Bondholders Are Rewarded As Deflation Starts To Take Hold

Amidst the focus on the stock market and speculation, whether it will rebound, bondholders have quietly in their own world continue to enjoy significant gains. The iShares 20+ Year Treasury Bond (TLT) recorded gains of 19.5%since January ( Figure 1) As impressive as these gains are, we will likely hear a common refrain that the big gains may be over, that rates can go no lower and sentiment favors the equity markets. Bond investors argue that there is no safer place to invest than sovereign debt, especially the US Treasuries. They point out the persistent and obvious uncertainty on the outlook for other asset classes as each nation contends with a set of indeterminate risks associated with the coronavirus. Today’s comments by Chairman Powell about the ‘uncertainty’ dogging the economic outlook, adds more weight to those who are looking for safety.

(Click on image to enlarge)

Figure 1 iShares Barclays 20+ Yr Treasury Bond, 12 Months

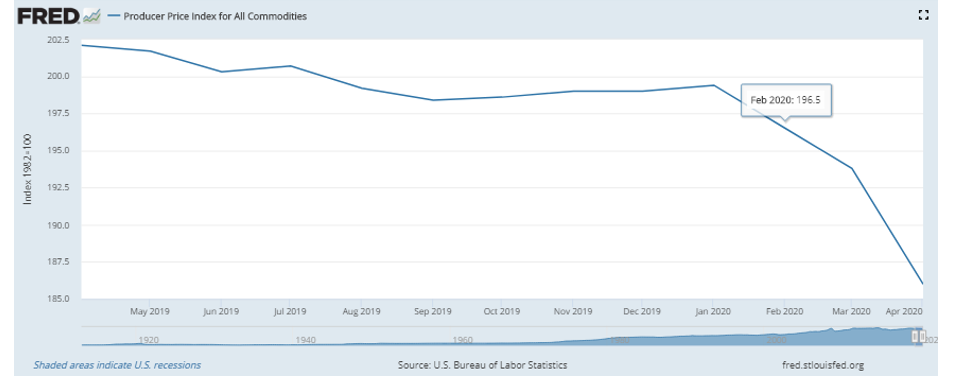

But now bondholders have even more reason to keep adding to their positions. The US producer price index (PPI) has started to turn negative, declining by 1.3% in April, the largest decline since December 2009. Final demand prices fell in February and March, prior to the world-wide shutdown and April’s results further entrenched price declines. We would have expected the index for final demand for services would drop dramatically, given the closure of the hospitality and tourism industries. However, over 80% of the drop in the overall index is due to a 3.3% drop in the price of final demand goods.

(Click on image to enlarge)

Figure 2 PPI for All Commodities, 12 months

More to the point is the headline inflation has steadily declined, month-by-month since January. This steady drumbeat of price declines has now seeped into the futures markets for interest rates as short-term rates brush up against zero. The Cleveland Federal Reserve's one-year forecast for inflation has shifted from 1.8% in January to -.05% today. It is these huge change in expectations that set up favorably for bondholders who now expect to have much high positive real rates of return.

It is amazing, prof, how the government seems to be paralyzed when it comes to helping end demand, like Americans should not be such a moral risk to society. And yet end demand is what is crumbling. They only see the supply side issues, which won't fix end demand.

Worse yet it's all being plugged with debt. Nobody seems to want to raise equity to ward off insolvency because it will mean a watering down of share values. The system is becoming totally corrupted by the obsession with share values.