COT Bonds Speculators Raise 3-Month SOFR Bets As Eurodollars Are Phased Out

Image Source: Pixabay

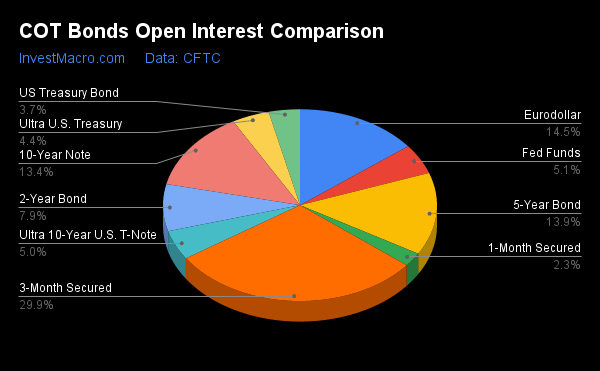

Here are the latest charts and statistics for the Commitment of Traders (COT) reports data published by the Commodities Futures Trading Commission (CFTC). The latest COT data is updated through Tuesday, April 11, and it shows a quick view of how large traders (for-profit speculators and commercial hedgers) were positioned in the futures markets.

Weekly Speculator Changes Led by SOFR 3-Months & 5-Year Bonds

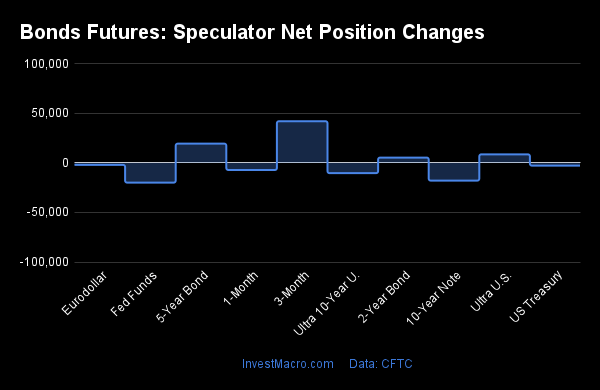

The COT bond market speculator bets were lower this week, as four out of the nine bond markets we cover had higher positioning while the other five markets had lower speculator contracts.

Leading the gains was the SOFR 3-month bond (41,837 contracts), with 5-year bonds (19,258 contracts), ultra Treasury bonds (8,480 contracts), and 2-year bonds (5,214 contracts) also experiencing a positive period.

The bond markets with declines in speculator bets for the week were Fed Funds (-20,036 contracts), 10-year bonds (-18,006 contracts), the Eurodollar (-2,166 contracts), US Treasury bonds (-2,938 contracts), and ultra 10-year bonds (-10,494 contracts).

SOFR Contracts to Replace Eurodollar Contracts This Week

This week was an important time for the Secured Overnight Financing Rate (3-Months) or SOFR contracts. The SOFR contracts are relatively new on the scene as these futures only started in 2020.

The SOFR contracts are in the process of taking the place of the Eurodollar contracts as the Eurodollars are being phased out, and this week marks the last week for traders to use the Eurodollars contracts. Going forward, the Eurodollars contracts will be converted into 3-month SOFRs.

Eurodollars were the most traded and the highest open interest contract in the futures market for many years because it was a way for investors to express a view on short-term interest rates based on the London Interbank Offered Rate (LIBOR).

However, LIBOR was fraught with controversy, as it was a survey based on banks and was caught up in a manipulation scandal in 2012. In that scandal, bank participants colluded to move the LIBOR rate higher or lower and use that to their advantage.

The SOFR has taken precedence because it is calculated using actually market data (provided by the NY Fed Bank) instead of survey data. The SOFR data is from the US Dollar Treasury overnight repurchase agreement (REPO) transactions, which are essentially loans between banks that are backed and collateralized by Treasury securities.

The SOFR contracts now have the highest open interest levels, with these contracts exceeding over 10 million in open interest in March. To read more on the SOFRs and how to imply the SOFR interest rate from the futures contracts, see here.

Data Snapshot of Bond Market Traders | Columns Legend

|

Apr-11-2023

|

OI

|

OI-Index

|

Spec-Net

|

Spec-Index

|

Com-Net

|

COM-Index

|

Smalls-Net

|

Smalls-Index

|

|---|---|---|---|---|---|---|---|---|

| Eurodollar | 4,630,651 | 0 | -649,485 | 57 | 801,073 | 41 | -151,588 | 71 |

| 5-Year | 4,446,566 | 97 | -761,981 | 2 | 722,702 | 94 | 39,279 | 92 |

| 10-Year | 4,275,293 | 84 | -639,037 | 0 | 622,661 | 88 | 16,376 | 87 |

| 2-Year | 2,531,969 | 68 | -496,841 | 25 | 460,413 | 72 | 36,428 | 73 |

| FedFunds | 1,624,730 | 57 | -167,276 | 19 | 175,875 | 81 | -8,599 | 74 |

| Long T-Bond | 1,179,823 | 52 | -132,584 | 41 | 69,508 | 35 | 63,076 | 95 |

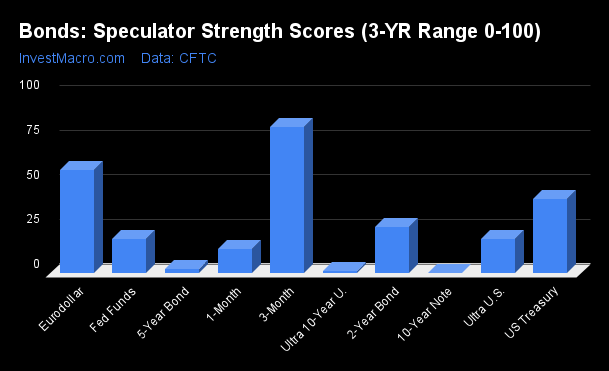

Strength Scores Led by SOFR 3-Month & Eurodollar

COT Strength Scores (which are a normalized measure of speculator positions over a three-year range, from 0 to 100, where above 80 is Extreme-Bullish and below 20 is Extreme-Bearish) showed that the SOFR 3-month (82%) and the Eurodollar (57%) were the leaders of the bond markets this week. The US Treasury bond (41%) comes in as the next highest in the weekly strength scores.

