Heads I Win, Tails...

Image source: Pixabay

Executive Summary

- Economy has proven surprisingly resilient, but some cracks are emerging on the consumer side

- Easing cycle may trigger residential asset sales in Q4, just as demand is starting to soften

- With another rate-cutting cycle on the horizon, ‘Mag-7’ might continue to prosper, this time via valuation multiple expansion

This post discusses—implicitly or explicitly—investments in US rates, equities, housing and FX.

Happy Nosommar

Welcome back, dear readers.

As I pen this, I can't help but notice a few investors online indulging in Midsommar celebrations under beautiful weather conditions. If you’re based anywhere close to where I am (Zug, Switzerland), you’ve probably enjoyed Nosommar so far... Anyway.

The current investment environment remains muddled and characterized by numerous cross currents that complicate visibility. Few great / clear investment ideas emerge. If any at all.

Today’s post brings a couple of short, rapid-fire ideas / observations I find intriguing, but will require further refining / patience to see how they ultimately unfold. A preliminary sketch rather than a detailed map.

Hard landing > soft lading > no landing?

We questioned the hard landing narrative for a while, swiftly pivoting early on towards a ‘no landing’ outcome for the US economy. For the past 18 months, we’ve maintained a bullish stance, touting the possibility of new all-time highs for markets as early as one year ago.

As some other participants, we’re starting to see some cracks on the consumer side in the form of data softness. We are not ready yet, however, to turn bearish as we can foresee a scenario where these issues resolve as Powell & Co cut rates later this year.1 You know the drill…

All this boils down to potentially Goldilocks 2.0, with a resilient economy and investor-friendly monetary / fiscal policy supporting top-line growth and valuations. And even if the economy slows down, I believe the monetary headroom (i.e., higher rates and somewhat lower balance sheet) helps underwrite the vaunted Fed put. Famous last words…

Read more: $30 GOLDILOCKS (2.0) AND THE THREE BEARS

Now onto our thoughts.

The Unbearable Weight of Massive Housing Supply

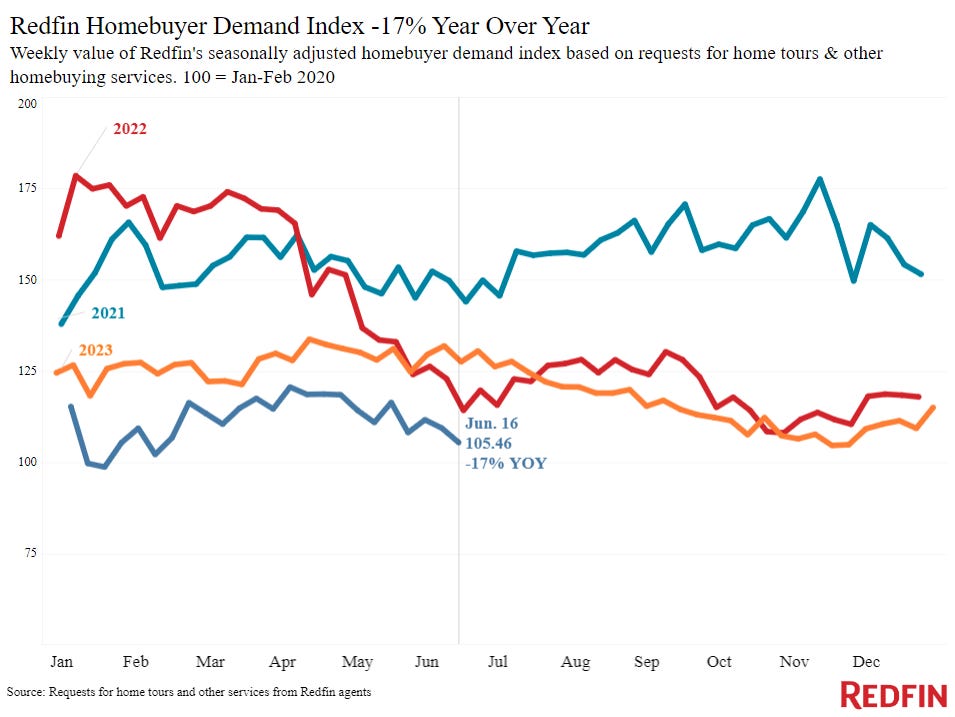

Real estate sales have been bottling up in the US, creating a massive lack of residential stock for sale. New listings are “still near historic lows” and “becoming stale”, which has been supportive of housing prices. Despite these being at record highs, we believe many sellers are holding back, waiting for the best moment to put their assets back on the market.

The upcoming Fed cutting cycle is the most widely anticipated in history. There’s a good chance most find this the optimal time. Our concern is that—as the Fed starts its easing cycle—we start seeing a significant influx of residential assets for sale in Q4, potentially triggering a glut in the market. This could happen just as demand is starting to soften, reshaping the US housing landscape and potentially de-stabilizing the rest of the economy. Lots of ifs, I know.

Source: Redfin

It’s a scenario worth monitoring as we move towards the latter part of the year. The Unbearable Weight of Massive Housing Supply. Nick Cage.

