Bonds And The Re-Inflation Trade Re-Examined

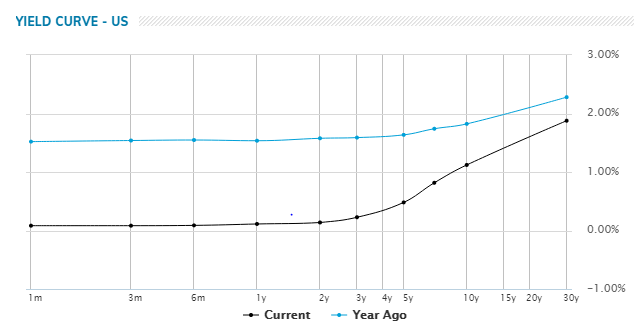

Following close on the heels of the elections in Georgia last week the so-called “reflation trade” was the topic of the day. Analysts argued that the Democrats’ control over the presidency and both houses of Congress will allow Biden to push through a very aggressive stimulus package. A flood of new debt issuances will be needed to cover increases in deficit financing. Not hesitating for a day, bond investors steepen the yield curve such that the 10-year yield broke through 1% and the 30 yr hit 1.87% by week’s end (Figure 1). Similarly, real interest rate bonds, TIPs, went deeper into the red as investors sought protection against inflation exceeding the 2% Fed target rate. Wall Street forecasters were warning bondholders that the 10-year rate would likely hit 1.8% or higher with the anticipated economic growth surge in late 2021. Investors were betting on a perfect combination of near-zero short-term rates (a sign of ample liquidity) and rising long term rates (a sign of economic revival) to support equities.

Figure 1 US Treasury Yield Curve, Current and Year Ago

How realistic is this assumption that the yield curve will continue to steepen? A number of factors will keep long term rates from continuing to climb to wit:

- The US Treasury market has already the highest interest rates of any of the major industrialized countries; Germany’s 10-year rate is minus 0.5%, the UK’s is 0.2% and Japan’s is held in check at zero by the Bank of Japan’s QE policy; a widening spread will attract international investors to buy Treasuries and drive US rates lower;

- The Fed has essentially painted itself into a corner, declaring it will not raise rates for at least three years, even though inflation were to exceed its 2% target; this implies that real long-term rates will remain negative and this is bullish for long-dated assets;

- The US output gap or deflationary gap is still quite wide, estimated to be 3%; US job growth is clearly stalling; this gap will continue to anchor the Fed funds rate and any widening at the long end will just provide a buying opportunity---- there are decidedly limits to how much steepening the market can endure before investors rush into to take advantage of the spreads;

- The Fed has a great influence on the shape of the yield curve through its QE buying program; it would not look favorably on long term rates blowing out at a time that the Treasury is looking to finance a higher Federal deficit; while the Fed will not explicitly say it will adopt a form of yield curve control, it is very mindful of the importance of keeping long rates down for this reason.

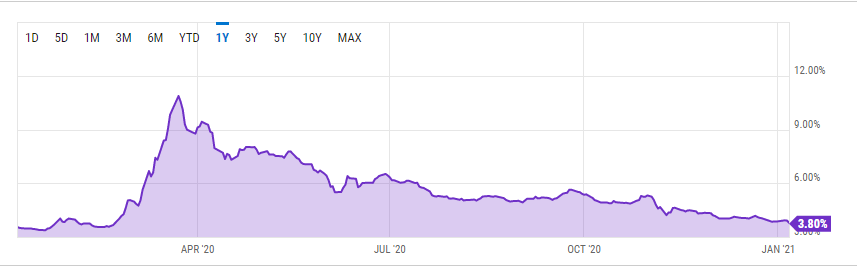

David Rosenberg observed that “from my lens, in the arena of government bonds, Treasury securities are trading as if they are high yield. Not to mention this rare situation where long-dated Treasury yields trade at a premium to the investment-grade universe — now that is an anomaly”. Rosenberg goes to note that one of the most influential bond managers, Jeffery Gundlach, advocates holding 25% in long Treasuries. (Government bond spreads).

Figure 2 High Yield Bond Spread

A final word. All optimism in the financial markets resides in a third and fourth-quarter economic revival. Yet, the economy continues to be depressed by the pandemic and threatened by new strains now appearing in several different countries.

Comments

No Thumbs up yet!

No Thumbs up yet!