Foreigners Dumped Record Amount Of US Treasuries Amid March Liquidity Crisis

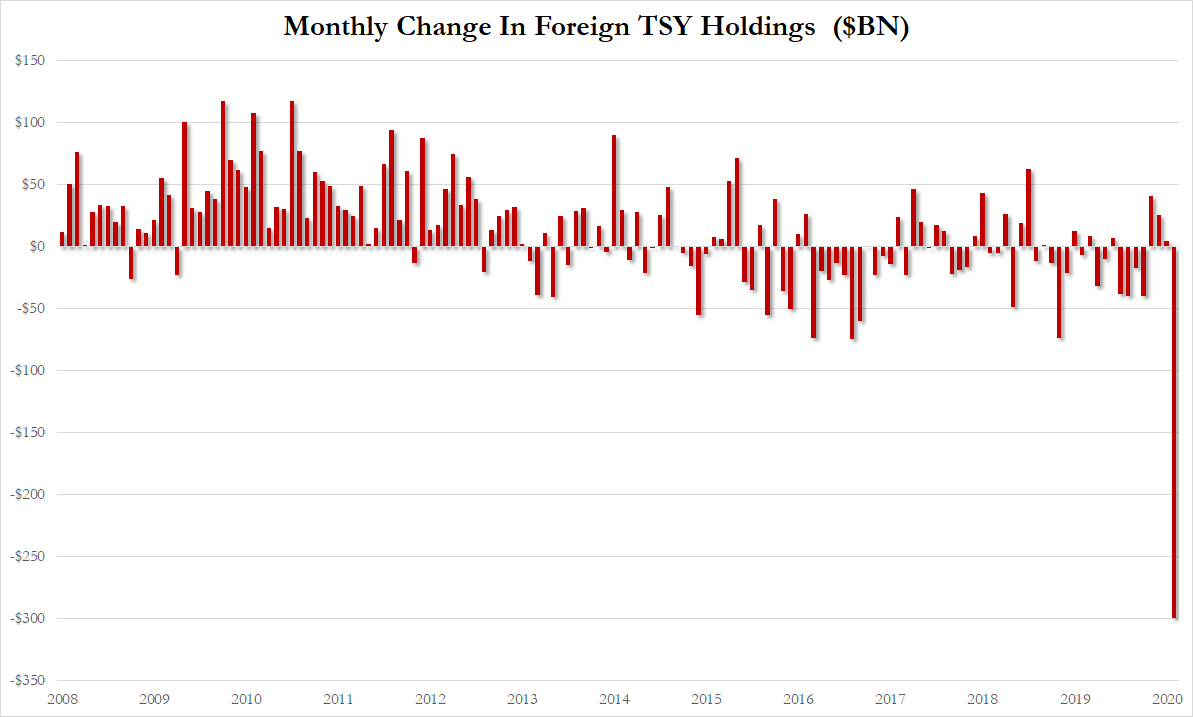

Foreign holdings of U.S. government debt fell in March, at a time when panic over the COVID-19 pandemic was driving volatility in the world’s safest market to highs unseen since 2009.

Treasury’s report showed total foreign ownership of Treasuries dropped by a record amount...

