Fading The Rip Higher

An AI's impression of The Dow Jones Internet Composite Index

Not Buying The Bounce

Stocks ripped higher Tuesday, despite all the familiar macro headwinds remaining in place: record inflation, rising interest rates, pending profit downgrades, the ongoing Ukraine War, plus added tensions with China.

“When she's not busy exercising call options on Nvidia, Inc. $NVDA shares to profit from pending legislation, or bailing her husband out of jail for a DUI arrest, Nancy Pelosi…”

— Portfolio Armor (@PortfolioArmor) July 19, 2022

Provokes China 🇨🇳 over Taiwan 🇹🇼.https://t.co/3tM9s49YBM

There was relief on news that Russia planned to restart gas deliveries through its Nord Stream 1 pipeline on Thursday, but after hours there was negative news on both Nord Stream 1 and inflation. Germany's DW News reported comments by Russian President Vladimir Putin that gas supplies via Nord Stream 1 could be further reduced, due to maintenance work.

President Vladimir Putin said Russian gas supplies to Europe could be further reduced, due to maintenance work in Nord Stream I pipeline. https://t.co/escvAyx2Pt

— DW News (@dwnews) July 20, 2022

And June inflation data in the UK came in red hot.

🇬🇧 *UK JUNE CONSUMER PRICES RISE 9.4% Y/Y; EST. 9.3%

— Christophe Barraud🛢🐳 (@C_Barraud) July 20, 2022

*UK JUNE CORE CPI RISES 5.8% Y/Y; EST. +5.8%

*UK JUNE RETAIL PRICE INDEX RISES 11.8% Y/Y; EST. +11.8%https://t.co/lqXRk7JLAk

Long Energy, Short Treasuries and Tech

Our system doesn't consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach painted a fairly clear picture in our top ten names as of Tuesday's close:

- Long Energy: ProShares Ultra Bloomberg Natural Gas (BOIL), Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH), Valero Energy Corp. (VLO), Comstock Resources, Inc. (CRK).

- Short Treasuries: Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV), ProShares UltraPro Short 20+ Year Treasury (TTT).

- Short Tech: Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS)

Screen capture via Portfolio Armor on 7/19/2022.

A Hedged Bet Against Tech

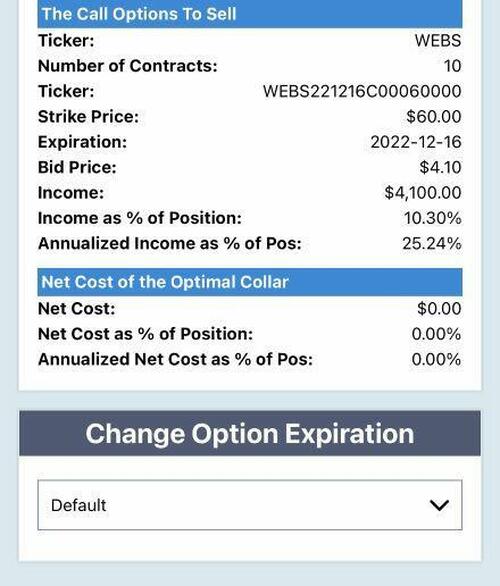

WEBS is a 3x levered bet against the Dow Jones Internet Composite Index. That index includes forty stocks of the largest companies that get half or more of their revenues via the internet, everything from Amazon, Inc. (AMZN) to Netflix, Inc. (NFLX). Of course, triple-leveraged ETFs can be extremely risky, so here's a way to buy it and cost-effectively hedge in case we're wrong.

As of Tuesday's close, this was the optimal collar to hedge 1,000 shares of WEBS against a greater-than-25% drop, while not capping your possible upside at less than 50% over the same period.

Screen captures via the Portfolio Armor iPhone app.

Best case scenario, you're up 50% by December; worst case scenario, you're down 25%. And you're not paying anything to hedge.

More By This Author:

In Case Netflix Disappoints This Week

Riding The Natural Gas Rollercoaster

CPI Print Supports Worst Of Both Worlds Prediction

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more