On the downside, 10-year bonds (0%) and ultra 10-year bonds (1%) came in at the lowest strength levels and are in Extreme-Bearish territory (below 20%). The ones with the next lowest strength scores were 5-year bonds (2%) and ultra Treasury bonds (19%).

Strength statistics:

- Fed Funds (19.0%) vs. Fed Funds the previous week (21.4%).

- 2-year bond (25.5%) vs. 2-year bond the previous week (24.8%).

- 5-year bond (2.2%) vs. 5-year bond the previous week (0.0%).

- 10-year bond (0.0%) vs. 10-year bond the previous week (2.2%).

- Ultra 10-year bond (1.2%) vs. ultra 10-year bond the previous week (3.4%).

- US Treasury bond (41.4%) vs. US Treasury bond the previous week (42.4%).

- Ultra US Treasury bond (19.0%) vs. ultra US Treasury bond the previous week (15.4%).

- Eurodollar (57.4%) vs. Eurodollar the previous week (57.4%).

- SOFR 3-months (81.6%) vs. SOFR 3-months the previous week (78.2%).

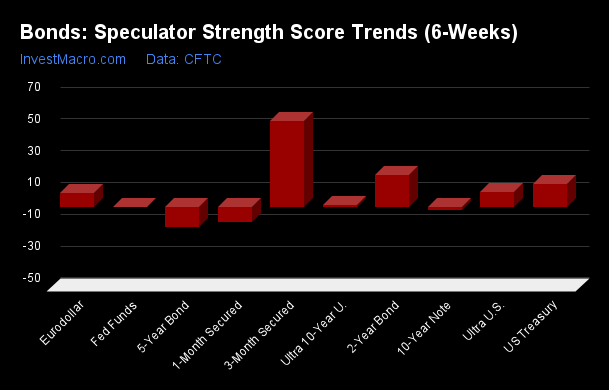

SOFR 3-Months & 2-Year Bonds Top the Six-Week Strength Trends

COT Strength Score Trends (or otherwise called the move index, which calculates the six-week changes in strength scores) showed that the SOFR 3-months (54%) and the 2-year bonds (20%) were the leaders for the trends over the past six weeks. US Treasury bonds (14%) and 5-year bonds (-12%) were the next highest in terms of the trends data.

10-year bonds (-1%) led to the downside, with Fed Funds (0%) and ultra 10-year bonds (1%) following closely behind.

Strength trend statistics:

- Fed Funds (0.5%) vs. Fed Funds the previous week (-7.1%).

- 2-year bond (20.4%) vs. 2-year bond the previous week (24.4%).

- 5-year bond (-12.4%) vs. 5-year bond the previous week (-20.8%).

- 10-year bond (-1.4%) vs. 10-year bond the previous week (-14.7%).

- Ultra 10-year bond (1.2%) vs. ultra 10-year bond the previous week (-9.8%).

- US Treasury bond (14.4%) vs. US Treasury bond the previous week (8.2%).

- Ultra US Treasury bond (9.9%) vs. ultra US Treasury bond the previous week (-1.9%).

- Eurodollar (9.0%) vs. Eurodollar the previous week (9.3%).

- SOFR 3-months (54.2%) vs. SOFR 3-months the previous week (43.9%).

