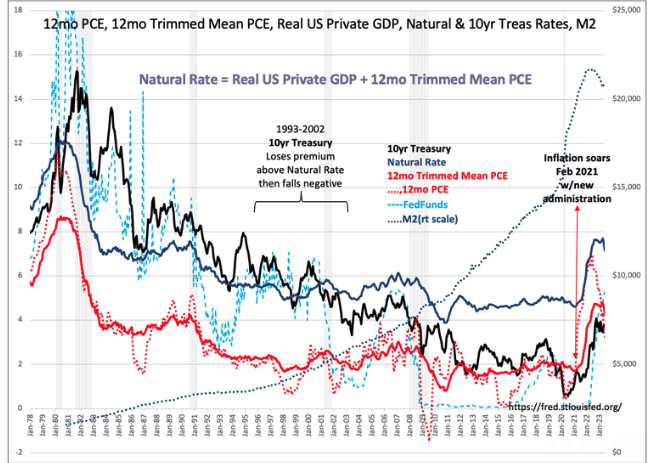

The 12mo PCE, 12mo Trimmed… is the complete history monthly of the Fed’s latest inflation measure(from 1978) vs. interest rates and M2. Inflation occurs, as Milton Friedman made clear, when M2 out-paces Real GDP(GDP adjusted for inflation). Restated, when the M2 grows faster than the Real economy the excess M2 inflates prices. In 1978 the Fed introduced the Trimmed Mean PCE to provide a less volatile inflation measure for better guidance on inflationary pressures over time. The PCE, shown as the Dashed …12mo PCE, is far more volatile than the Solid Red 12mo Trimmed PCE. Using Momentum Price techniques, the consensus has declared an inflation 2.5%-2.4% projection for 2024-25 using the PCE downward trend without regard to the reality of money supply growth vastly exceeding the ability of RGDP growth. M2 has soared 40% from 2020 vs. long-term US RGDP growth of ~3%. Some have begun to recognize the inflation’s ‘stickiness’ as the Solid Red 12mo Trimmed PCE holds above 4% and they are shifting out of 10yr maturities towards equities better able to withstand inflation. Oil and other commodity issues benefit from investors seeking inflation protection. If one examines the data, oil and commodities do not cause inflation. Misdirected government policies are the basis for inflation. Unless there is a reversal of the current path, inflation is likely to persist at the 4%-5% range and 10yr Treasury rates most likely will rise till there is a competitive return which appears to be at this point a 7%-8% level.

In Summary: In my opinion, as inflation persists, rates are likely to rise as investors seek protection owning equities of companies that have the ability to pass through inflation’s costs and remain profitable. Industrials, commodities, and consumer goods producing companies with high demand are favored. The current level of demand for personal vehicles and air travel favor these sectors among others but not exclusive. With “The Magnificent 7” dominating the SP500, the shifts higher in US industrials is barely perceptible. In my opinion, US industrials are likely to come into favor by Momentum Investors i.e. price-trend followers, and a sizable rise in the SP500 appears likely the next 3yrs or so. Meanwhile, investors would do well to avoid the “The Magnificent 7”.

More By This Author:

Truck Tonnage Remains In Uptrend

Nearly 1/2 Of SPR Gone

Real Retail Sales Steady, Income Rises

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more