Market Needed An Excuse To Pull Back – Israel Provided It

Image Source: Unsplash

I have recently written about the stock market rallying very far and very fast. A pullback was due. With Israel attacking Iran on Thursday night, the excuse for lower prices came. A 2-4% pullback would shake out the weak-handed holders I have been chirping about lately. You know those folks. They sold into the tariff tantrum plunge. They hate and disavowed the rally until the last few weeks. Then they bought near the peak and revised history to say they have been bulls for a while. Buy high. Sell low. Rinse and repeat.

2-4% lower would likely be a screaming buy unless the attack spreads regionally. And it’s Friday, so don’t be surprised if investors do not want to go home with max long exposure. It would be a moral victory for the stock market to close down 1% or less.

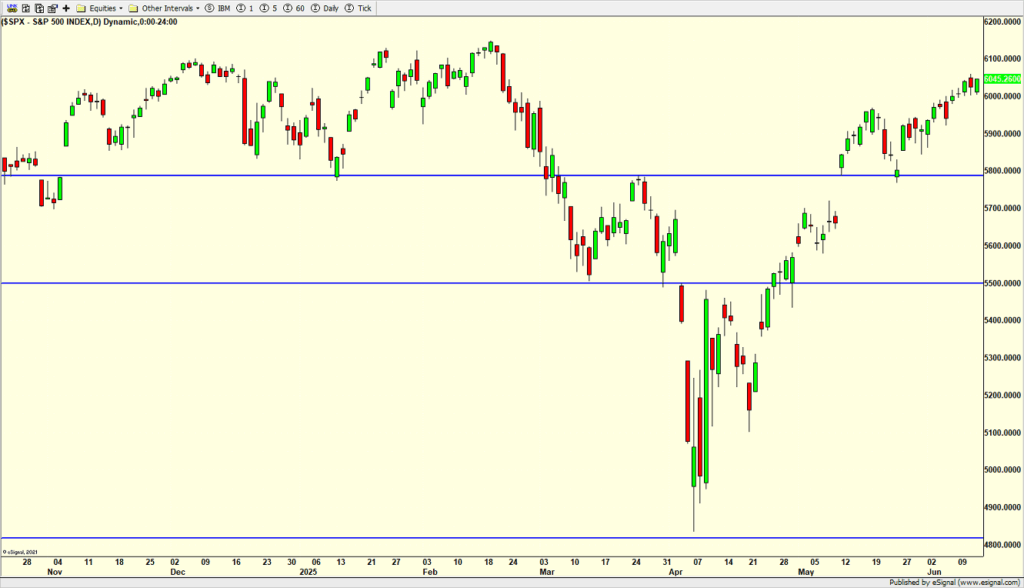

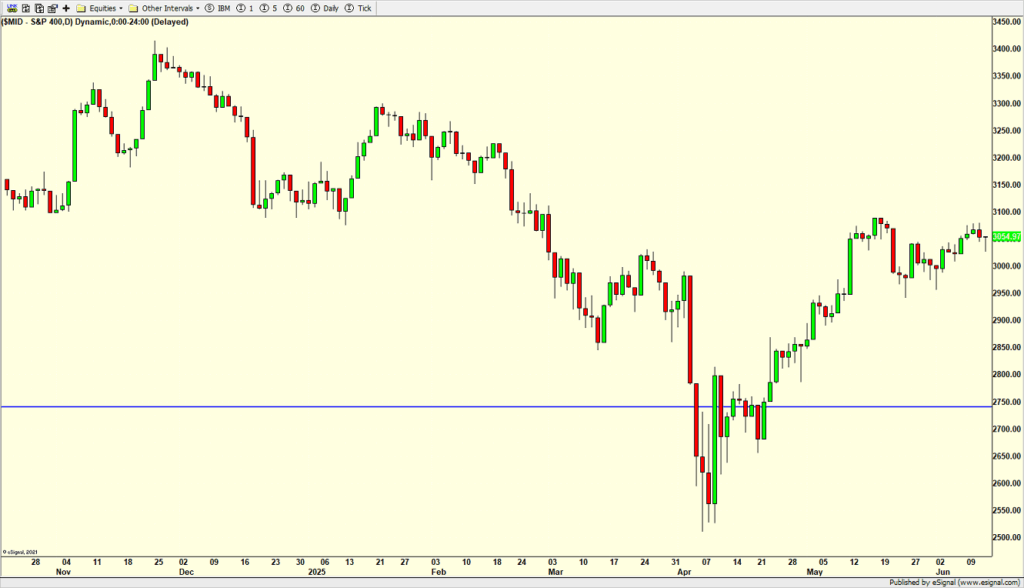

When I run through the major stock market indices, I find that the S&P 400 mid cap index is the only one that did not exceed its May high. This is the index I will be most interested in watching assuming the pullback takes shape.

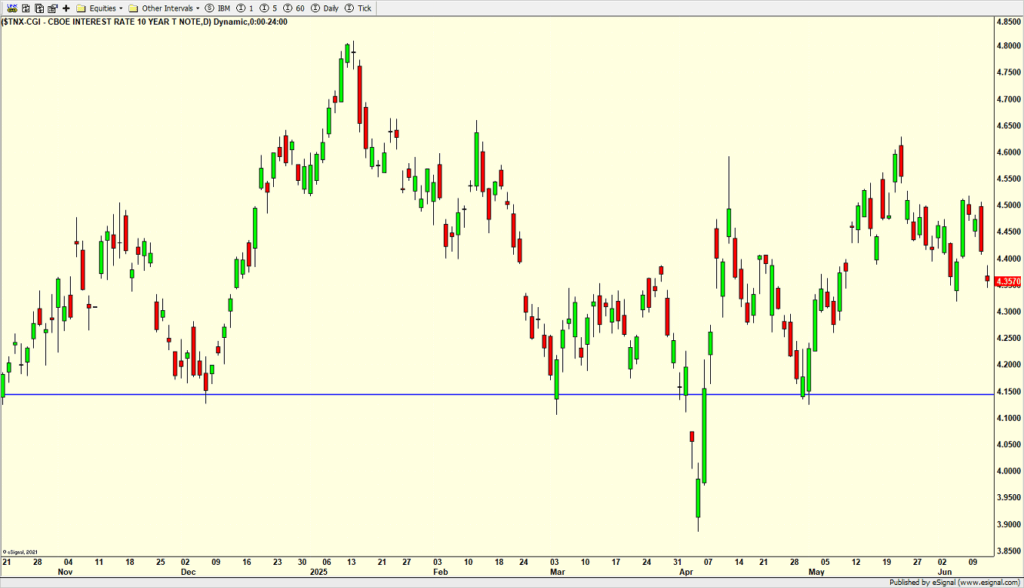

I also want to see if bonds and gold offer safe havens. The former saw yields come down sharply the last two days as if someone knew. My thesis has been that bonds stay in a wide trading range for a while with weakness being bought and strength sold. I fully expect oil to spike. No surprise there.

The weekend is here and CT is still waiting for some warmth. It’s likely to be the 16th straight weekend with rain if that’s even believable. I see golf in my future with lots of family time including a parent/child, 9 hole golf tourney with my wife and in-laws. It’s also the U.S. Open at Oakmont in Pittsburgh, a course I had the privilege of playing almost exactly one year ago. The course is a bear, one of the hardest I have ever played. My arms were tired from trying to hit out of the rough so many times. As the story goes, under the cover of darkness the powers that be quietly removed 2000 trees overnight when setting courses back to their original layout became the in thing.

On Wednesday, we bought SSO. We sold QLD, SPHB, some MQQQ, some ARKK, some XHB and some UWM. On Thursday, we bought PCRX and QLD. We sold DH and SSO.

More By This Author:

Dumb Money Finally Buying StocksGoldilocks Came – Media Labeled “Weak” And “Stronger”

Geopolitical Nonsense

Disclaimer: All essays, research, and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a ...

more