Recession Probability If The Rest Of August Is Like The First Half

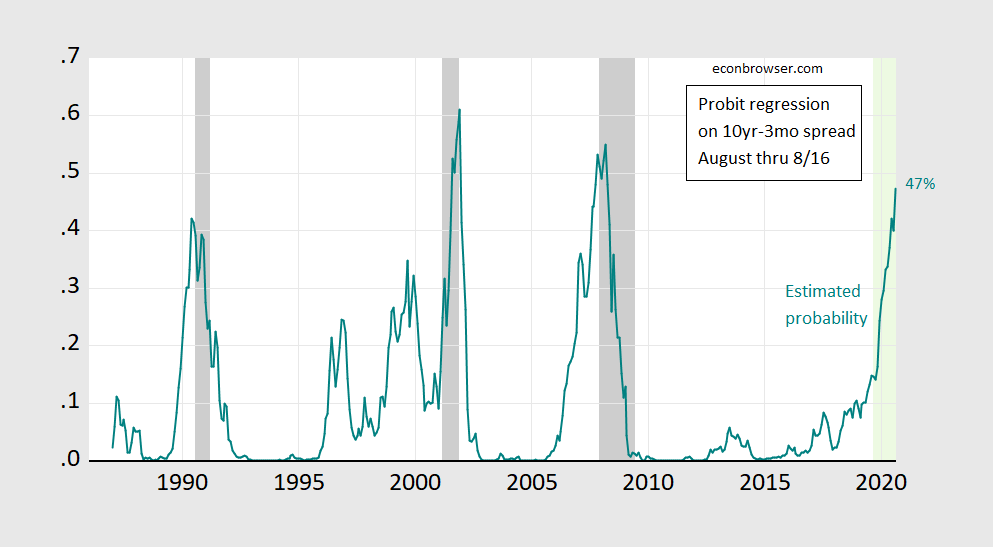

…using plain vanilla 10yr-3mo probit regression, over 1986M01-2019M08 period, using data shown below in Figure 1

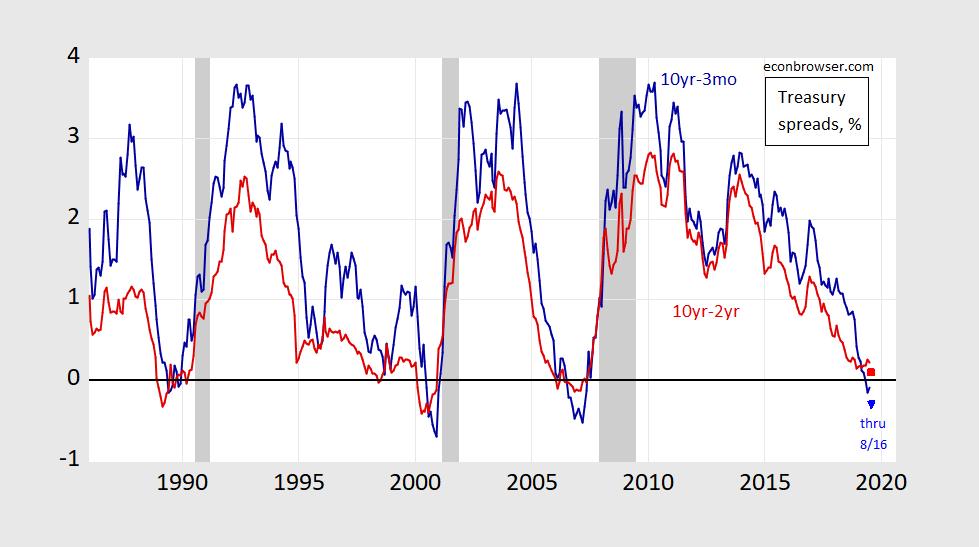

Figure 1: Treasury 10yr-3mo spread (blue), and 10yr-2yr spread (red), both in %. August observation is average over 8/1-16. NBER defined recession dates shaded gray. Source: Federal Reserve via FRED, Treasury, NBER, and author’s calculations.

The critical assumption is that the 10yr-3mo Treasury spread over the rest of August is the same as the first half, and the spread does not move toward zero, nor continue to fall.

The regression estimates:

Prob(recessiont+12) = -0.329 – 0.869 spreadt + ut+12

McFadden R2 = 0.29, NObs = 392. Coefficients significant at 5% msl bold. The spread is in percentage points.

Here are the predicted probabilities:

Figure 2: 12 month ahead probability from probit regression on 10yr-3mo spread, (teal). NBER defined recession dates shaded gray. Forecast period shaded light green. Source. NBER and author’s calculations.

If the rest of August is like the first half, then the probability of a recession in August 2020 is 47%.

Should one deliver a recession call? That would depend on the threshold. Over the last three recessions, a 40% threshold would catch all three recessions, and yield no false positives. 47% > 40%.

Obviously, if one believes this time is different — so one should use a term premium adjusted spread — the implied probability of recession would be lower (as demonstrated in this post).

Disclosure: None.