Conditions Are In Place For A Relief Rally

(Click on image to enlarge)

(Click on image to enlarge)

Tightening financial conditions have been putting stocks under pressure in recent weeks. However, in recent days, Intermarket analysis suggests that this pressure may be easing in the short term.

For example, the dollar, the ultimate safe-haven asset, has been easing off the last few days relieving pressure on risk assets. In addition, interest rates have been coming in as well, relieving pressure on the tech and growth stocks that are most hurt by rising interest rates.

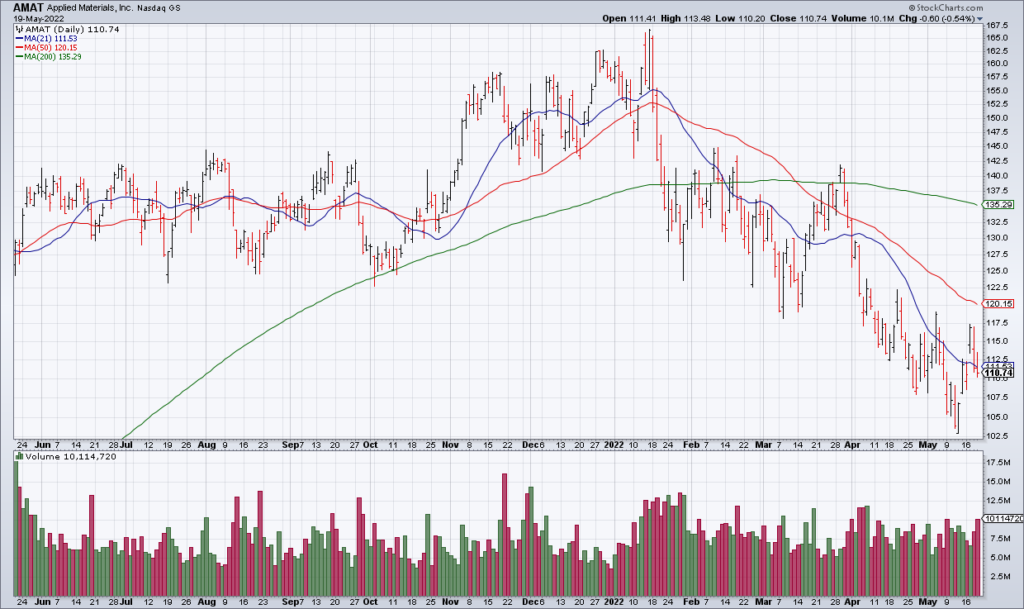

#earnings to end the week https://t.co/lObOE0dOhZ $AMAT $PANW $DE $FL $ROST $DECK $VFC $BAH $RLX $FLO $ATEX $GLOB $AINV $BBAR $THMO pic.twitter.com/k8xJLmP8Bd

— Earnings Whispers (@eWhispers) May 19, 2022

(Click on image to enlarge)

While Walmart (WMT), Target (TGT), and Cisco (CSCO) got crushed each of the last three days, Palo Alto Networks (PANW) and Applied Materials (AMAT) are faring better after reporting earnings Thursday afternoon. PANW beat on revenue and EPS and raised full-year guidance. Its shares are currently +11% in the premarket. AMAT’s results came in inline and their guidance looks fine. Shares are currently -1.5% in the premarket. John Deere (DE) is on tap for later this morning.

Nasdaq Futures are currently off to the races at +1.6%. At a certain point, enough is enough.