What Landing?

Image Source: Pexels

Executive Summary

- Over the past months, financial currents were underscored by discussions around Goldilocks 2.0 and the ‘immaculate disinflation’ narrative

- In housing, reluctant sellers are holding the door to significantly lower valuations/housing prices shut

- Right tail outcomes now seem more palpable, as markets more often than not markets have historically continued to ‘crash up’

This post discusses—implicitly or explicitly—investments in US rates/bonds and equities.

Damn, it’s been a long time…

First of all, I’d like to extend a warm welcome (back) to everyone. For those who don’t follow me on Twitter (@GoingJGalt) you must have been wondering what I’ve been up to lately.

Well, I’ve been connected to the markets as intensely as ever. However, I had the brilliant idea to tangle myself up in all sorts of new non-listed investments that required my attention. These include a couple of investments in Indonesia (mainly real estate/villas and tourism-oriented ventures) and some private equity types of investments (e.g., preferred equity in a technological QoE firm).

There have also been a couple of personal changes, the most important of which is Mr. and Mrs. Galt’s full-time move to Switzerland.

Actual views from Galt’s Gulch

On the other hand, my listed portfolio was relatively well positioned for the most part… owning uranium (spot), big oil equities, and ChinaTech. I’ve been taking it on the chin on my long JPY exposure. Bottom line: Performance has not been anything to write home about, but I’ve not had to make too many changes.

I’ll share more details in upcoming posts (if you’d like!). But for now let’s jump right into today’s note, which will bridge some of the key developments I’ve seen across markets between today’s and my last missive and lay out the foundations for future notes…

Today more than ever, thanks for reading.

Where we left off

Recall our previous discussions in the wake of the decline of Silicon Valley Bank, Silvergate Bank, and Credit Suisse. We touched upon how markets had “moved substantially already—particularly in rates and bonds” and were “discounting substantial damage from lower credit creation and reduced inflationary pressures”. Something’s gotta give…

With systemic risk concerns abating, data needs to start reflecting this damage soon or public discussion will shift back to inflation, reverting / scaling back some of the latest moves.

Such a reversion would see a U-turn in equities, while interest rate-sensitive assets such as bonds / gold / certain FX currency pairs sell off and oil / energy / commodities go bid.

Read more: $28 MONETARY TIGHTENING VS. BANK CREDIT TIGHTENING

Market resilience soon became evident (again) forcing a swift recalibration reminiscent of a timely Reverse Uno card move.

Source: Going John Galt

Over the past months, financial currents were underscored by discussions around Goldilocks 2.0 and the ‘immaculate disinflation’ 1 narrative. These conversations were underpinned by several key developments.

-

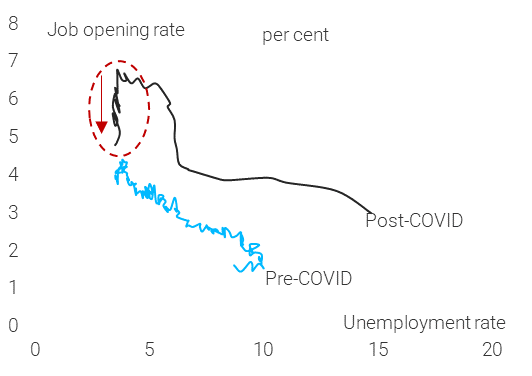

Labor markets have shown signs of strain. A notable point of interest was the recent U.S. JOLTS Job Openings data, a reported 8.8mn vs. 9.5mn (est.), even with unemployment metrics remaining stable. Immaculate disinflation is possible, after all.

Source: Dario Perkins (@darioperkins)

- Inflation (core and headline) has cooled, with wholesale prices teetering on the precipice of deflation. MoM may be have been stalling somewhat lately, but the YoY trend is lower, as hotter datapoints roll off.

- Services remain a beacon of resilience, driving surprisingly robust GDP prints and suggesting that the primary driving force of the US economy remains defiantly strong.

US Housing deserves special mention

US home prices remain relatively resilient despite a staggering rise in mortgage rates and payments. As per the Atlanta Fed, median housing payments represent 43.2% of median income, which is the highest in at least 20Y.

