Omicron Flattens The Yield Curve

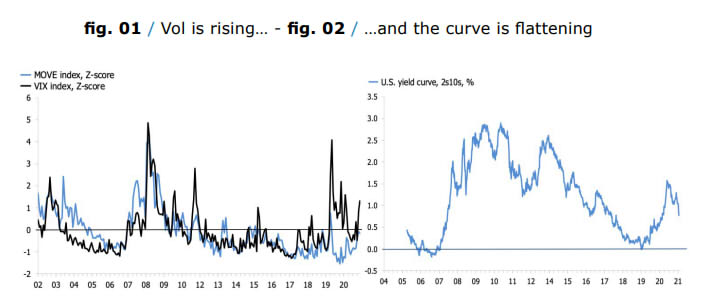

Apart from soul-searching on the endgame for COVID-19, the arrival of the Omicron variant seems to have had two relatively predictable effects on financial markets. Volatility has shot higher, and the yield curve has flattened. Put differently, stocks have sold off, and the long bond has rallied.

The MSCI World is down just under 4% from its peak at the start of November, and the U.S. 10-year yield is off some 25 bps. Neither of these numbers are dramatic, but they’re eye-catching, all the same.

I suspect these shifts are driven by both fears of Omicron—despite little hard evidence that it is the vaccine-evading super-bug everyone has feared—and the fact that monetary policymakers so far have had little interest in changing their stance. More specifically, Fed officials have said nothing to shift expectations that it is expected to taper QE to zero by the middle of next year, and start raising rates shortly thereafter.

In Europe, I also detect little evidence that the ECB is shifting its message that its emergency QE program, PEPP, will end in March. I won’t pass judgement on that story, though, until I see the new forecasts later this month. It’s interesting that many commentators have latched on to the idea that a new virus panic will be inflationary.

This makes sense, to an extent. Our collective response to the virus has been to support demand, while being comparatively helpless to alleviate the damage wrought on the supply side. Specifically, as Dom White articulated well recently, the policy response to COVID-19 has lifted demand for goods in the West, while stinging the supply of goods in the East.

We have seen this story play out with our own eyes, but I’d be more interested in an inflationary impulse from Omicron if the curve wasn’t doing what it is doing. Specifically, markets are now signalling that if the Fed pushes ahead with higher rates next year— after ending QE—it will be a short-lived hiking cycle.

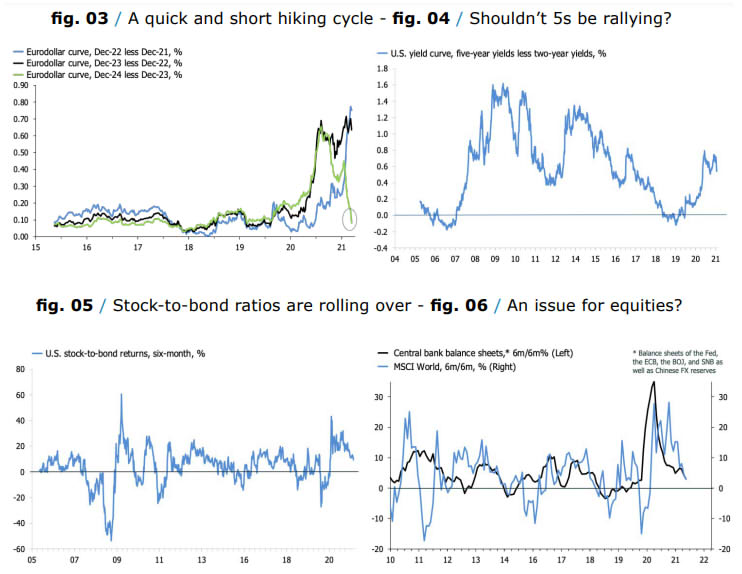

The move in Eurodollars is nothing short of spectacular. My third chart below shows that the rate expectations for 2022 and 2023 are holding up, but the curves for 2024 and 2025 are flattening, rapidly, even now inverting. It’s only a matter of time before the 23-22 curve gives up the ghost. It’s interesting to me that the 2s5s is holding up so well, even as the 2s10 has flattened sharply.

The result, obviously, is that the 5s10s is starting to look like a pancake. That’s all well and good, but the 2s5s can’t remain priced as is for long. In other words, if the trend in Eurodollars is anything to go by, 5-year cash bonds are a decent punt.

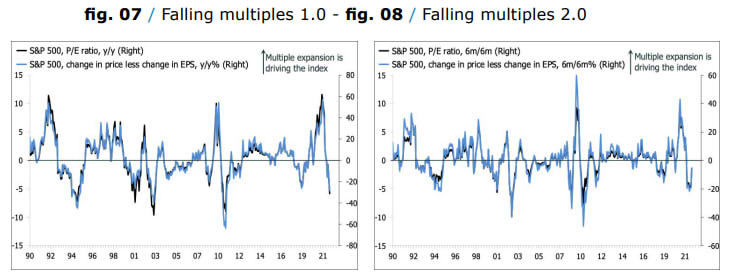

Meanwhile, for equities the story is more straightforward, at least in principle. The P/E multiple on the S&P 500 is no longer rising; it is in fact contracting slightly, as is the valuation of the MSCI World. In addition, trailing earnings are now rising at a much slower pace, even moving sideways. In combination, these two shifts points to falling prices, or at least, a slower advance.

In fact, through most of this year, a falling multiple hasn’t been an issue for the stock market, due to rapidly rising earnings, but now that the advance in profitability is plateauing, it is a becoming more of a challenge. This is especially the case in the context of a potentially valuation-crushing return of virus restrictions, and if not that, tightening monetary policy.

Analysts still expect everything to end well—when don’t they?—with earnings on the MSCI World and the S&P 500 rising by around 15% over the next 12 months. If that’s true, the multiple can come down further without knocking down prices. That would certainly be pleasant, but valuations are, in my view, now caught between a rock and a hard place.

If Omicron turns out as scary as we fear, surely that would hit multiples. If it isn’t, policy tightening will resume, also a threat for valuations. Or will it? Please don’t take this as a recommendation to sell stocks. After all, they usually go up, leaving investors with the relatively simple decision to decide when to buy the dip. What I am saying then is that this time probably hasn’t arrived yet.

Disclosure: None