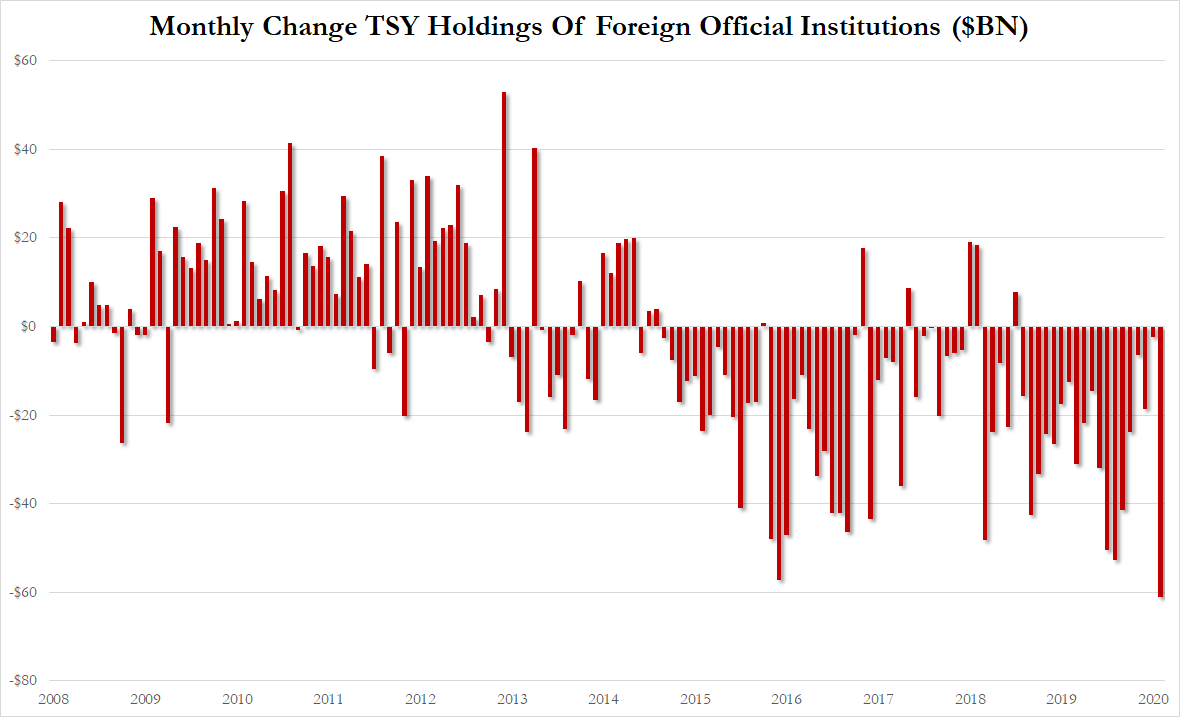

In fact this was a record monthly sale of US Treasuries by central banks...

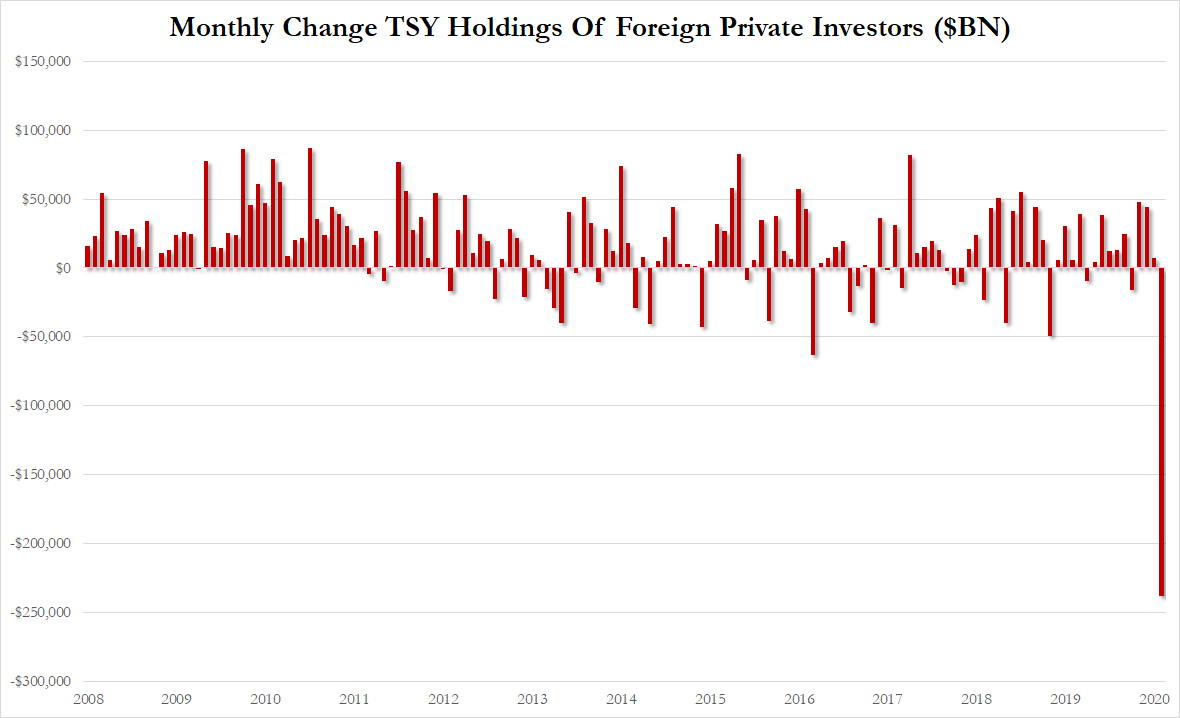

And record selling by foreign private investors...

