Market Morsel: Expectations Are Not Predictions

Image Source: Unsplash

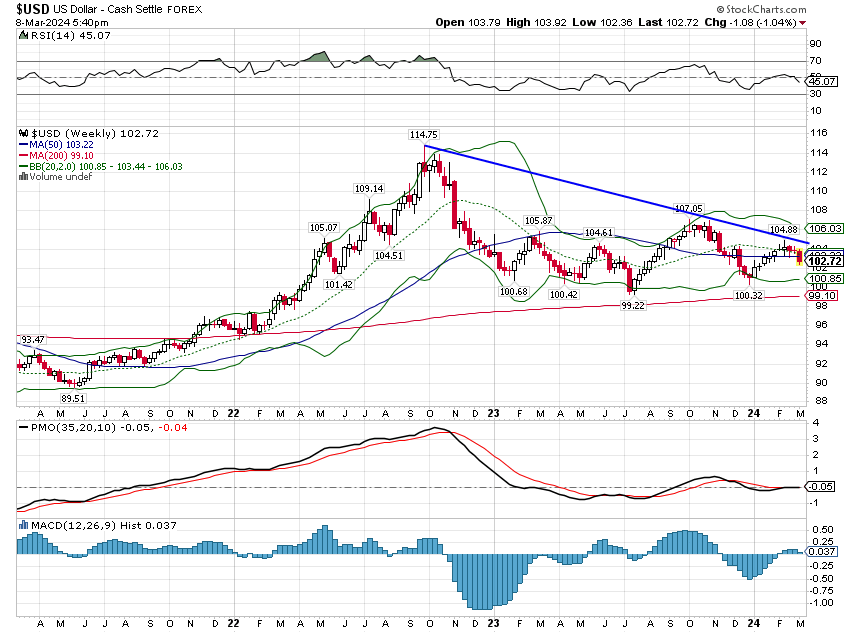

Longer term, I think there are more significant reasons to expect a weaker dollar, starting with our politicians’ (of both parties) newfound infatuation with industrial policy. Government-directed investment may create activity but long-lasting benefits have, in the past, proved quite elusive. The real problem with our government deficits and debt isn’t the debt itself but rather what the borrowed money is spent on. I have zero confidence that any government-directed investment effort, whether led by Democrats or Republicans, will produce a return in excess of the cost. With our future economic growth almost entirely dependent on productivity growth, wasted investment based on the whims of politicians is not something we can afford. The dollar seems the likely relief valve if growth stalls.

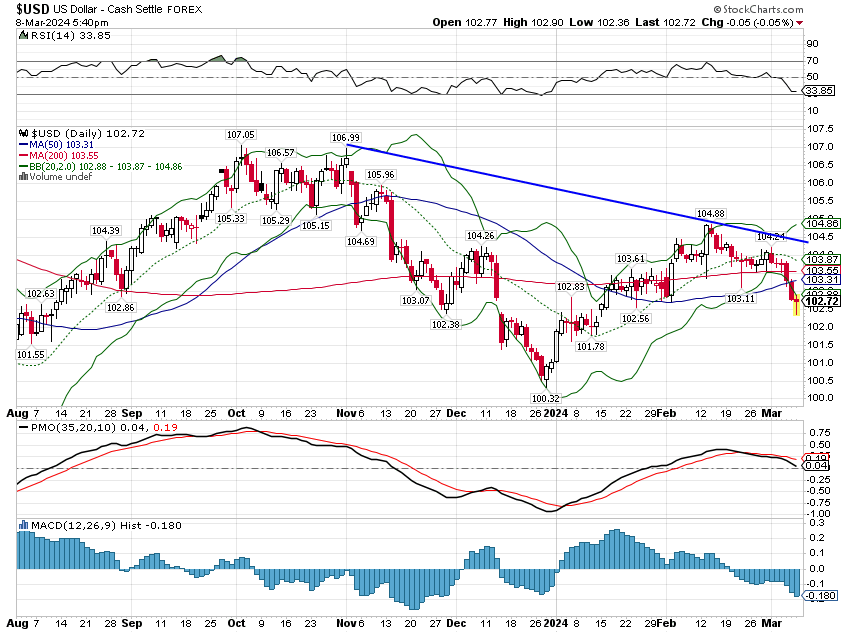

In the short term, I expect the dollar to rise back to the 104/105 area before resuming its downtrend. We don’t really do much with short-term movements and this is no different. If, on the other hand, the dollar breaks that short-term downtrend I may have to reassess.

Market Pulse: Presidential Portfolios, 1/15-2024

I say all the time that I don’t try to predict the future because I don’t think it’s necessary to invest successfully. I do, however, have expectations based on several decades of trading experience. But expectations are not predictions and if my expectations are not met, I try to adjust as quickly as possible. In this case, my expectations were met; the dollar has resumed its short term downtrend.

