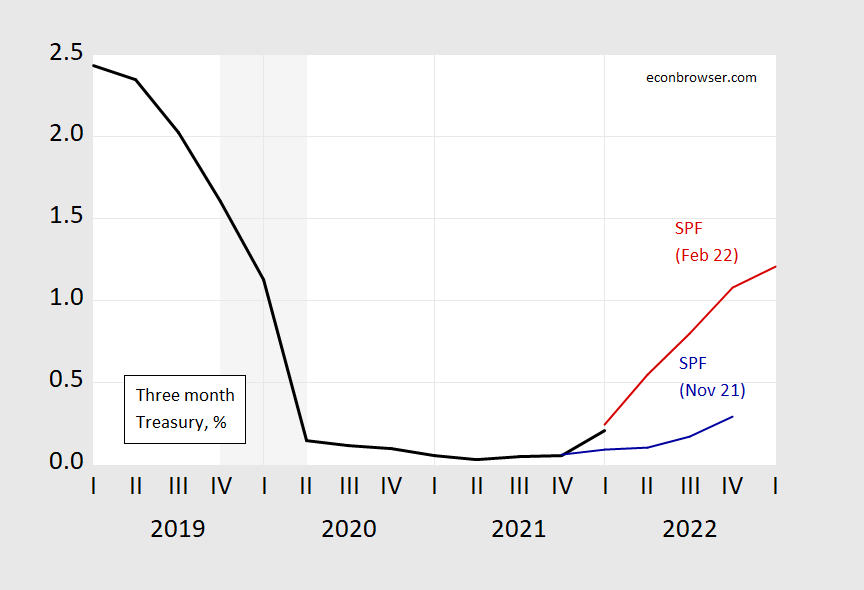

Interest Rate Forecasts – Survey Of Professional Forecasters February Survey

Even before the Thursday’s CPI release, forecasters had upped their short term rate forecasts, along with long term.

Figure 1: Three month Treasury bill yield (black), Survey of Professional Forecasters November 2021 survey (blue), February 2022 (red), in %. Actual 2022Q1 is through 2/10. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, Philadelphia Fed SPF, and NBER.

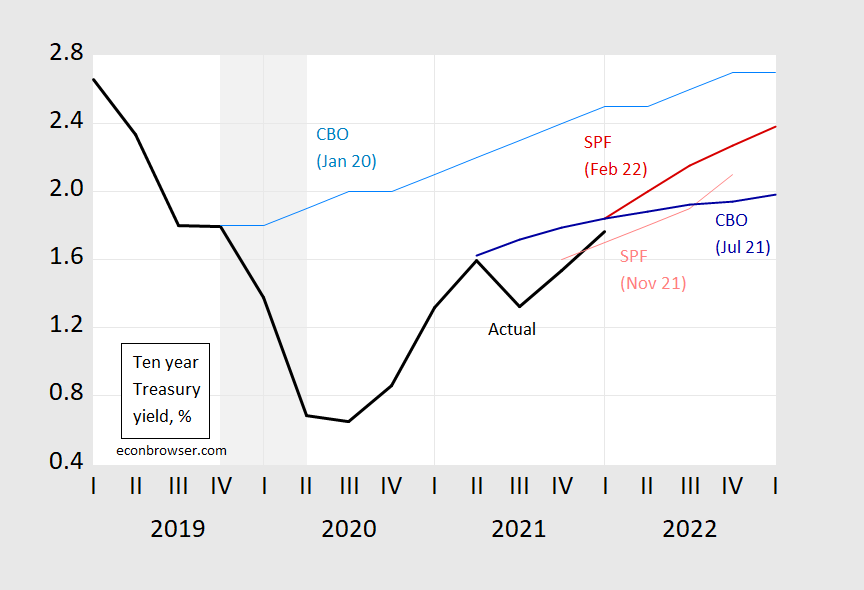

The trajectory for ten year Treasurys also rose:

Figure 2: Ten year Treasury yield (black), Survey of Professional Forecasters November 2021 survey (blue), February 2022 (red), CBO January 2020 projection (sky blue), CBO July 2021 projection (blue), in %. Actual 2022Q1 is through 2/10. NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, Philadelphia Fed SPF, CBO, and NBER.

Forecasted Q1 yields are now at levels CBO projected back in July of 2021; but the trajectory is for a faster rise in the future — although to levels still below what was projected on the eve of the pandemic.

Disclosure: None.