Real Retail Sales Steady, Income Rises

Image Source: Pexels

“Davidson” submits:

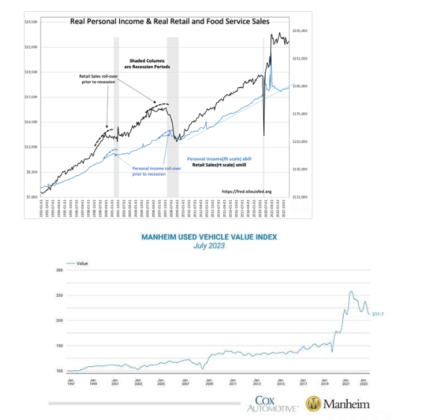

Adjusted for inflation, Real Retail Sales and Real Personal Income reflect economic activity that is rising more than the impact of inflation. Demand for goods and services is responsible for many corporations raising guidance and expanding facilities. Building facilities that incorporate newer lower cost means of raising output is a primary driver of economic activity that continues the rising trend in employment. This will hold till the deficits built during the COVID lockdowns have been fulfilled. In my estimate, this should last between 3yr-5yrs.

(Click on image to enlarge)

A proxy for unfulfilled demand is the Manheim Used Vehicle Index. This index remains elevated from levels pre-COVID and reflects a higher demand for used vehicles for basic transportation which is not being satisfied by new vehicle manufacturing. Currently at 211.7, this index will decline as the new vehicle supply normalizes and the index shifts towards 150-160 range. The current new Light Weight Vehicle sales are just under 16mil SAAR(Seasonally Adjusted Annual Rate). An 18mil SAAR pace for at least 2yrs is necessary to normalize current demand if there is no recession. There remains no indication that a recession is likely.

Economic data indicate economic expansion is continuing and likely to do so for several years. This is positive for equity prices even with persistent inflation and rising interest rates.

More By This Author:

Does The Fed Actually Set Rates?

More Upside Surprises And Upward Revisions

Economic Signs Continue To Be Positive

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more