7-Year Tails Despite Strong Foreign Demand In Year's Final Treasury Auction

And so, after a strong 2Y auction on Tuesday and a medicore, tailing 5Y sale yesterday, we finally came to the last bond auction of 2022 when just after 1pm ET, the Treasury sold $35 billion in 7 Year paper in what can at best be described as a sloppy affair.

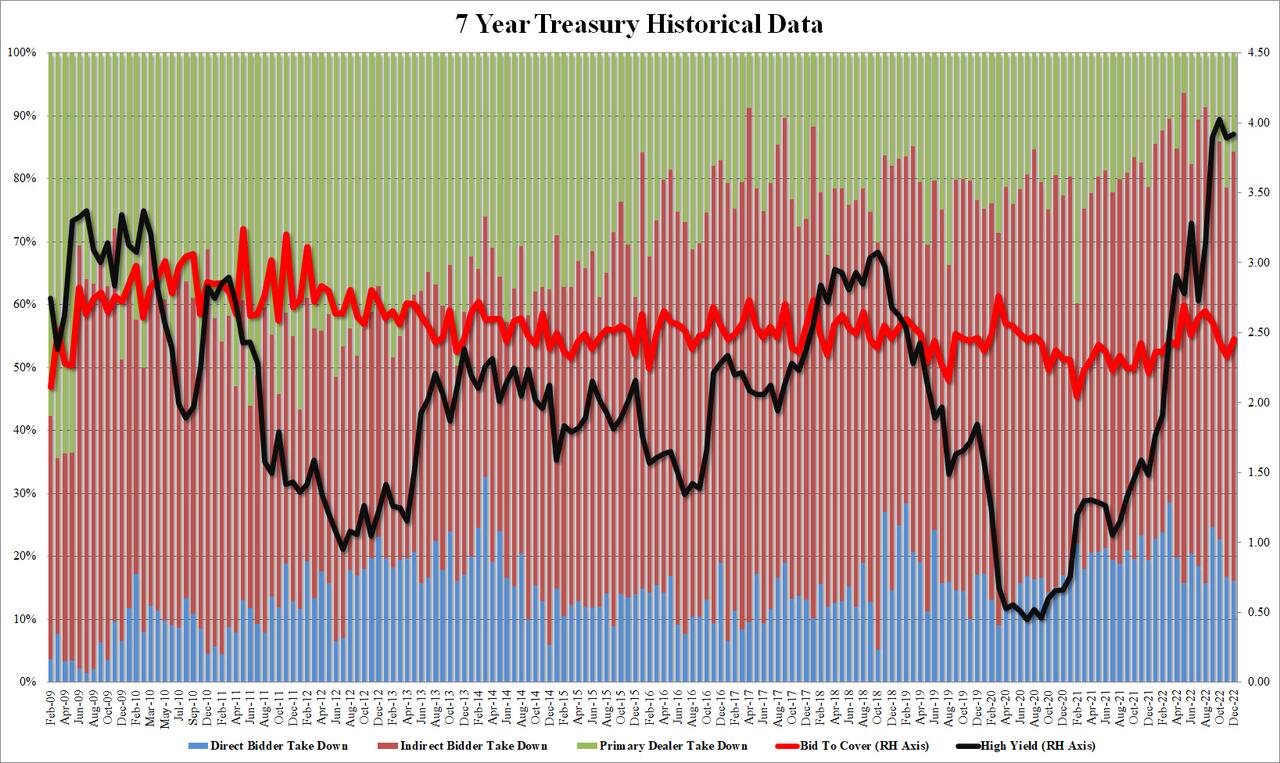

The high yield of 3.921% was just above last month's 3.890%, and tailed then when issued 3.913 by 0.8bps. This was the third consecutive tail if far smaller than last month's 2.7bps gaping tail.

The bid-to-cover of 2.454 was higher than both October and November, but below the six-auction average of 2.512.

The internals were stronger, with Indirects taking down 68.1%, the highest since August and well above the 66.0% recent average; and with Directs awarded 16.2%, or slightly below the recent average of 19.8%, Dealers were left holding 15.8%, above the average of 14.2%.

(Click on image to enlarge)

Overall, a subpar 7Y auction, although if one ignores the tail - which can be ascribed to the sharp drop in yields intraday and the lack of concession - the auction wasn't that bad which probably explains the lack of any notable market reaction to the bond sale.

More By This Author:

WTI Extends Losses After Small Crude Build, Gasoline Stocks Plunged Last Week

WTI Holds Losses After API Reports Small Crude Draw

5Y Treasury Auction Sees Solid Demand, Slight Tail

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more