Inflation Expectations Are Rising. Will Actual Inflation Follow?

The Treasury market continues to price in higher odds of reflation and the Federal Reserve remains inclined to let the economy expand for longer with little if any monetary pushback due to nascent signs of pricing pressure. That lays the foundation for higher inflation. But so far, the hard data offers minimal support. Will 2021 be the year of an inflationary regime shift?

The odds have certainly increased for firmer inflation, but it’s premature at this stage to see the rebound as something more than a modest recalibration following the sharp disinflation/deflation pressure immediately following the onset of the coronavirus crisis last spring. If there’s more than a corrective bounce brewing for inflation, the macroeconomic support will become conspicuous over the next several months. But for now, the numbers still point to a period of normalization following last year’s disinflation/deflation shock.

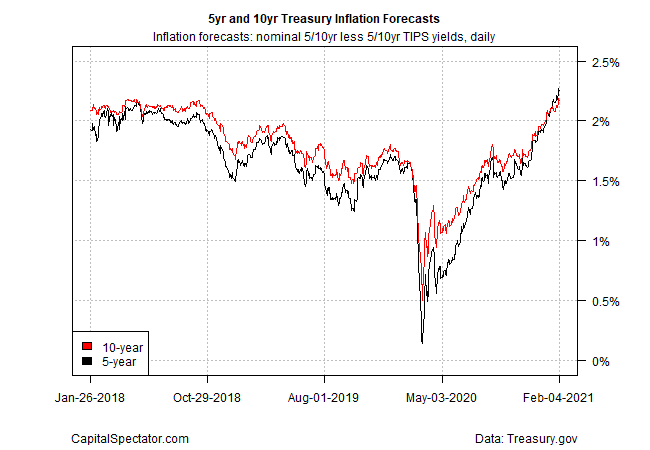

For some context, let’s start with Treasury market expectations. The implied forecast via nominal less inflation-indexed yield spreads continue to rise. Notably, the spread for the 5-year maturities rose to 2.27% earlier this week – an eight-year high – before edging down yesterday (Feb. 4).

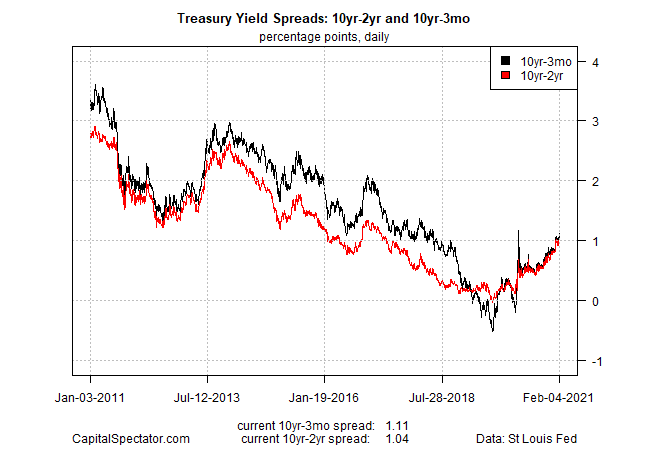

Echoing the market’s inflation outlook, the Treasury yield curve has steepened in recent months. The 10-year/3-month spread is currently at 1.11 percentage points, marking a sharp U-turn from the recent descent into negative terrain.

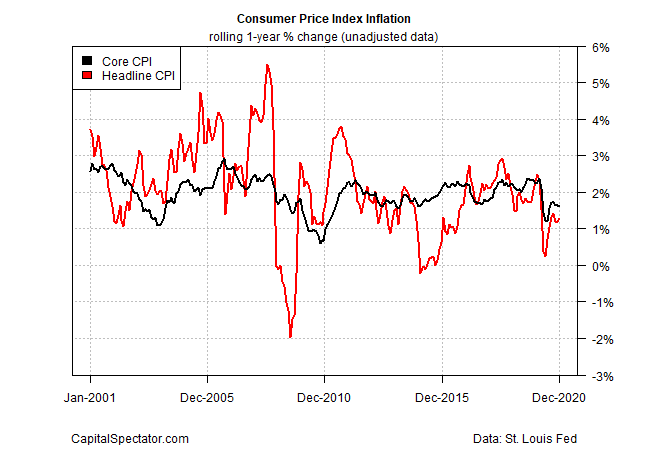

Official inflation measures have rebounded too, although the one-year trend for consumer prices (headline and core) is still well below pre-pandemic levels. Core CPI increased 1.6% for the year through December, well below the 2%-plus trend that prevailed before the coronavirus shock.

A popular and arguably compelling narrative is that as the vaccine rollout continues and the pandemic recedes, the economy will recover and inflation pressures will continue to bubble. All the more so if the Biden administration’s ambitious $1.9 trillion coronavirus relief plan is enacted. Add to that the ongoing monetary stimulus from the Federal Reserve, with no plans to turn hawkish for the foreseeable future.

It all adds up to firmer pricing pressure. Agreed. But the reflation trade, after rebounding from last year’s crash, may soon run out of road until (or if) the secular forces that suppressed interest rates and inflationary pressures over the previous decades. For example, consider how the year-over-year change in the velocity of a broad measure of money supply (M2) compares at the close of 2020. This measure of how frequently the average unit of currency is used for spending continues to unleash a strong disinflationary wind – a wind that’s blowing with unusual force during the pandemic. The dramatic downside bias for money velocity will likely offset a large degree of the monetary stimulus supplied by the central bank and fiscal support from Congress.

Another macro factor that’s likely to keep reflation modest is the relatively wide output gap for the US economy, measured by the ratio of real GDP to real potential GDP (the latter estimated by the Congressional Budget Office). At the end of last year, the output gap was still negative after crashing earlier in the year. Although the output gap has rebounded from a record low, it remains deeply negative. Presumably, recovery will proceed in the year ahead and repair and recovery will continue. But this proxy for inflation pressure is on track to keep pricing pressure muted through 2021.

No one can rule out a hotter-than-expected run of inflation. Much depends on how the pandemic unfolds in the months to come, which will be largely determined by the degree of success in distributing the vaccines. Another factor to watch: consumer spending. Household savings have surged recently and so Main Street’s willingness to enhanced ability to spend could unleash a burst of inflationary pressures.

Offsetting the potential for a surge in consumer spending is the ongoing horror show in the labor market, which continues to shed workers at sky-high levels. Initial jobless claims dipped below 800,000 last week for the first time since late-November, but that’s still on par with the deepest levels of past recessions.

Inflation will rebound and stabilize in 2021, but at this stage, it doesn’t appear likely that the pricing pressure will materially rise for any length of time above the pre-pandemic trend. The disinflation/deflation risk of 2020 is fading, but it’s not yet clear that this will soon lead to a new and persistent inflationary regime that’s distinctly hotter than what prevailed before the pandemic.

Disclosure: None.

A well reasoned position on the outlook for inflation. A destruction of velocity is one of the key factors in the deflationary forces of work