Betting Against Bonds

Karolina Grabowska/Pexels

Turning Slightly More Bearish

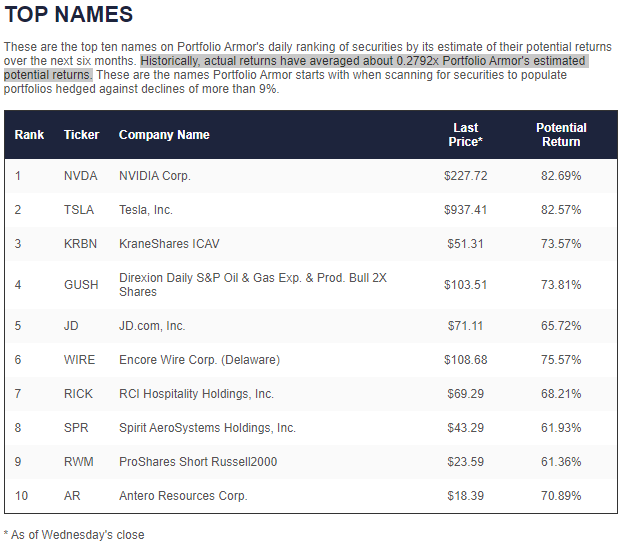

In a post in late January, I mentioned that a bearish ETF had hit our top names for the first time since 2020:

Our system's universe of securities includes inverse and bearish ETFs, and that, at some point in the current market environment, those might appear among our top names, and in our hedged portfolios. That point ended up being Wednesday, as you can see below.

Screen capture via Portfolio Armor on 1/26/2022.

The ProShares Short Russell 2000 (RWM), an inverse ETF of the Russell 2000 small cap index, appeared in our top ten alongside some familiar long names such as Nvidia (NVDA), Tesla (TSLA), and the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares (GUSH).

RWM was a top name of ours again on Monday, and it was joined by another bearish ETF, the ProShares UltraShort 20+ Year Treasury ETF (TBT).

Betting Against The Long Bond

TBT is a 2x levered bet against long duration U.S. Treasuries, the bonds most sensitive to interest rate movements. Our system doesn't consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach often reflects the macro picture, and the inclusion of TBT certainly does.

As we pointed out over the weekend (Sanctioning Ourselves), U.S. sanctions on Russia--particularly, the freezing of its dollar reserves--will likely lead to a weaker dollar, as non-Western countries diversify away from the dollar to avoid having their reserves frozen by us in a future conflict.

In short:

— David Pinsen (@dpinsen) March 12, 2022

👉 China 🇨🇳 sells U.S. 🇺🇸 Treasuries to buy Russian 🇷🇺 commodities.

👉 Higher inflation in the U.S.

👉 The Yuan becomes a commodity-backed currency, and a threat to dollar supremacy. https://t.co/PbQitqgCc9

A likely result of that will be higher interest rates in the U.S., as it may take higher rates to entice risk-averse, non-European countries to hold U.S. Treasury bonds. Higher rates, of course, are bearish for existing bonds. That's a scenario where TBT, which bets against long-dated Treasury bonds, should do well.

In Case We're Wrong About TBT

It's possible we'll end up being wrong about TBT. Maybe the rest of the world will put aside the sanction risk for now and buy U.S. Treasuries as a haven, as they have in the past. With the hedge below, you can make money holding TBT if we end up being right, and strictly limit your downside risk in the event we end up being wrong.

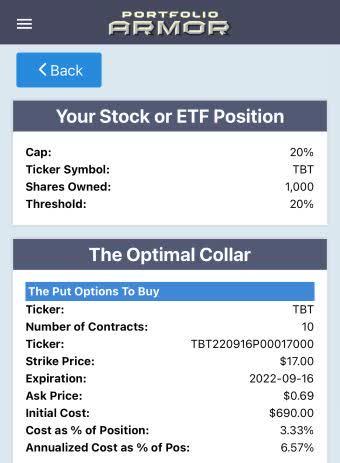

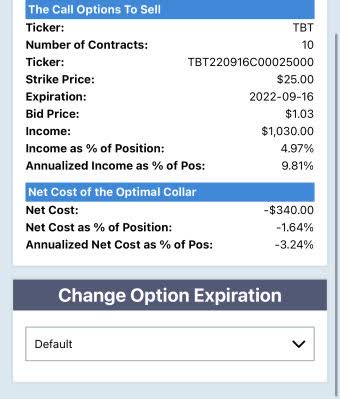

As of Monday's close, this was the optimal collar to hedge 1,000 shares of TBT against a >20% drop by September, while not capping your possible upside at less than 20% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

The net cost was negative with this collar, meaning you would have collected a net credit of $340, or 1.64% of position value, when opening the hedge. That cost assumes, to be conservative, that you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads. In practice, you can often buy and sell options at some price between the bid and ask, so your net credit would likely have been larger than $340 if you did so.