Corporate Bond Issuance Continues To Soften, Can Potentially Impact Buybacks In Coming Quarters

Corporate bond issuance is on pace to decline 14.3 percent this year. This comes at a time when corporations have been aggressively buying back shares.

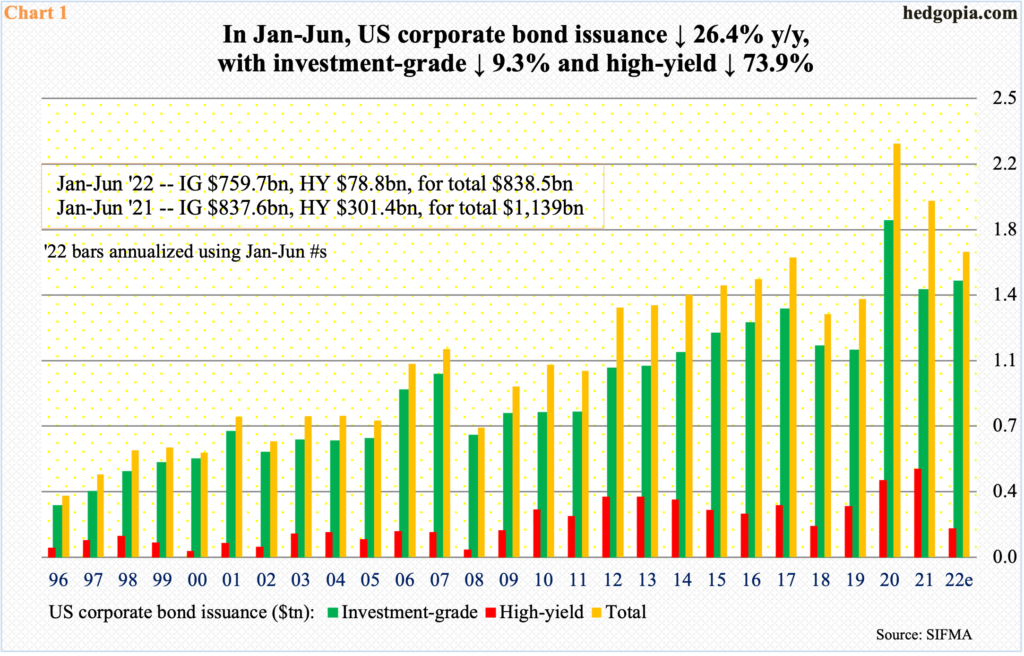

With six months in, US corporate bond issuance remains soft. In June, corporations issued $73.2 billion in investment-grade and $11.2 billion in high-yield, for a six-month total of $759.7 billion and $78.8 billion respectively. In the corresponding period last year, the first-half issuance was $837.6 billion and $301.4 billion, in that order.

If the trajectory seen in January-June holds up for the next six months, investment-grade issuance will total $1.52 trillion and high-yield $157.6 billion this year. This respectively will be up 3.2 percent and down 67.5 percent from 2021, with total issuance on course for a 14.3-percent drop to $1.68 trillion. Total issuance set a record in 2020 when bonds worth $2.27 trillion were issued (Chart 1).

The first-half collapse in high-yield in particular is noteworthy.