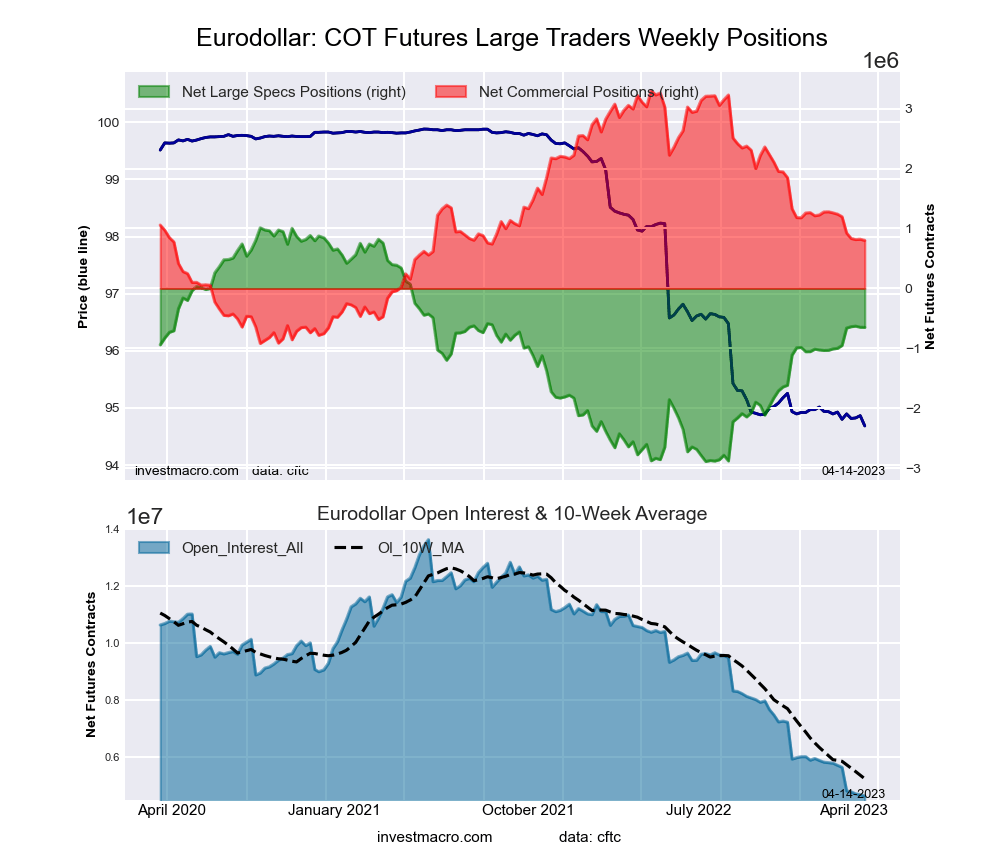

Individual Bond Markets - 3-Month Eurodollars Futures

The 3-month Eurodollars large speculator standing this week recorded a net position of -649,485 contracts in the data reported through Tuesday. This was a weekly reduction of -2,166 contracts from the previous week, which had a total of -647,319 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.4%. The commercials are Bearish with a score of 40.7%, and the small traders (not shown in chart) are Bullish with a score of 71.1%.

| 3-Month Eurodollars Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 6.2 | 67.7 | 4.5 |

| –% of Open Interest Shorts: | 20.3 | 50.4 | 7.7 |

| – Net Position: | -649,485 | 801,073 | -151,588 |

| – Gross Longs: | 288,650 | 3,134,754 | 207,022 |

| – Gross Shorts: | 938,135 | 2,333,681 | 358,610 |

| – Long to Short Ratio: | 0.3 to 1 | 1.3 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 57.4 | 40.7 | 71.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.0 | -10.4 | 19.5 |

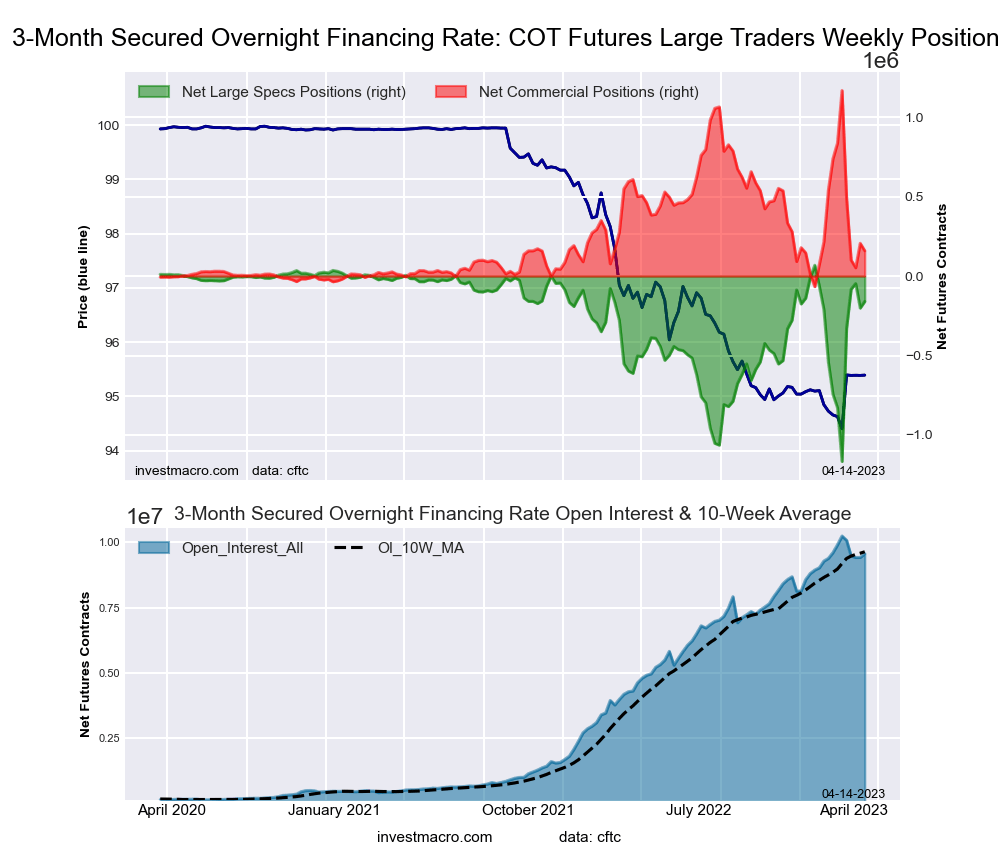

Secured Overnight Financing Rate (3-Month) Futures

The Secured Overnight Financing Rate (3-month) large speculator standing this week recorded a net position of -159,440 contracts in the data reported through Tuesday. This was a weekly advance of 41,837 contracts from the previous week, which had a total of -201,277 net contracts.

