Liquidity Stress Is Intensifying

At first glance, everything seems under control: stocks are holding steady and the U.S. economy is resilient. And yet, something is going wrong in the global financial system.

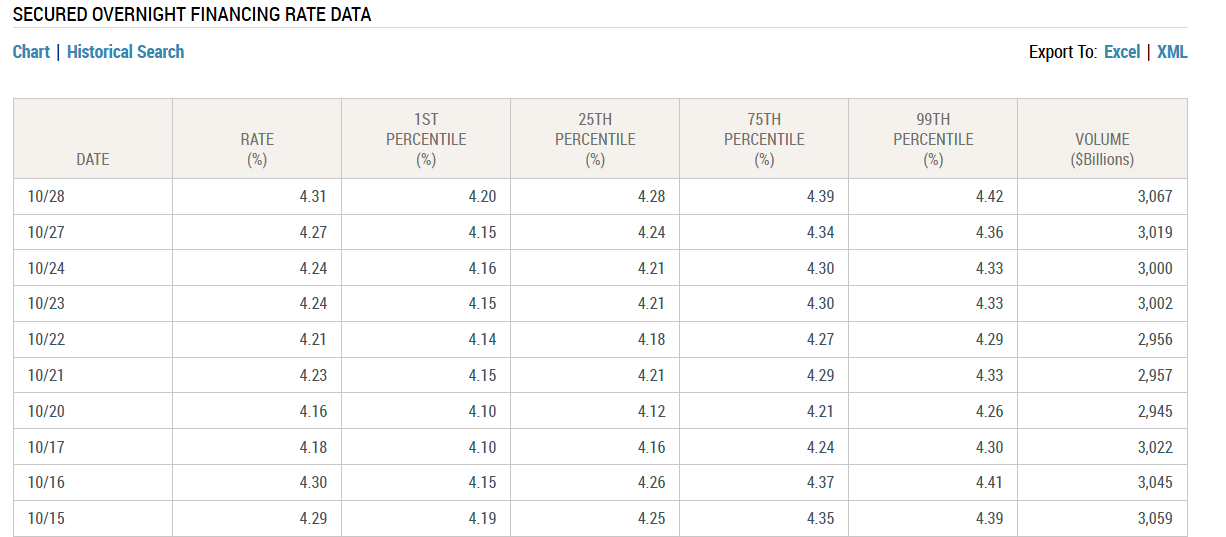

In recent days, the cost of very short-term cash – the SOFR (Secured Overnight Financing Rate), which measures how much it costs to borrow money overnight – has risen sharply.

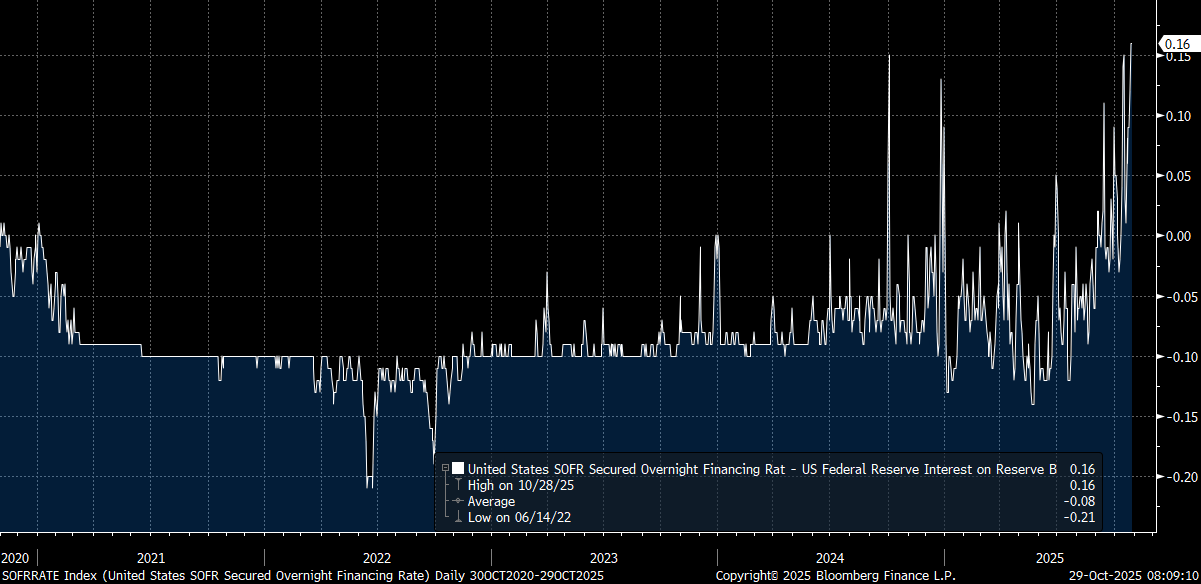

The SOFR overnight rate, which measures the actual cost of money between institutions, now exceeds the IOR rate – the rate the Fed pays banks on their reserves. This spread, the largest since the beginning of the current monetary cycle, shows that it is now more expensive to obtain cash on the market than to leave it sitting in the Fed's vaults.

