What Does The Disruption Of The Silver Market Mean?

For several days now, the financial markets have given the impression of order and recovery. However, all signs indicate that the system is being propped up by increasingly precarious artifices. Monday's flash crash in the VIX is the most striking illustration of this: while volumes on the S&P 500 remained anemic, implied volatility was compressed by more than three points in a matter of hours – not because the risk had disappeared, but because it had been artificially crushed by algorithms and derivative flows.

(Click on image to enlarge)

This type of intervention, which is now a recurring event, makes it possible to stave off forced selling, induce a mechanical rebound in the indices, and give the illusion of stability. However, during the same session, several billion dollars of short positions were introduced at the opening, particularly on the S&P 500, around the critical threshold of 6,575 points. These shorts were methodically wiped out by volatility manipulation: the VIX fell by three points in less than two hours, triggering a widespread short squeeze that propelled the S&P above 6,650, forcing sellers to buy back in a panic. On the surface, everything seemed orderly. In reality, this artificial compression of risk simply wiped out, in a single session, the massive positions built up since Friday's shock.

At the same time, the cryptocurrency market offers another picture of disorder. After the liquidation of more than $20 billion on Friday, volumes virtually exploded, revealing statistical anomalies that were impossible to ignore. Some tokens have daily volume ratios equivalent to ten, twelve, or even fifteen times their market capitalization – a phenomenon that is completely absurd in a normal market. To grasp the extent of the madness, imagine a listed company whose entire capital is traded twelve times in a single day. Such a level of activity cannot be organic. It reveals systematic manipulation of liquidity, orchestrated by major exchange platforms – mainly Binance and Tether – in order to maintain the facade of a “lively” and sustained market.

The day's data confirms this: several low-capitalization tokens, such as First Digital USD (FDUSD), Plasma (XPL), and Pump.fun (PUMP), are trading at volumes more than eight or ten times their market cap – even surpassing industry giants such as Tether and USDC. A market that trades twelve times its own value in twenty-four hours is no longer a market: it is a closed circuit, fueled by mirror trading and automated wash trades.

It is therefore no surprise that, at the same time, Tether issued several hundred million USDT “out of thin air” before injecting them into Kraken and Binance: monkey money intended to give the illusion of buyer demand and artificially prop up bitcoin. This pseudo-liquidity is, in the crypto world, the equivalent of emergency monetary QE by central banks. The system is still breathing, but only thanks to artificial injections.

Behind these superficial manipulations lies a much deeper structural imbalance: the dominance of fiscal policy over monetary policy – in other words, fiscal dominance.

For the past two years, the Fed has been unable to pursue an independent policy. The weight of the US deficit and the need to continuously refinance more than $35 trillion in debt are imposing constraints on the central bank. The US Treasury has chosen to flood the market with short-term securities – T-Bills with maturities of a few months – to avoid issuing long-term debt, where rates have become unsustainable.

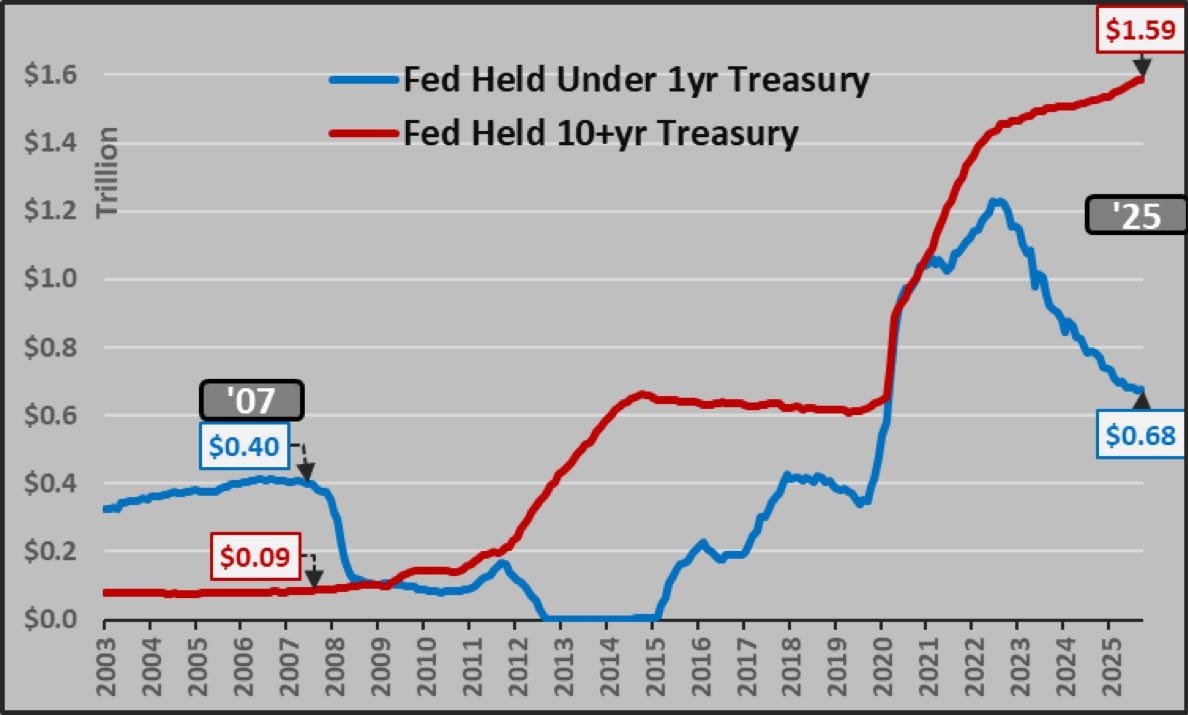

This shift has resulted in a sharp decline in the average maturity of the debt held: $0.68 trillion with a maturity of less than one year, compared with $1.6 trillion with a maturity of more than ten years. The structure of the Fed's balance sheet now reflects that of a system that finances itself in the short term. This is a typical symptom of a monetary policy that is subordinate to fiscal needs: issuance is no longer used to manage rates, but to survive the next refinancing. This fiscal QE, disguised as maturity management, aims to artificially contain long-term rates – without which the Treasury's interest burden would become explosive.

