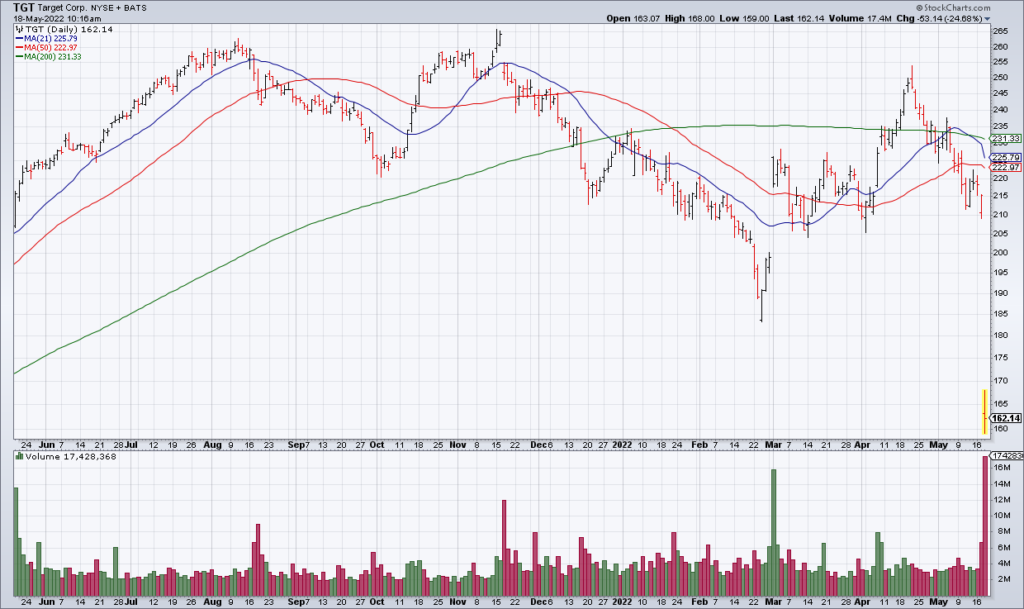

TGT: Off Target

(Click on image to enlarge)

Apparently Walmart (WMT) isn’t the only retailer being hit hard by inflation. Target (TGT) reported earnings Wednesday before the market opened and its quarter was similarly ruined by inflation and supply chain issues.

The operating margin declined to 5.3% from 9.8% a year ago. Think about that: For every dollar of revenue, only about half as much went to the bottom line as it did a year ago. TGT also lowered full-year operating margin guidance from 8% to 6%. No surprise that TGT shares are being bludgeoned to the tune of -25% this morning.

Nevertheless, Americans still need to buy things and TGT and WMT are the two leading general merchandise retailers in the country. TGT earned $13.56/share in 2021. Even if EPS declines to $10/share this year, TGT is a good value here at $160. More importantly, I believe that both of these retailers have pricing power. Where else are consumers going to shop? I picked up some TGT shares this morning just like I added to my WMT position yesterday.