This week’s current strength score shows the speculators are currently Bullish-Extreme with a score of 81.6%. The commercials are Bearish-Extreme with a score of 18.3%, and the small traders are Bullish-Extreme with a score of 88.0%.

| SOFR 3-Months Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 20.1 | 57.7 | 0.5 |

| –% of Open Interest Shorts: | 21.8 | 56.0 | 0.5 |

| – Net Position: | -159,440 | 159,269 | 171 |

| – Gross Longs: | 1,920,637 | 5,513,375 | 48,102 |

| – Gross Shorts: | 2,080,077 | 5,354,106 | 47,931 |

| – Long to Short Ratio: | 0.9 to 1 | 1.0 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 81.6 | 18.3 | 88.0 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 54.2 | -55.0 | 4.8 |

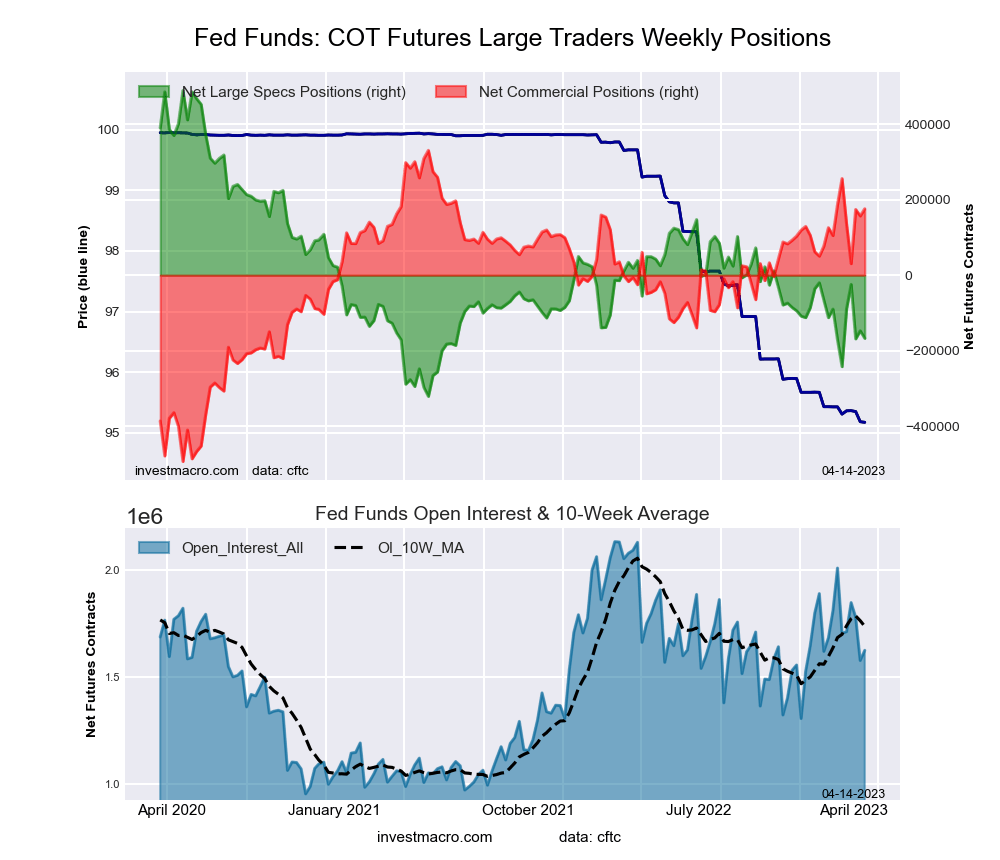

30-Day Federal Funds Futures

The 30-day Federal Funds large speculator standing this week recorded a net position of -167,276 contracts in the data reported through Tuesday. This was a weekly decline of -20,036 contracts from the previous week, which had a total of -147,240 net contracts.

This week’s current strength score shows the speculators are currently Bearish-Extreme with a score of 19.0%. The commercials are Bullish-Extreme with a score of 81.2%, and the small traders are Bullish with a score of 74.1%.

| 30-Day Federal Funds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 2.3 | 82.1 | 2.4 |

| –% of Open Interest Shorts: | 12.6 | 71.3 | 2.9 |

| – Net Position: | -167,276 | 175,875 | -8,599 |

| – Gross Longs: | 37,100 | 1,334,569 | 38,360 |

| – Gross Shorts: | 204,376 | 1,158,694 | 46,959 |

| – Long to Short Ratio: | 0.2 to 1 | 1.2 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 19.0 | 81.2 | 74.1 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.5 | -1.3 | 14.0 |