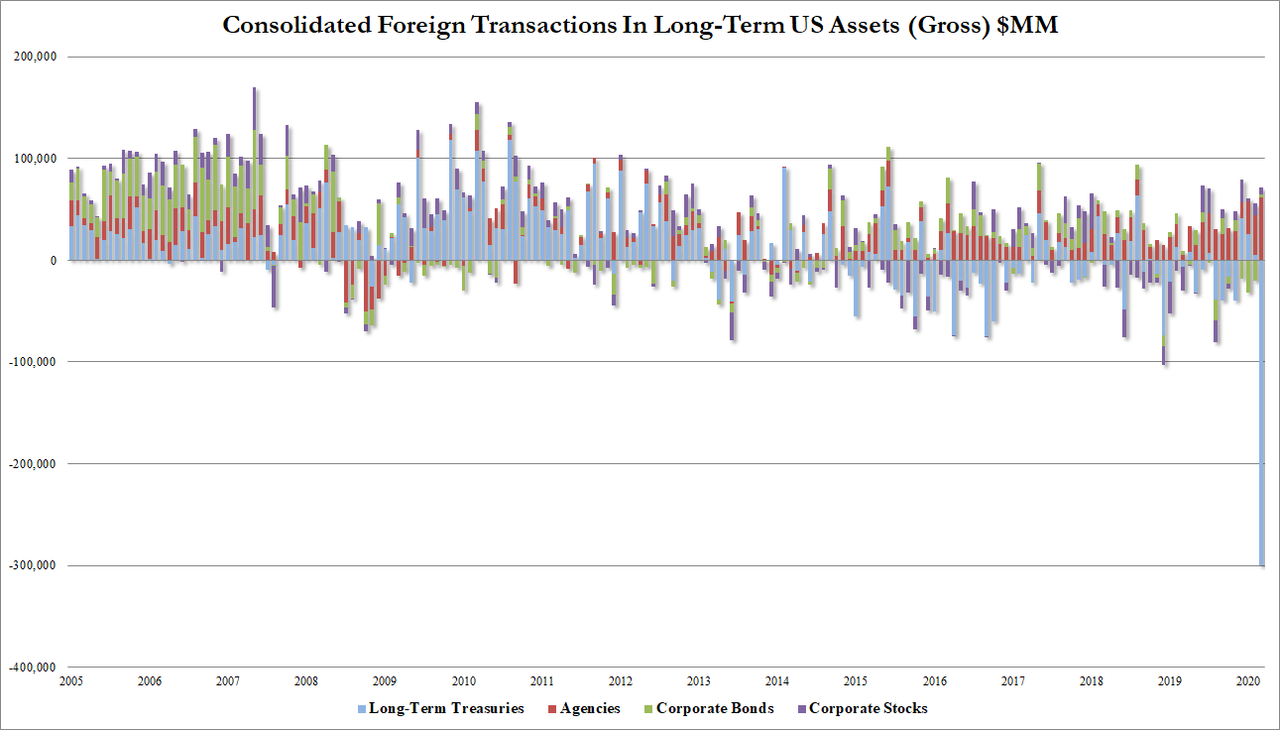

In aggregate it was a record month of selling for all US assets but the Treasury selling ($299.3BN) was offset by...

-

buying of $61.5BN in Agencies

-

buying of $3.177BN in Corporate Bonds

-

buying of $6.812BN in Stocks

(We do note that TIC data are mark to market, so the value of holdings are driven in part by price swings in the relevant month and as liquidity crises struck, we saw bonds getting sold along with everything else)

The total for China - the second-largest holder of U.S. government debt - sank $10.7 billion in March to $1.08 trillion. Japan still has the largest pile of Treasuries outside the U.S.; the value of its holdings rose $3.4 billion to $1.27 trillion.

