Incoming Choppers: Inflation, Not Deflation, Will Surprise You

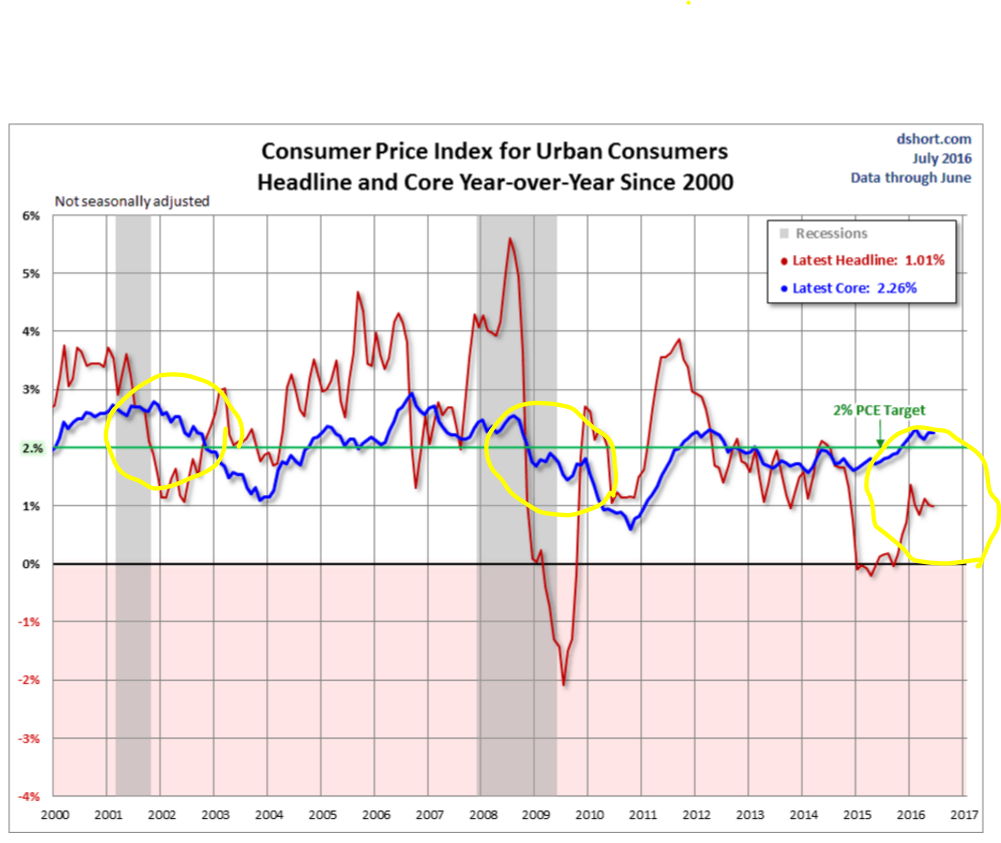

The CPI numbers that were released mid-July failed to make any meaningful headlines. The year over year Core CPI (excludes food & energy) came in at 2.3%. Now, this isn't the CPI gauge that the Federal Reserve looks at - they only watch the Headline CPI (includes food & energy). It makes this author wonder: if it weren't for the huge drop in oil prices since 2014 and the massive appreciation in USD Index (aka US dollar), what would Headline CPI be?

"The energy index has declined 9.4 percent over the past year, with all of its major components falling over the period. The fuel oil index has declined 19.6 percent, and the index for gasoline has decreased 15.4 percent. The indexes for natural gas and electricity have posted smaller declines, falling 5.0 percent and 1.8 percent, respectively," says the BLS (Bureau Of Labor Statistics)

The Fed would have well over the 2% inflation target by now, but the steep fall in oil (energy) does a wonderful job offsetting the CPI as a whole.

It's interesting that empirically, the last two times that Core CPI was higher than Headline CPI, we were in recessions.