In other words, financial institutions are willing to pay more to borrow dollars in the very short term than they would earn by leaving them at the central bank. This is a sign of localized liquidity shortages: dollars exist in the system, but they are no longer circulating where they are needed. The big banks are holding on to their reserves, money market funds have almost emptied their investments at the Fed, and the daily financing market (the Repo market) is suffocating.

When the SOFR consistently exceeds the IOR rate, it does not mean that the Fed has lost control, but that the dollar market is finding it increasingly difficult to breathe: the cost of cash is now dictated by scarcity, not monetary policy.

The cost of cash has not been this high in five years. Above all, the volume of these transactions has exploded: more than $3 trillion is now lent or borrowed every night on the US secured financing market, known as the “Repo” market (for repurchase agreements).

This is where large financial institutions – banks, money market funds, hedge funds, and primary dealers – exchange cash for U.S. Treasury bills as collateral, usually for a single night.

This market, whose benchmark rate is the SOFR (Secured Overnight Financing Rate), has become the beating heart of the dollar system: it now determines the true price of short-term money.

Every evening, more than $3 trillion in transactions are carried out on this market, a historic record that illustrates both the system's growing dependence on daily financing and the tension that arises as soon as the demand for liquidity exceeds the lending capacity of banks.

This means that a huge part of the global financial system is now refinancing itself on a daily basis. Every evening, thousands of institutions – banks, money market funds, hedge funds – close their positions only to reopen them the next morning.

It is as if the global economy were living on a 24-hour cycle. This record level of activity is not a sign of good health, but rather a state of permanent tension.

The more trading volume increases, the more it means that players need immediate cash to keep their positions running.

The system is running at full capacity, but without reserves: every dollar that comes in goes straight back out, recycled into another financing operation.

In short, the rise in SOFR and the explosion in these volumes show that the dollar market is still functioning, but at the cost of constant effort, like a heart beating too fast to maintain pressure.

This is a sign of overheating, not strength.

This is not insignificant: it means that cash is becoming scarcer in a system already saturated with U.S. Treasury bills.

An abundance that suffocates

Treasury bonds are supposed to be the safest and most liquid asset in the world. They are the “cash” of large institutions: they can always be bought, sold, or used as collateral.

But today, there are too many of them.

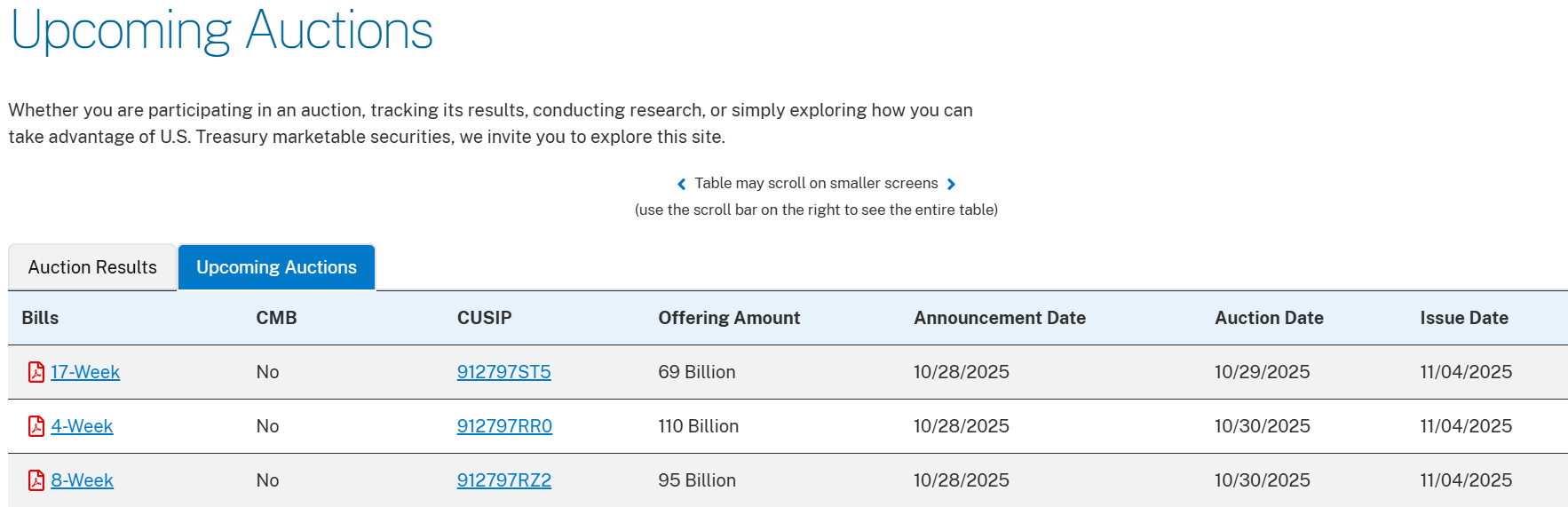

Since the beginning of the summer, the US Treasury has been issuing public debt at an unprecedented rate to finance ever-increasing deficits. This avalanche of issuance fuels apparent liquidity, but it hides a more tense reality: a large portion of these securities is absorbed by players who keep them in reserve, without putting them back into the short-term financing circuit.