But this artificial construct is beginning to crack, as more and more investors – central banks, institutional funds, and now the general public – are realizing the deception of debt financing through disguised money creation. Under the guise of “stability” or “yield curve management,” governments are now permanently dependent on central bank liquidity. This mechanism, known as “fiscal dominance,” keeps markets afloat while concealing the system's loss of credibility. And it is precisely in the physical metals market – where reality cannot be printed – that this illusion is beginning to shatter.

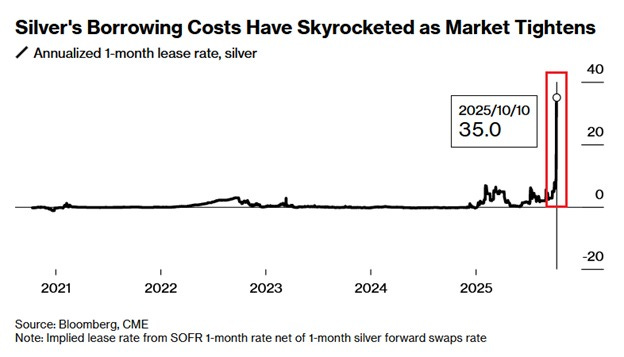

Available stocks on the LBMA and COMEX have melted away by a third in two years, and the situation has reversed: for the first time since 1980, futures contracts are trading at a steep backwardation, with spot prices more than $2 higher than futures maturities. This means that metal delivered today is worth significantly more than metal promised tomorrow – an unmistakable sign of market dislocation. Bar holders are refusing to lend, leasing rates are soaring, and delivery premiums are reaching record levels.

The latest market data indicates that silver leasing rates in London have reached historic highs:

In short, there is no longer enough silver “available” to circulate. What remains in the vaults belongs to players who no longer wish to lend it.

The phenomenon is actually more profound: it strikes at the very heart of the model of the big precious metal banks, the Western Bullion Banks.

Their model is based on massive simultaneous buying and selling of gold and silver – both long and short – in order to generate small margins on colossal volumes. The problem is that these trades involve metal that is not allocated to the LBMA, i.e., paper delivery promises, only a small fraction of which is backed by physical metal. As long as liquidity flowed between them, the system held up.

But in recent weeks, industrial clients – which are inherently inelastic – have ended up draining the LBMA's floating supply of silver to a critical level. One bank then refused to lend physical metal to its counterparts. Interbank trading immediately came to a standstill.

Even the usual workaround – borrowing shares from the SLV fund to convert them into physical metal – came to a sudden halt. Today, bullion banks no longer lend physical silver to each other: the interbank metal system has ground to a halt.

In this context, the pressure on physical stocks poses a much more serious threat: that of future deliveries on futures contracts. If stocks eligible for delivery continue to dwindle at the current rate, some contracts may find themselves without any real counterparties. Short positions will have to deliver metal that no longer exists in the vaults. This scenario, long considered impossible, is now on everyone's lips in specialized trading rooms. And this is where the parallel becomes obvious: the silver market now plays the role of the canary in the coal mine – the one that warns of the collapse.

While the stock markets are driven by algorithms and bitcoin is kept afloat by synthetic liquidity, the silver market highlights the divide between paper and reality. The physical metal is lacking, delivery promises are faltering, and the most savvy investors now prefer to demand the metal rather than its derivative equivalent. This shift is not insignificant: it may herald the end of the cycle where everything could be monetized, securitized, and re-mortgaged. In a world where short-term debt fuels the system like an IV drip, the scarcity of the tangible is once again becoming the only economic truth.

And silver, the most monetary of industrial metals, has become the central witness to this. This is not an isolated episode, but rather a sign of a system that is only held together by manipulation.

Many investors are beginning to understand that trading 0DTE options in such an environment is like playing Russian roulette. The VIX, now used to crush the premiums on these options, no longer measures risk: it hides it.

The market no longer has real prices or real volatility – only forced adjustments. It is no longer a stock exchange, but a casino emptied of its market makers, populated by retail traders and algo scalpers, where liquidity is nothing more than an illusion.

Meanwhile, demand for physical gold and silver is exploding: it is no longer an investment, but an escape from an over-leveraged paper system, where no indicator is reliable anymore.

The “endgame” will not be played out on a Bloomberg screen... it is already being played out in the vaults, where there is nothing left to lend.

More By This Author:

The Holders Of France's Debt Must Remain Secret, According To The SenateSilver: “Reset” Underway In A Frozen Market

Big Picture Silver Charts Point To Triple-Digit Prices

Disclosure: GoldBroker.com, all rights reserved.