Source: Zero Hedge

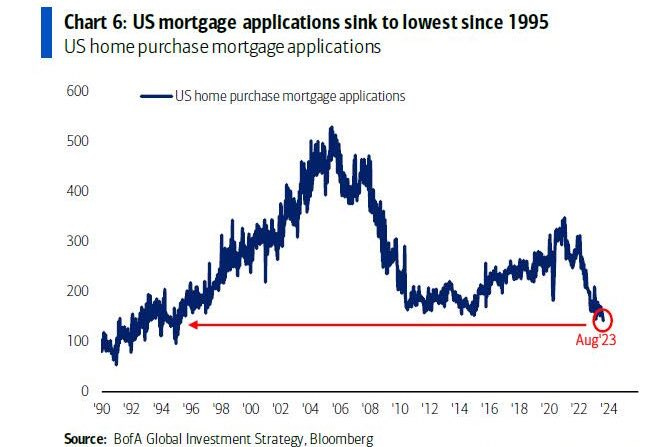

This resilience can be explained by the immense delta between mortgage rates and effective rates, which includes mortgages fixed at much lower levels over time. This differential has fostered a virtual ‘seller’s strike’ among existing homeowners that has driven US mortgage applications to their lowest since 1995. Context.

Source: BofA

Who would renounce a 3.6% rate to enter into a 30Y 7.53% mortgage?

Reluctant sellers are holding the door to significantly lower valuations/housing prices shut. It’s hard to envision a significant drop in prices with these dynamics going on. Hodor.

Never say never

The market's skepticism that the economy can handle “higher for longer” has been noticeably alleviated. The economy seems to have turned the corner…

(Click on image to enlarge)

Source: BofA, Clocktower

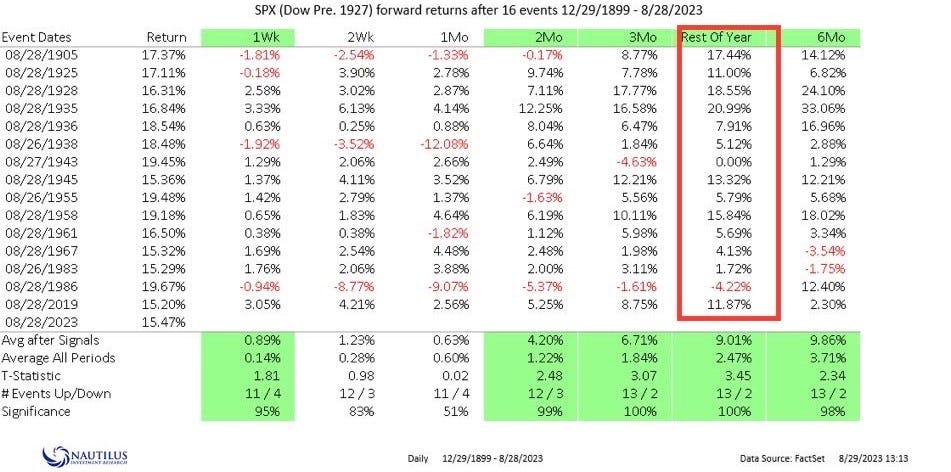

Just a short while ago, the strategy du jour among investors was hedging against left-tail risks. Now, the pendulum has swung and the probability of a right-tail outcome seems more palpable to many. Historically, more often than not markets have continued to ‘crash up’.

(Click on image to enlarge)

Source: Nautilus Investment Research

Now picture this. It’s entirely possible that expectations for a cooler core CPI going forward could force rates lower. Such a rate drop could happen even if the slowing of headline CPI stalls, as long as the market is able to digest the reasons (i.e., positive base effects fading, ‘temporary’ uptick in commodities’ prices).