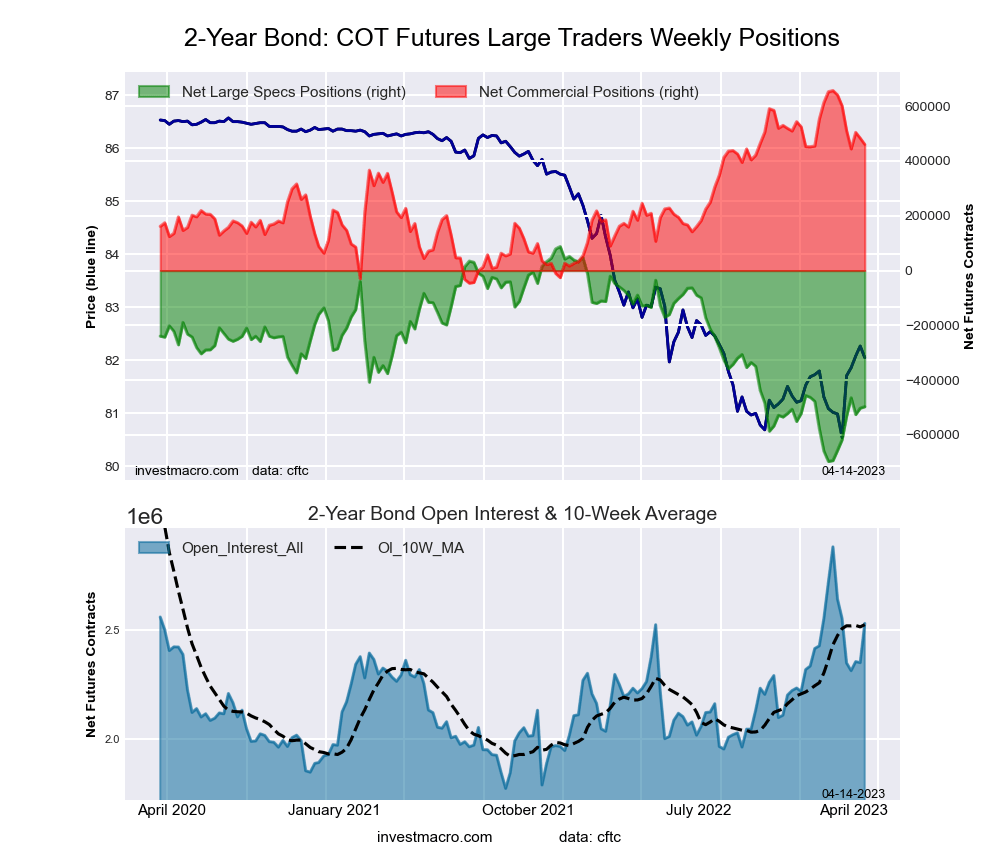

2-Year Treasury Note Futures

The 2-year Treasury note large speculator standing this week recorded a net position of -496,841 contracts in the data reported through Tuesday. This was a weekly advance of 5,214 contracts from the previous week, which had a total of -502,055 net contracts.

This week’s current strength score shows the speculators are currently Bearish with a score of 25.5%. The commercials are Bullish with a score of 72.0%, and the small traders are Bullish with a score of 73.3%.

| 2-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 8.7 | 82.3 | 8.1 |

| –% of Open Interest Shorts: | 28.4 | 64.2 | 6.7 |

| – Net Position: | -496,841 | 460,413 | 36,428 |

| – Gross Longs: | 221,139 | 2,084,824 | 205,672 |

| – Gross Shorts: | 717,980 | 1,624,411 | 169,244 |

| – Long to Short Ratio: | 0.3 to 1 | 1.3 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 25.5 | 72.0 | 73.3 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 20.4 | -25.7 | 9.9 |

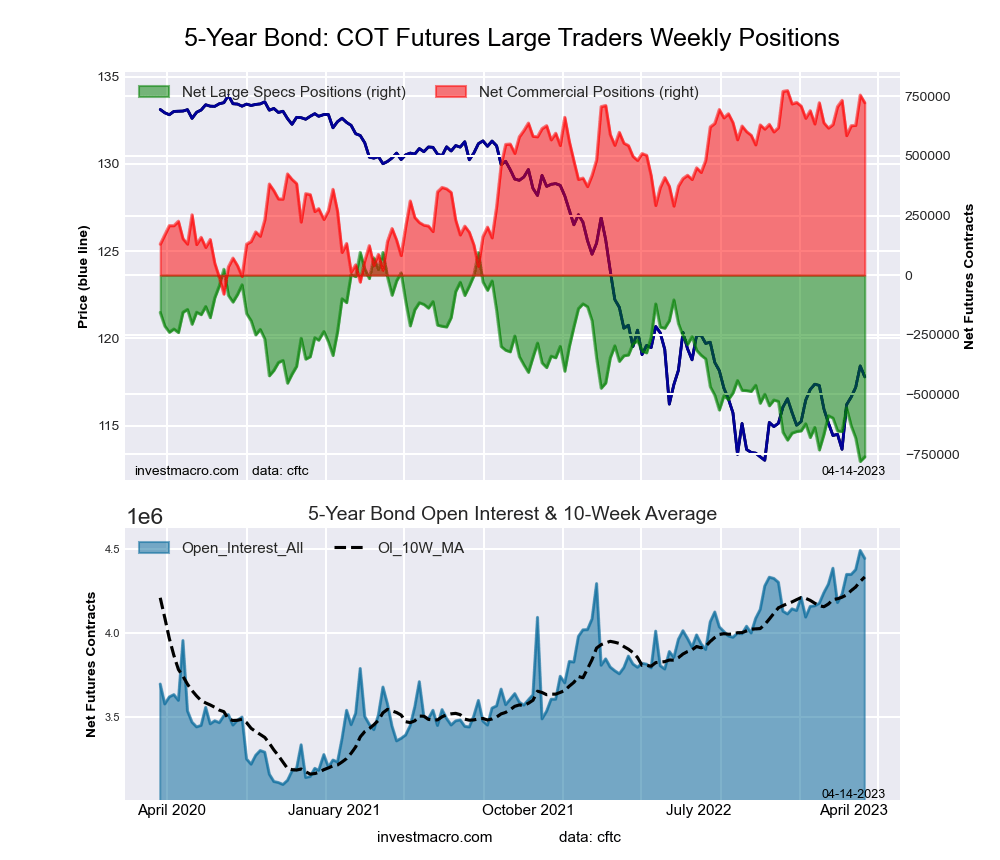

5-Year Treasury Note Futures

The 5-year Treasury note large speculator standing this week recorded a net position of -761,981 contracts in the data reported through Tuesday. This was a weekly gain of 19,258 contracts from the previous week, which had a total of -781,239 net contracts.