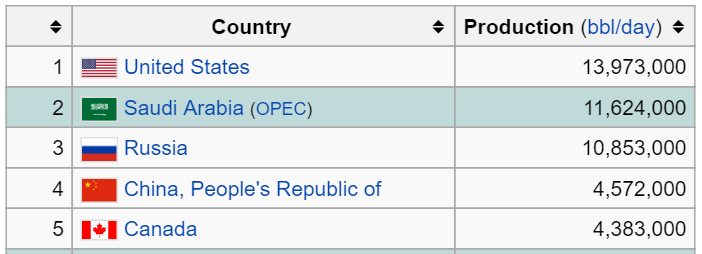

Many pundits, even the brains at the Fed, said that the lower oil prices would spur consumer demand (the marginal savings from filling up the gas tank would be used to go buy other stuff). Therefore, a lower oil price was a net benefit. But unfortunately this isn't the 199's where the USA imports almost all of its oil. If it were, then yes, a cheap oil price is much better because importing it is cheaper. But since 2012 the USA is a top 3 oil producer, thanks to the fracking bubble.

Especially since fracking in the US is extremely expensive to produce and so much of the corporate debt and junk bonds are backed by these companies, a low oil price is a net liability. The junk bond defaults, the high paying oil jobs lost, the lost state tax revenue, and potential banking crisis outweigh the idea that consumers will have a few extra saved dollars from filling their tanks up. Again, hats off to the Fed. It is safe to say that many of those bonds of fracking companies aren't going to be paid back. And they will be seen for what their name truly means: junk.

Anyways, only a handful of older individuals even watch the CPI (or as they remember it, the annual inflation rate) these days. Millennials have never even heard of the word 'inflation' outside of their high school economics class, nor have ever had to worry about it.

"Back in my day . . ." the older investors begin to lecture the younger investors about inflation and why they should care. The Baby-Boomer generation (born directly post WWII) spent their young adult lives in the 1970's watching soaring gasoline, food, and rent prices. But their parents, today's millennials' grandparents, during the Great Depression and pre-war years (late 1920's to mid-40's) had falling prices. Being unemployed with a falling cost of living sure beats the hell out of being unemployed with a rising cost of living.

Today's young adults have never had to worry about two issues: inflation and interest on capital. This is not the same kind of interest that many millennials are used to. The kind that they watch compounding on their student debts, and no matter how much they pay, it feels more and everlasting. No, interest on capital is something of pre-2007. Anyone born after 1990 has never noticed anything from the "accumulated interest" statement on their savings account balance.

But today's youth are tomorrow's leaders. And as far as they're concerned, it is the New 'New' Age. This is the awkward period of history that future historians will gawk at. It is an age of stabilization in the stock markets, where the Central Banks act as a backstop. It is an age of zero-percent interest, fueling historic debt levels across multiple sectors. And it is an age of deflation and anemic growth, where Central Bankers will do anything to get their growth and inflation. Ideas that were once so appalling, they couldn't have even be written in economic texts, such as negative interest rates and quantitative easing. The central bankers are now literally opting to begin 'Helicopter Money', which is fiscal and monetary easing. Simply, this is where governments will give big tax breaks/refunds to citizens while engaging in big infrastructure projects, as the central banks monetize it i.e. pay for it. The treasuries will issue bonds to pay for all this, and the central banks will conjure paper dollars to give them in return for those meaningless bonds.

The Former Fed Chairman, Ben Bernanke, was recently in Japan telling their elites that the BOJ (Bank of Japan) still has weapons in its arsenal to use, i.e. helicopter money. It has been 30 years of deflation in Japan and low growth while trillions have been printed and borrowed and thrown at them. Clearly it is structural (demographics, debt cycles, etc) problems in Japan, not cyclical. But they won't admit that, because that puts their BOJ out of jobs. Kuroda (BOJ Chief) says that 'Helicopter Money ' will never happen in Japan. Just like he said there will be no negative rates 10 days before unleashing negative rates. This author has his doubts (100%).

Contrary to the 99% of millennials, this author is unique in a sense: a cynic, gold-loving, anti-academic, empirical, and religiously skeptical. One day the central bankers will get their inflation. And hopefully it won't be too late for an entire generation to learn about inflation and the difference between 'real' and 'nominal' returns.

Until then, one truly has to wonder if these former central bankers and finance ministers end up quitting because they see more opportunity and easy money in bonds, equities and currency trading.

I have a hunch.

Nice article, except that real #HelicopterMoney won't need treasury bonds, which are already in short supply as collateral for derivatives. Real helicopter money would just involve base money, even if Bernanke and others don't quite want to face that kind of real helicopter money.