Source: Bloomberg

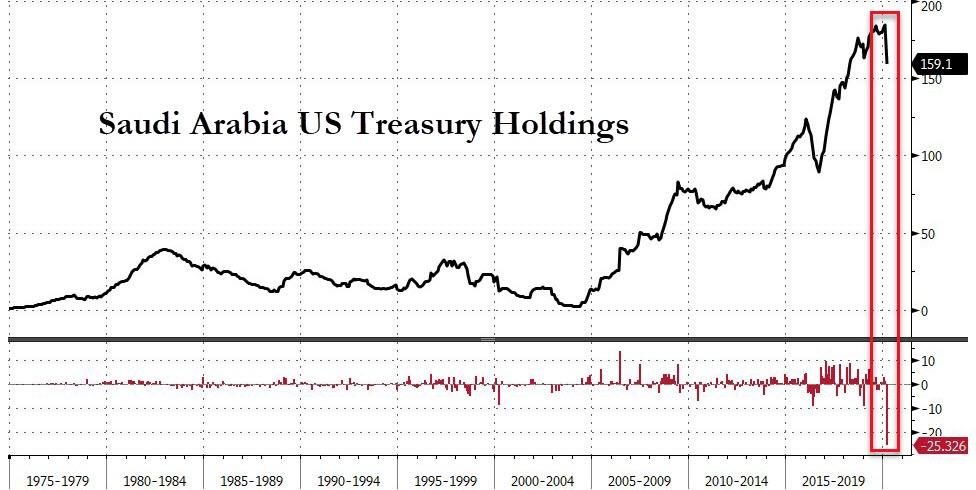

Saudi Arabia dumped a record $25.3 billion in US Treasuries...(which makes sense as petro-exporters dumping anything and everything for liquidity)

Source: Bloomberg

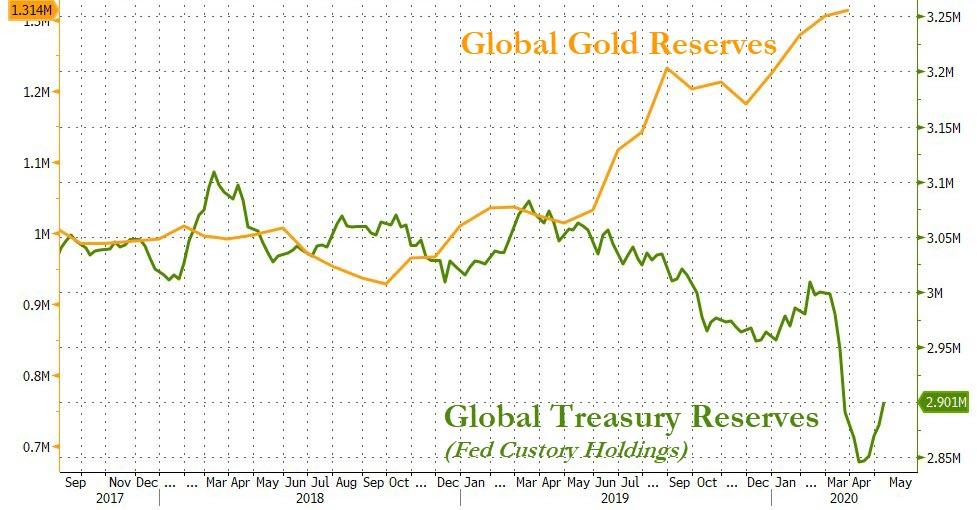

But while they were all selling US Treasuries, they were buying something...

Source: Bloomberg

As the recent trend of rotation from US Treasuries to gold continues.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

This is not a good sign, however, can anyone be surprised given no attempt at balancing things, asking the Federal Reserve to increase their holdings, and Trump going on a new trade etc. war with China. It is true the market is where it is because there is not much else to put your money these days, however, if the US has trouble with government bond issues later that will affect everything. The US can't afford to finance its own debt levels alone.

Worrisome, but not surprising at all.

True. The big issue is we will have to watch foreign holdings of our government debt. If it drops precipitously then it's time to worry.

Agreed Mr. Woong.