This week’s current strength score shows the speculators are currently Bearish-Extreme with a score of 2.2%. The commercials are Bullish-Extreme with a score of 94.0%, and the small traders are Bullish-Extreme with a score of 91.8%.

| 5-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 7.0 | 83.4 | 8.2 |

| –% of Open Interest Shorts: | 24.2 | 67.2 | 7.3 |

| – Net Position: | -761,981 | 722,702 | 39,279 |

| – Gross Longs: | 312,076 | 3,708,958 | 365,278 |

| – Gross Shorts: | 1,074,057 | 2,986,256 | 325,999 |

| – Long to Short Ratio: | 0.3 to 1 | 1.2 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 2.2 | 94.0 | 91.8 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -12.4 | 1.9 | 25.4 |

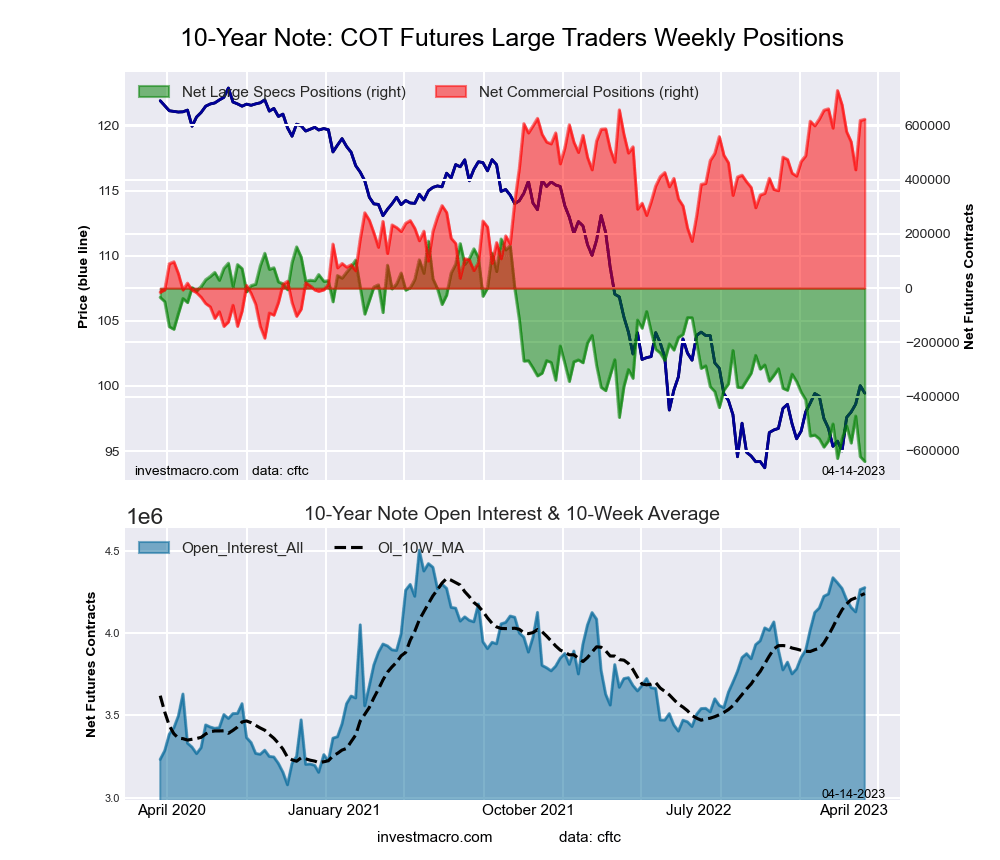

10-Year Treasury Note Futures

The 10-year Treasury note large speculator standing this week recorded a net position of -639,037 contracts in the data reported through Tuesday. This was a weekly reduction of -18,006 contracts from the previous week, which had a total of -621,031 net contracts.

This week’s current strength score shows the speculators are currently Bearish-Extreme with a score of 0.0%. The commercials are Bullish-Extreme with a score of 88.4%, and the small traders are Bullish-Extreme with a score of 87.4%.

| 10-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 9.8 | 79.7 | 8.7 |

| –% of Open Interest Shorts: | 24.7 | 65.1 | 8.3 |

| – Net Position: | -639,037 | 622,661 | 16,376 |

| – Gross Longs: | 418,080 | 3,405,619 | 371,253 |

| – Gross Shorts: | 1,057,117 | 2,782,958 | 354,877 |

| – Long to Short Ratio: | 0.4 to 1 | 1.2 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 0.0 | 88.4 | 87.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.4 | -11.6 | 28.9 |

