Rates Spark: More Recalibration

Market rates are still calibrating higher on the back of hawkish data and central bank rhetoric. The reflex is bear flattening highlighting the sensitivity of the market to central banks' and their stated data dependency. But the broader move remains the correction from the extremes at the end of last year which entailed a resteepening of curves

Image Source: Pexels

More recalibration on hawkish data and central bank rhetoric

The market reactions to the upside surprise in UK CPI and later the better-than-expected data out of the US highlights that the calibration of central bank cut expectations remains an important driver of rates in general.

But the knee-jerk bear flattening on the back of the releases also shows that this is more a near-term timing issue with regards to upcoming cuts, and not the if. This notion that cuts are coming has been confirmed by recent remarks from European Central Bank President Lagarde who said that the ECB could be in a position to cut rates in summer, although she did guard her message by the usual need for data dependency. More importantly, hawkish members like Nagel have also come around to this view that there will be cuts “sooner or later”.

But Lagarde also stressed a point that we have made before, and was also mentioned by her colleague Klaas Knot earlier on Wednesday. The easier financial conditions created by markets discounting steep cuts could eventually lead to central banks having to keep rates on hold for longer. Pricing fast and steep cuts can become self-defeating.

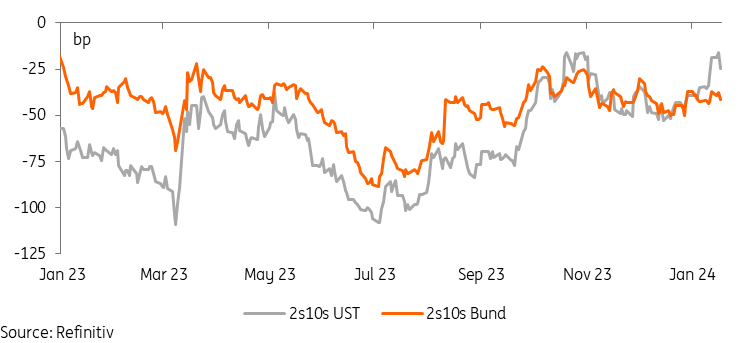

That in mind we might well push a more inverted (money market) curve in front of us for some time especially in EUR space. At the same time the bear flattening reactions such as the past sessions are taking place in what we still see as a broader corrective process coming from the very low rates witnessed at the end of last year. And this broader move was more driven by a resteepening of curves from the back end, especially in US space. Keep in mind the ECB seems more hesitant with regards to cuts having a narrower focus on inflation and potentially greater exposure to Middle East tensions.

While the 2Y-10Y UST curve came close to the highs of late October we think this still has a little more room to run, also eyeing a term premium that is still noticeably negative in the US. The latest tailed 20Y UST auction should add to the weight felt at the long end, but the topic of the term premium could return to the focus once the next quarterly refunding round by the US Treasury comes up at the end of this month. The counterbalancing factor could be indications that the Fed is moving closer to slowing the quantitative tightening process.

The UST 2-10Y curve has outsteepened Bunds can still see more of it

Events and market view

After a full agenda on Wednesday, Lagarde will be the only speaker from the ECB on Thursday. She’ll discuss European financial integration at the World Economic Forum, with also strained public budgets on the agenda. The ECB will also publish the minutes of the December meeting, where the central bank made a first subtle dovish shift even if already then pushing back against any notion of cuts following soon. In the US we have the Fed’s Bostic, who will elaborate on the economic outlook.

In terms of data, the agenda is light for Europe but US markets, on the other hand, will kick off with housing starts, building permits and also the closely watched weekly initial jobless claims. Consensus suggests initial jobless claims to come in around 205k, relatively stable compared to the 203k reported last week.

Primary market activity Thursday features a triple tranche Austrian syndication, consisting of a new 10Y benchmark alongside taps of Austria’s 10Y and 30Y green bonds. We will also see short to medium term and linker auctions from France and auctions out to the 15Y maturity from Spain. The US Treasury will sell a new 10Y TIPS.

More By This Author:

US Resilience Suggests The Fed Will Wait Until The Second Quarter Before Cutting RatesFX Daily: Enthusiasm Has Been Curbed

UK Inflation Unexpectedly Picks Up Amid Stubborn Services Price Rises

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more