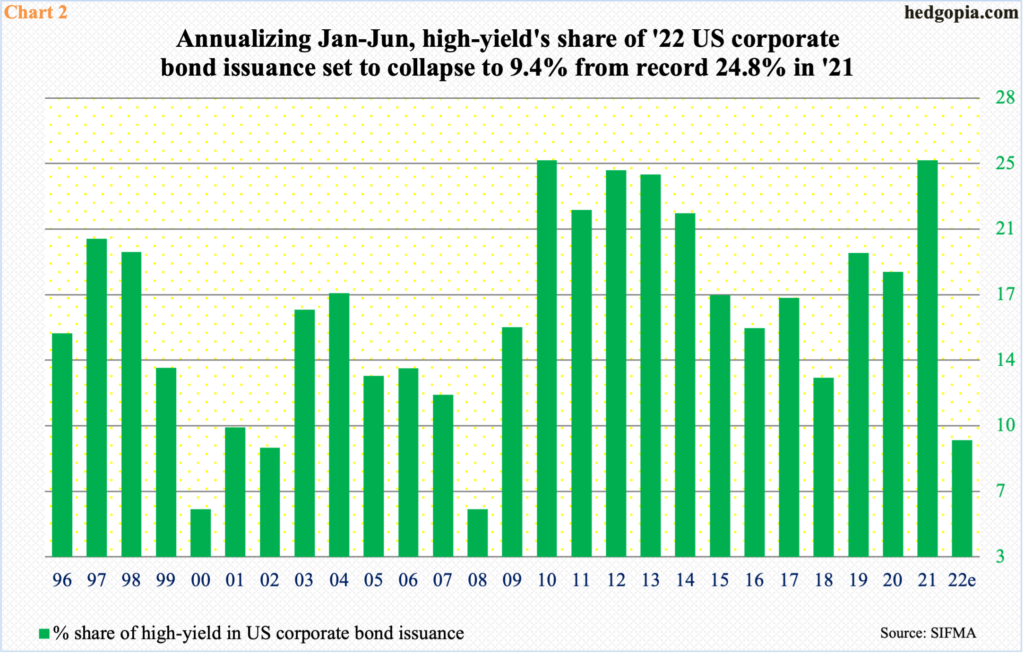

By nature, high yield is risky. They are called junk bonds for a reason. Investor demand for these securities remains high when times are good, or when they anticipate for things to get better. The opposite is true when the economy is downshifting, which is the case now.

Real GDP shrunk 1.6 percent in 1Q, and if the Atlanta Fed’s GDPNow model has it right, the economy will contract another 2.1 percent in the just-concluded 2Q.

Investor avoidance of high-yield this year comes on the heels of a record 2021 when corporations issued $485 billion in these bonds. This year, risk-off sentiment has prevailed. High-yield’s share of total issuance is on course to end the year at 9.4 percent, down substantially from last year’s record 24.8 percent (Chart 2).

High yield is one of the vehicles for investors to express caution. Using this yardstick, the investing environment is a risk-off.

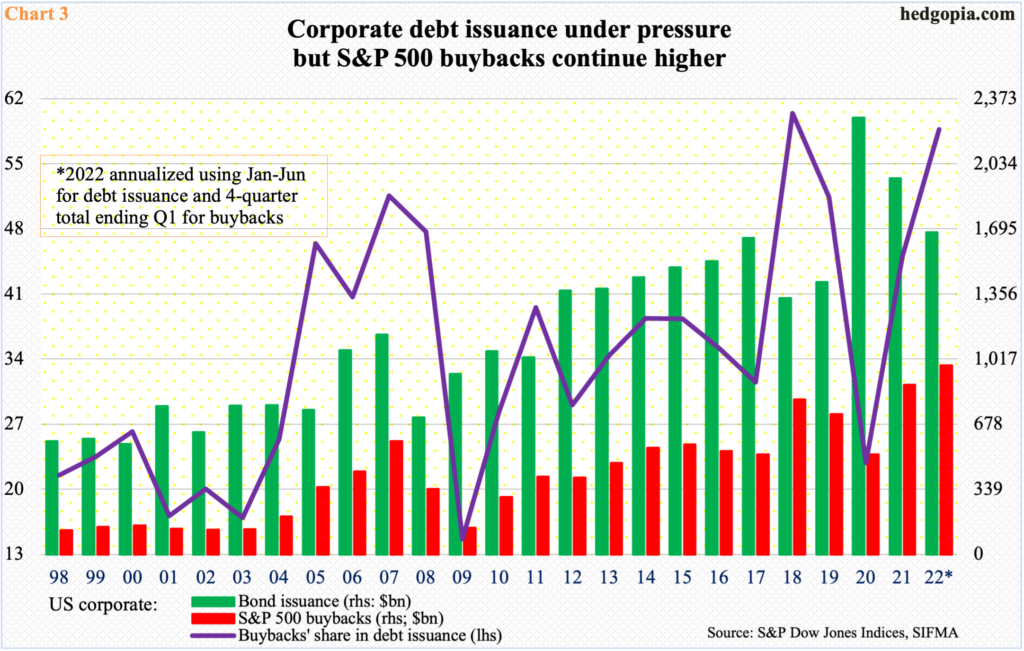

With that said, the same cannot be said about the way corporations have been buying back shares. In 1Q, S&P 500 companies spent $281 billion in buybacks – a fresh record. Given the gradual deterioration in the macro picture, it may not be helpful to annualize this number. But the prevailing momentum can be ascertained from the fact that buybacks totaled $984.6 billion in the four quarters to 1Q – a record.

It is obviously hard to quantify how much of the bond issuance goes toward buybacks, but a fresh dose of cash does not hurt. In this respect, the decline in bond issuance can potentially begin to adversely impact the buyback momentum in the coming quarters. As Chart 3 shows, buybacks and bond issuance have gone the opposite ways.

More By This Author:

Managements Have Opportunity To Use 2Q Earnings Season As Kitchen-Sink Quarter

Futures Positions Of Noncommercials, Large Specs' Net Short - CoT Report

Equity Bulls Put Foot Down At Or Near Support