“Heads, I win…”

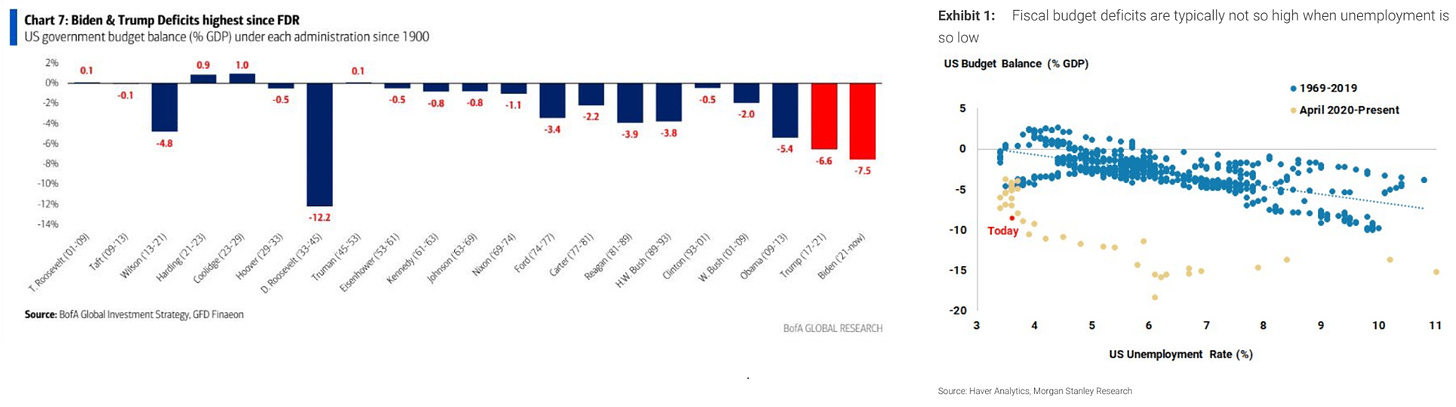

I had been mulling over the implications of ‘higher for longer’ rates for a while and Kevin Muir's latest insights have added some sharp clarity to my thoughts. Kevin argues that recent rate hikes have been oddly stimulative, especially for “those with capital”.

The explanation is a combination between “How The Economic Machine Works” by Ray Dalio and Mosler’s Modern Monetary Theory (“MMT”), as popularized by Kelton.

The US Treasury pays higher rates on its debt, benefitting the bondholders—primarily wealthy individuals and companies with a strong balance sheet. These increased interest payments act are additional—somewhat covert—government spending, bolstering the economy’s strength by funneling money into the hands of these players. Unprecedented fiscal stimulus underwriting US economic resilience, talked about this before…

(Click on image to enlarge)

Source: BofA, Morgan Stanley

The impact is positive on those holding financial assets. Wealthy individuals and large, cash-flow positive companies with strong balance sheets are reaping the benefits (large caps). Lower propensity to consume > plow extra income back into markets > fuel for speculative bubbles. Rinse repeat.

In turn, the impact is negative for lower-income individuals and small, pre-profit companies with weak balance sheets. Effectively the small cap space and cash flow-negative tech.

Now, the twist.

Many saw large-cap companies suffering from rising rates due to compressing valuation multiples, clashing head-on with ‘TINA’ (“There Is No Alternative”). But these big players have thrived. They’ve levered higher interest to bolster their positions, using their balance sheet to accrue positive carry! “Heads, I win; tails, you lose!”

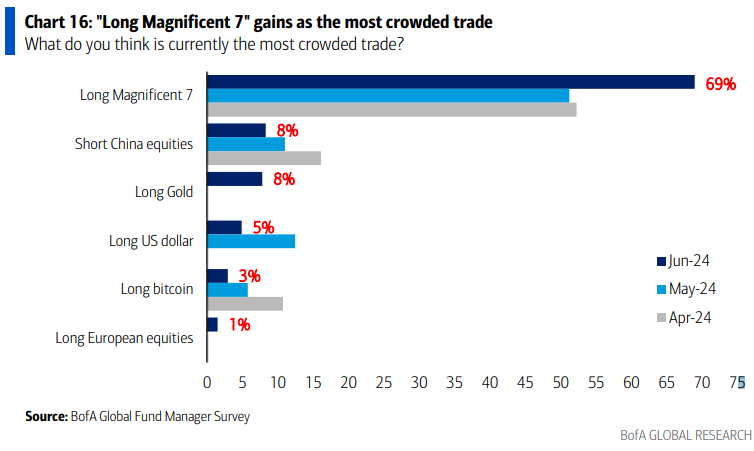

We all love discounted sales and underdog stories, but… with another rate-cutting cycle on the horizon, the ‘Magnificent 7’ might continue to prosper, this time benefiting from valuation multiple expansion.

Essentially, while everyone expected the giants to stumble, they’ve been dancing—and the music might just keep playing!

No wonder every investor has their eyes on these...

Source: BofA

That’s it for today—hope you are enjoying a great start to your Summer!

1 We are tactically bearish in the short term, but do not believe in a large (>10%) drawdown.

More By This Author:

$30 Goldilocks (2.0) And The Three Bears

What Landing?

$28 Monetary Tightening Vs. Bank Credit Tightening

Disclosure: This publication's content is for information and entertainment purposes only and should not be relied upon for investment decisions. Nothing produced under the Going John Galt brand ...

more