Another Chart Shows A Recession Is Coming

The probability of a recession is rising. I recently highlighted how the Federal Reserve will trigger a recession at its December meeting.

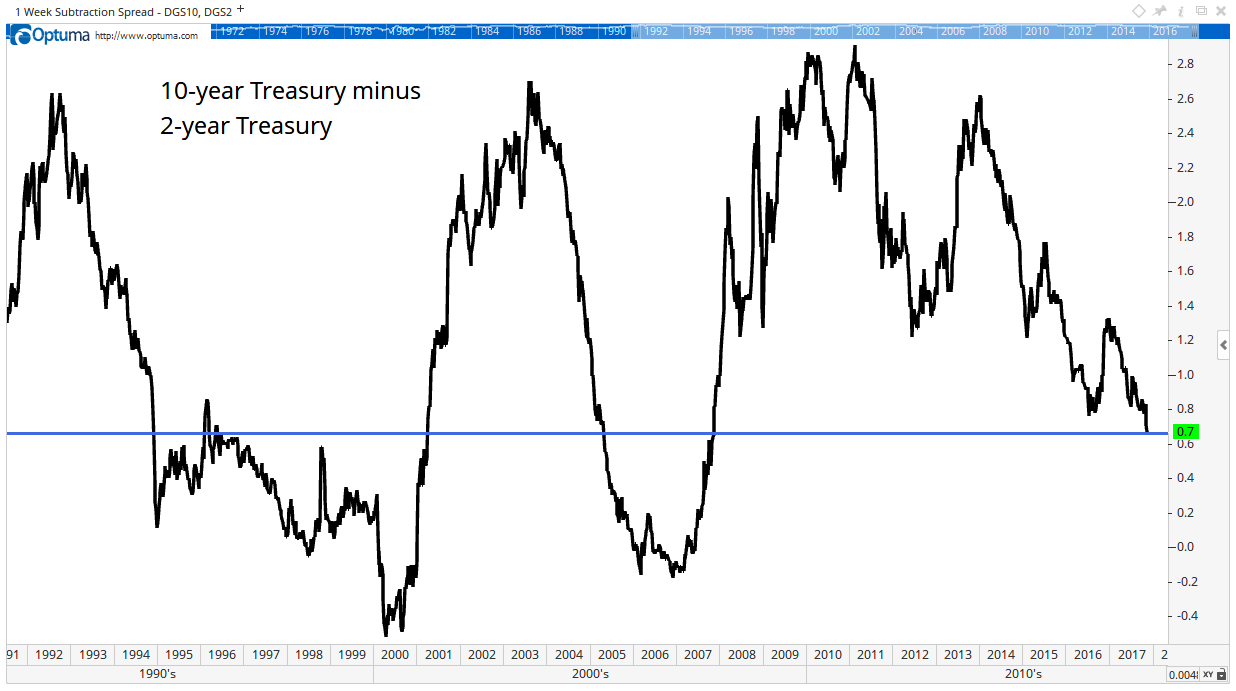

Now, market data confirms that research. The yield curve, a traditional recession indicator, is falling. It’s at a 10-year low. In fact, it’s only been this low twice in the past 20 years.

The yield curve is the difference between the interest rates of two different Treasury notes. This chart shows the difference between notes due in 10 years and in two years.

The interest rate on the 10-year Treasury is about 2.3%. On the two-year, the interest rate is about 1.6%. The difference is 0.7%.

A large and growing difference between the two rates indicates the economy is growing. That means investors are willing to pay more to borrow money. They pay more because they believe growth will increase the return on investments.

A falling yield curve shows investors are worried. They are no longer willing to pay high rates to borrow money. And the rate on the 10-year Treasury drops faster than the rate on the two-year.

Based on the previous two signals, the chart shows there is good news and bad news in this data.

The good news is that the market tends to rally when the yield curve drops to this level. The S&P 500 gained almost 30% in the 19 months after the yield curve dropped below 0.7% in 2005. In 1995, the signal kicked off a 300% rally.

Both rallies ended in crashes. That’s the bad news.

This data is consistent with the recession indicator I wrote about last month. The end of the bull market is near. But the gains before the top will be significant.

A declining yield curve moves with a boom. Period. When it bottoms, the boom ends. Period. Investors are not worried about paying high rates. They are too busy speculating in asset markets, taking money out of the short end and not yet concerned about either inflation or economic weakening.

Agreed, however, there is concern on the housing front. Prices have risen to the point it is making people second think taking on the debt to buy it. This is good for them, but bad for the housing market which is supported these days on more and more buying to rent out to people at inflated prices which make it hard or impossible for them to save. It's a vicious circle unique to this zomble economy.

Absolutely a zombie economy. Created on a lab table. But I have learned to play the indicators straight and things won't turn until the 10-2 curve turns and interest rates top out at 3.3% (30yr) and 2.9% (10yr).