In other words, the more debt the U.S. Treasury issues, the more the dollar pipeline fills up... without improving cash flow.

And this abundance creates a paradox: the more Treasury bills there are in circulation, the harder they become to circulate.

Why? Because the buyers of these securities – banks, insurers, money market funds – do not resell them.

They hold onto them to meet their security obligations, liquidity ratios, or prudential rules.

Each new issue therefore adds to already full balance sheets, without putting cash back into circulation.

Treasury auctions look good on paper, but they no longer feed the market where liquidity is really lacking.

An avalanche of Treasury bills does not create more liquidity, it absorbs it.

Every time the U.S. government issues new securities to finance its deficit, these bills must find a buyer, and that buyer must pay in cash.

In the short term, each auction removes dollars from the market: the money goes to the Treasury and will only return later, when the government spends it.

But the real problem comes from what happens next.

Once purchased, these Treasury bills remain stored on the balance sheets of banks, money market funds, and institutional investors. They no longer circulate: they are held to meet liquidity coverage ratios (LCR) or as collateral in financing transactions.

As a result, Treasuries, which are supposed to be the most liquid assets in the world, become frozen assets that tie up cash instead of freeing it up.

Added to this is a second, even more powerful phenomenon: collateral transformation.

Faced with rising risky debt – private loans, speculative bonds, structured products – banks and funds are seeking to exchange their dubious assets for “clean paper,” i.e., Treasury bills, in order to raise cash more easily. This transformation mechanism, at the heart of the repo market, allows risk to be laundered: toxic assets are temporarily removed from bank balance sheets and replaced by Treasuries, which are considered risk-free.

In this way, the real danger is shifted, but not eliminated: it circulates outside regulated balance sheets, hidden in collateral and securitization transactions. There is therefore no longer any direct link between the deterioration of the real economy and apparent financial tensions. Everyone knows that the system is based on increasingly fragile collateral, but what matters now is no longer the quality of the bonds, but the ability to obtain cash against Treasuries.

It is a kind of recycling: doubtful credit is transformed into “official” collateral.

But each transformation of this type consumes liquidity twice: first to obtain the Treasuries needed for the exchange, and then to finance these Treasuries in the repo market.

The more risky assets there are in the system, the more Treasuries are needed to “purify” them, and the more demand for cash skyrockets.

It's a vicious circle: the government issues more and more Treasury bonds, banks tie up a growing portion of them on their balance sheets, and the rest is used to transform private risk into public collateral.

As a result, financing channels become clogged, and the dollar paradoxically becomes scarce in a world drowning in US debt.

The Fed has just lowered its key interest rates by a quarter of a point. Many believe that by lowering rates, the Fed can “put cash back into the system.”

But that's not how it works today.

A rate cut makes money cheaper, but it doesn't create more of it.

And the current problem isn't the price of the dollar: it's the fact that dollars are no longer circulating where they are needed.

When the Fed cuts rates, it sends a signal to the entire system: “financing is easier.”

But in reality, it is still the same players – the big banks and money market funds – that control the distribution of cash. However, these institutions are keeping their reserves out of caution, because they know that balance sheets are already overloaded with public debt and collateral that needs to be refinanced.

Worse still, a rate cut can exacerbate the imbalance. It pushes the US Treasury to issue ever more debt – since borrowing becomes cheaper – while encouraging investors to seek more secure collateral to protect themselves.

The result: more Treasury bills to absorb, more demand for cash to finance them... and therefore even more tension in the financing market.

It's a cruel paradox: the more the Fed tries to ease, the more it risks saturating the system.

This is not a rate crisis, it's a plumbing crisis.

And as long as liquidity does not flow freely, even a lower key rate will not bring air back into the system.

In the short term, gold is being sold by funds seeking to free up cash.

In times of liquidity stress, each financing transaction (repo) becomes more demanding: banks are asking hedge funds to deposit more collateral in order to roll over their positions.

Faced with these margin calls, funds have no choice but to sell what they can sell immediately – and highly liquid gold becomes the first victim.

This is exactly what we are seeing today: sales of “paper” gold by funds strangled by financing stress.

But at the same time, China continues to accumulate physical gold, steadily building up its reserves.

The gold market is thus torn between two opposing forces: on the one hand, forced liquidations of financial gold; on the other, strategic demand for tangible gold.

This imbalance is temporary.

When the market fully realizes that the Fed cannot solve this liquidity problem by simply cutting rates, gold will regain its natural place: that of the ultimate refuge in a system saturated with debt and deprived of real liquidity.

More By This Author:

Is It Time To Sell Your Bitcoin And Buy Gold And Silver?

The United States Is Entering A Collateral Crisis

What Does The Disruption Of The Silver Market Mean?

Disclosure: GoldBroker.com, all rights reserved.