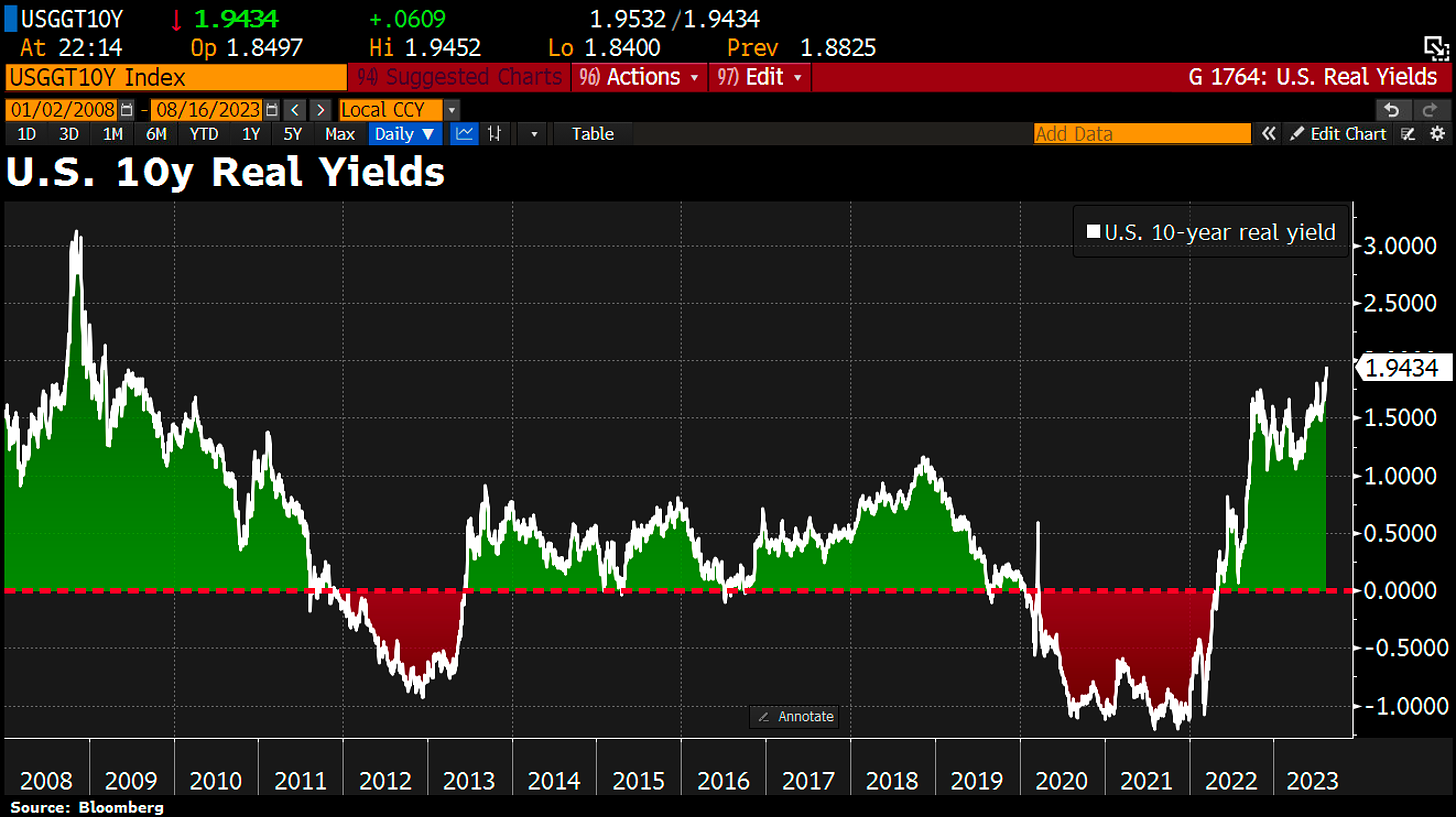

Now paint a picture where 10-year US reals plummet considerably from their 14Y highs. Don’t you think the S&P could undergo a significant mechanical re-rating in response?

This exercise suggests that we might see even loftier S&P levels going forward, even before looking at other positives 2. Perhaps even all-time highs? 3 Never say never.

Source: Holger Zschaepitz, Bloomberg

As the great Marko Papic recently asked himself… “What landing?”

As you see, I continue to be relatively constructive about the markets, even more so than about the economy itself. There are just more scenarios where things remain somewhat positive.

That’s it for today. I promise you won’t have to wait for such a long time for the next post.

0 VOTES · 2 DAYS REMAINING · SHOW OPTIONS

1 Narrative stipulating that disinflation could happen without a substantial slowdown in economic growth or a major hit to the job market.

2 These include increasing “monetary headroom” from the Fed’s Balance Sheet Reduction (~$1tn below peak) / higher rates, China’s renewed fiscal push, exciting developments on the technological side (e.g., AI, blockchain, robotics, biotech/genomics, etc.).

3 This landscape could become even more intriguing…

It's a stretch to think that the valuation multiples for America's towering mega-cap giants will abruptly shrink significantly, particularly if technicals remain supportive, growth maintains its momentum and inflation further softens. Imagine a situation where the broader market re-rates a couple of turns (just below 20x), with the “Magnificent 7” flat. Lower left tail odds.

More By This Author:

$28 Monetary Tightening Vs. Bank Credit Tightening

$27 No Perfect Time For Hikes

$26 Higher For Longer

Disclosure: This publication's content is for information and entertainment purposes only and should not be relied upon for investment decisions. Nothing produced under the Going John Galt brand ...

more