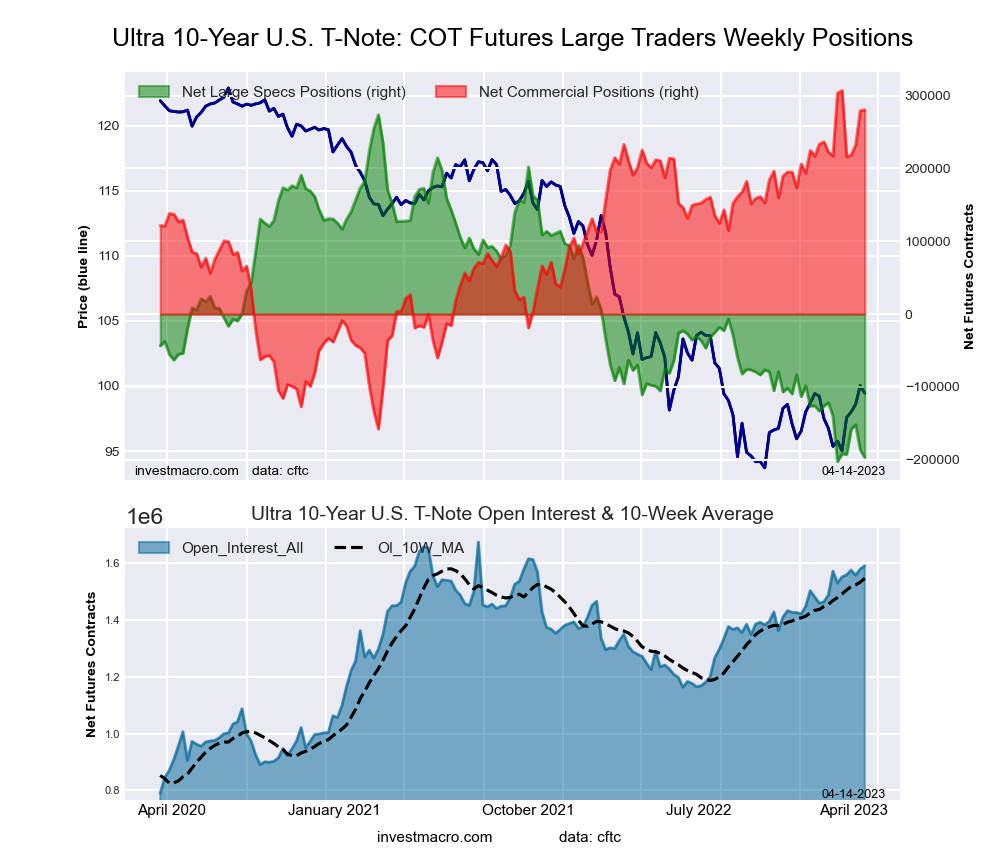

Ultra 10-Year Notes Futures

The ultra 10-year notes large speculator standing this week recorded a net position of -196,971 contracts in the data reported through Tuesday. This was a weekly fall of -10,494 contracts from the previous week, which had a total of -186,477 net contracts.

This week’s current strength score shows the speculators are currently Bearish-Extreme with a score of 1.2%. The commercials are Bullish-Extreme with a score of 94.3%, and the small traders are Bullish with a score of 64.4%.

| Ultra 10-Year Notes Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 7.9 | 81.1 | 9.7 |

| –% of Open Interest Shorts: | 20.3 | 63.4 | 14.9 |

| – Net Position: | -196,971 | 280,480 | -83,509 |

| – Gross Longs: | 126,517 | 1,290,288 | 153,890 |

| – Gross Shorts: | 323,488 | 1,009,808 | 237,399 |

| – Long to Short Ratio: | 0.4 to 1 | 1.3 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 1.2 | 94.3 | 64.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 1.2 | -4.9 | 10.3 |

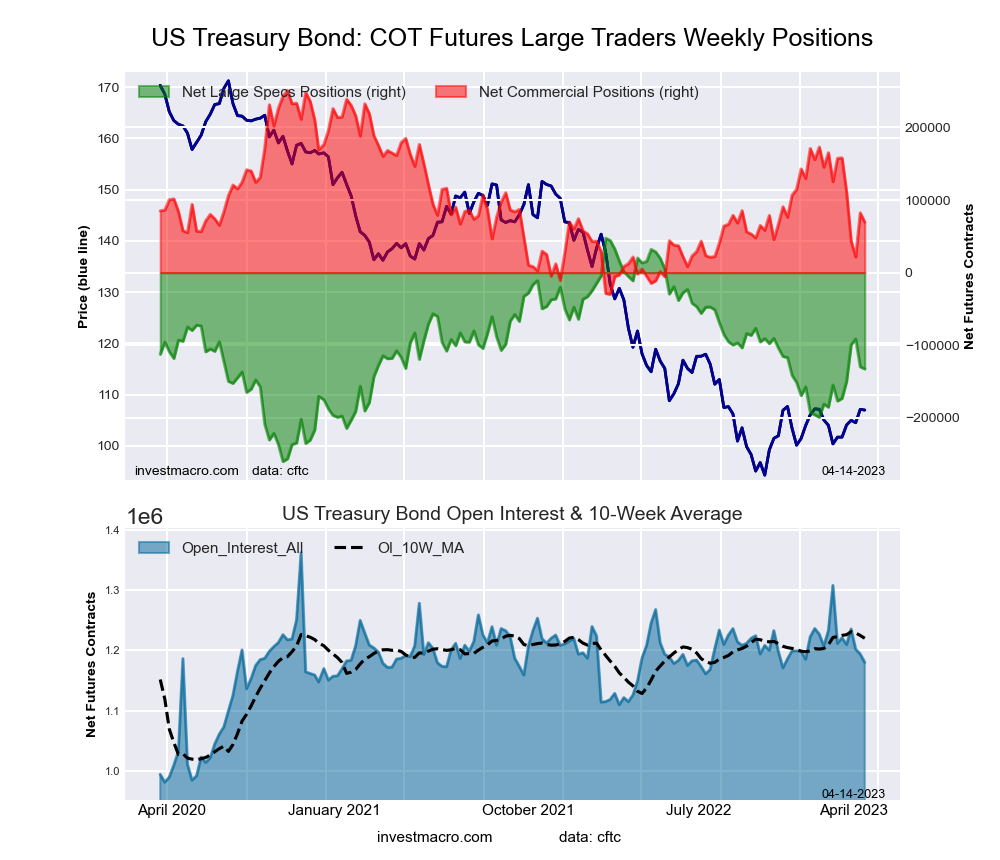

US Treasury Bonds Futures

The US Treasury bonds large speculator standing this week recorded a net position of -132,584 contracts in the data reported through Tuesday. This was a weekly decrease of -2,938 contracts from the previous week, which had a total of -129,646 net contracts.

