Rates And Houses

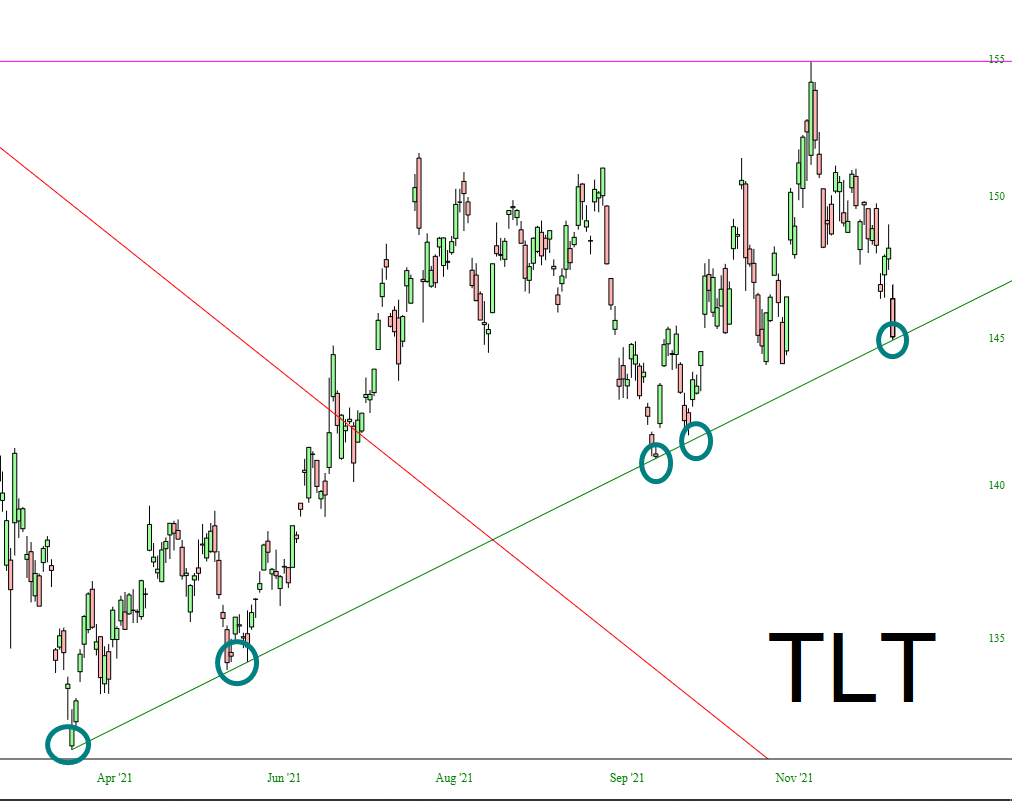

Bonds are getting hit very hard on this first trading day of the year. This is pretty much as low as TLT can go without breaking its intermediate-term uptrend. For ten months, this line has held fast, but given today’s move, interest rates are ripping higher (which lines up with the general idea that the Fed is going to be cranking rates for years to come).

(Click on image to enlarge)

One sector strongly affected by this is homebuilding since home affordability is closely tied to interest rates. Thus, as bonds fall, rates rise, monthly mortgage payments go up, and people are shut out of the market. Which is why we’re seeing hard reversals today in ITB…….

(Click on image to enlarge)

……and XHB:

(Click on image to enlarge)

The chart that remains the most interesting is IYR since it is sporting a very cool analog that I’ve written about two or three times already. The move we’re seeing lends some more credence to this analog, which suggests the real estate sector could have a grim 2022 ahead.

(Click on image to enlarge)

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more