(Click on image to enlarge)

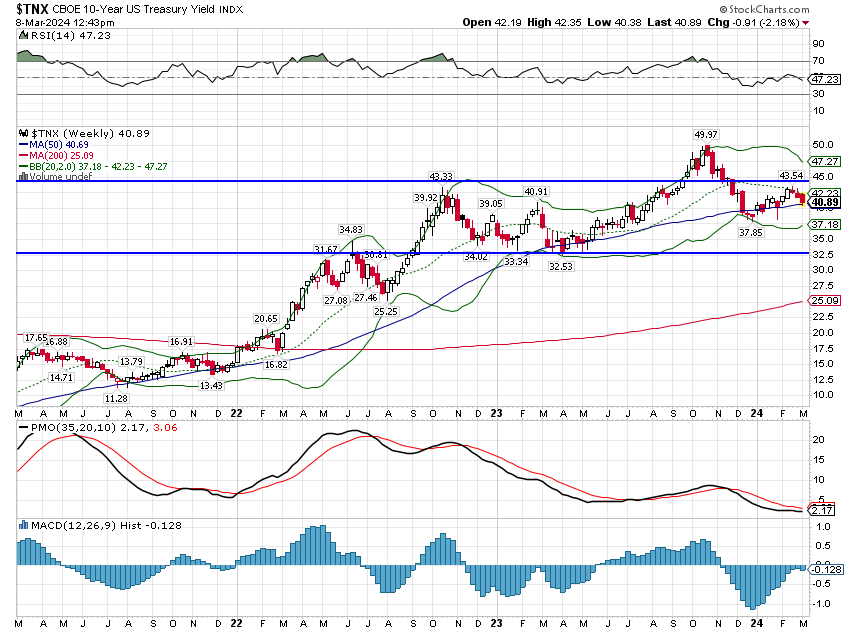

Interest rates have also come down recently although downtrend only applies to the very short term. The trend since October of 2022 is essentially no trend. Yes, we got a spike up to the highs last year but that was reversed fairly quickly.

(Click on image to enlarge)

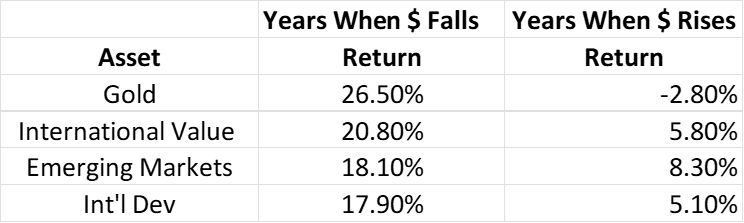

The dollar and interest rate trends are the most important indicators an investor has at their disposal. Changes in these two metrics have a big impact on asset class returns. If the dollar continues its downtrend, our expectations for some asset class returns will have to change too.

(Click on image to enlarge)

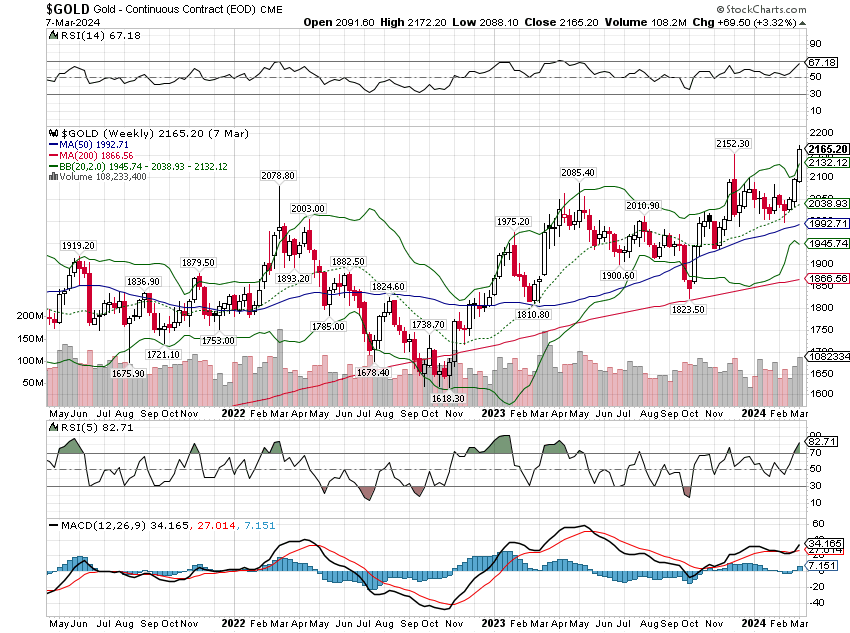

The long term trend of the dollar is still up but the short to intermediate term trend over the 17 months is down. I keep hearing people express surprise at the rise in gold but it really isn’t surprising at all. It bottomed when the dollar peaked and rallied as the dollar fell.

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: Artificial Intelligence?

Weekly Market Pulse: Questions

Weekly Market Pulse: Are You Ready For The Roarin’ Twenties?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more