This week’s current strength score shows the speculators are currently Bearish with a score of 41.4%. The commercials are Bearish with a score of 35.4%, and the small traders are Bullish-Extreme with a score of 95.1%.

| US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 5.9 | 79.0 | 14.7 |

| –% of Open Interest Shorts: | 17.2 | 73.1 | 9.4 |

| – Net Position: | -132,584 | 69,508 | 63,076 |

| – Gross Longs: | 69,855 | 932,461 | 173,415 |

| – Gross Shorts: | 202,439 | 862,953 | 110,339 |

| – Long to Short Ratio: | 0.3 to 1 | 1.1 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 41.4 | 35.4 | 95.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.4 | -31.3 | 32.2 |

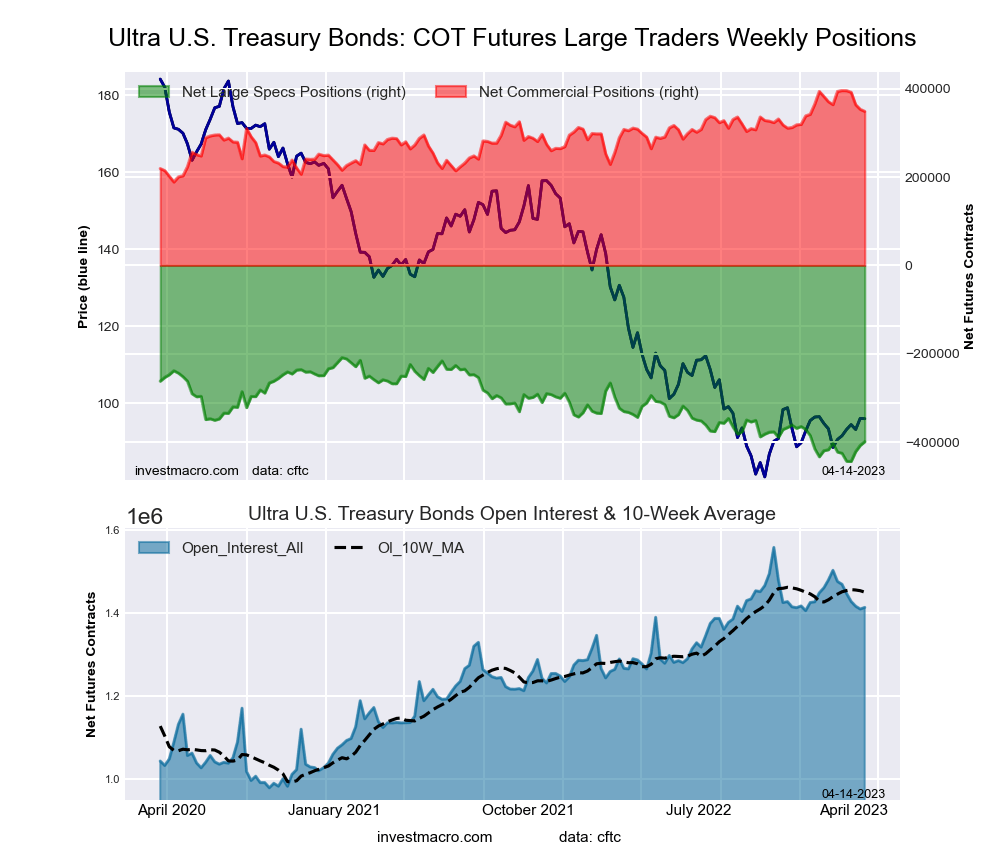

Ultra US Treasury Bonds Futures

The ultra US Treasury bonds large speculator standing this week recorded a net position of -399,278 contracts in the data reported through Tuesday. This was a weekly rise of 8,480 contracts from the previous week, which had a total of -407,758 net contracts.

This week’s current strength score shows the speculators are currently Bearish-Extreme with a score of 19.0%. The commercials are Bullish with a score of 77.2%, and the small traders are Bullish-Extreme with a score of 90.4%.

| Ultra US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 5.5 | 83.0 | 11.3 |

| –% of Open Interest Shorts: | 33.8 | 58.3 | 7.7 |

| – Net Position: | -399,278 | 348,669 | 50,609 |

| – Gross Longs: | 78,023 | 1,172,982 | 159,503 |

| – Gross Shorts: | 477,301 | 824,313 | 108,894 |

| – Long to Short Ratio: | 0.2 to 1 | 1.4 to 1 | 1.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 19.0 | 77.2 | 90.4 |

| – Strength Index Reading (3 Year Range): | Bearish-Extreme | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.9 | -21.8 | 21.9 |

Article By InvestMacro – Receive our weekly COT Newsletter

COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is three days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits), and non-reportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

More By This Author:

Large Currency Speculators Drop Their Canadian Dollar Bets To 220-Week Low

COT Metals: Gold And Silver Speculator Positions Continue To Move Higher

Bond Speculators Boost Their 5-Year Bond Bearish Bets To Highest Level Since 2018

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more