Positively Not Negative

Last week, I discussed the debate regarding the Federal Reserve (Fed) policy and negative rates. In this week’s blog, I wanted to follow up on the “negative rate” theme, specifically as it relates to U.S. Treasury (UST) t-bill rates.

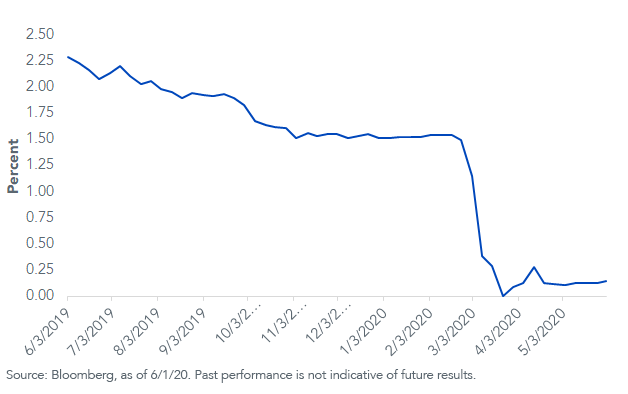

I have found there is little knowledge surrounding the fact that Treasury has an auction rule whereby t-bill yields can’t go negative at the actual auction itself. By rule, the lowest threshold for the high discount rate that is awarded is zero. The accompanying graph highlights where the 3-month t-bill rate has come in at the weekly auction for the last 12 months.

U.S. 3-Month T-Bill Auction High Discount Rate

Obviously, it has dropped considerably, but this is merely a reflection of the Fed’s rate-cutting policy that went into effect beginning in July of last year. In fact, the decline was pretty “orderly” until March, when the policymakers took dramatic action and dropped the Fed Funds target from 1.50%–1.75% to its current range of 0–0.25%.

If you look closely, the three-month t-bill auction rate did touch zero at the March 23 auction, but rose to 0.15% at this week’s auction, a touch above the current Fed Funds target mid-point. Interestingly, around the same time, the auction produced a “zero” rate, the three-month t-bill yield in the secondary market did briefly drop into negative territory. During the 3/18–3/27 period, the yield was negative each day, reaching a low point of -0.14%.

The key point: Under current Treasury auction rules, t-bill auction rates can’t go below zero, but yields can go negative in secondary market trading.

Looking ahead, I suspect the three-month t-bill yield could gravitate a bit higher. T-bills have been, and will most likely continue to be, the nation’s debt managers’ workhorse when it comes to Treasury financing. The three-month weekly auction size has already increased by a whopping $21 billion since March. Remember, the budget deficit is already swelling to more than $3 trillion, and it will most likely go even higher if Congress passes another rescue package this summer. Do I hear a $4 trillion deficit? This has to be funded—guess what instrument will continue to be overworked? That’s right, t-bills. Thus, if safe-haven demand begins to lessen (we’re seeing signs of this already), the supply/demand dynamic could very well shift, pushing yields higher, accordingly.

Bottom line: For fixed income portfolios, we continue to advocate a barbell approach where the ultra-short/short duration component utilizes a Treasury floating rate strategy. Treasury FRNs are reset each week with the UST three-month t-bill auction. The WisdomTree Floating Rate Treasury Fund (USFR) provides investors with the opportunity to take advantage of the t-bill auction rule I laid out here, and it may serve as principal protection as well. The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) is the other side of the barbell, adding to the balance with long-term income potential.

Unless otherwise stated, data source is Bloomberg, as of June 1, 2020.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more