5Y Treasury Auction Sees Solid Demand, Slight Tail

One day after a stellar 2Y auction stopped through by the widest margin since 2016, moments ago the Treasury sold $43 billion in 5Y paper in a solid if modestly tailing 5Y auction.

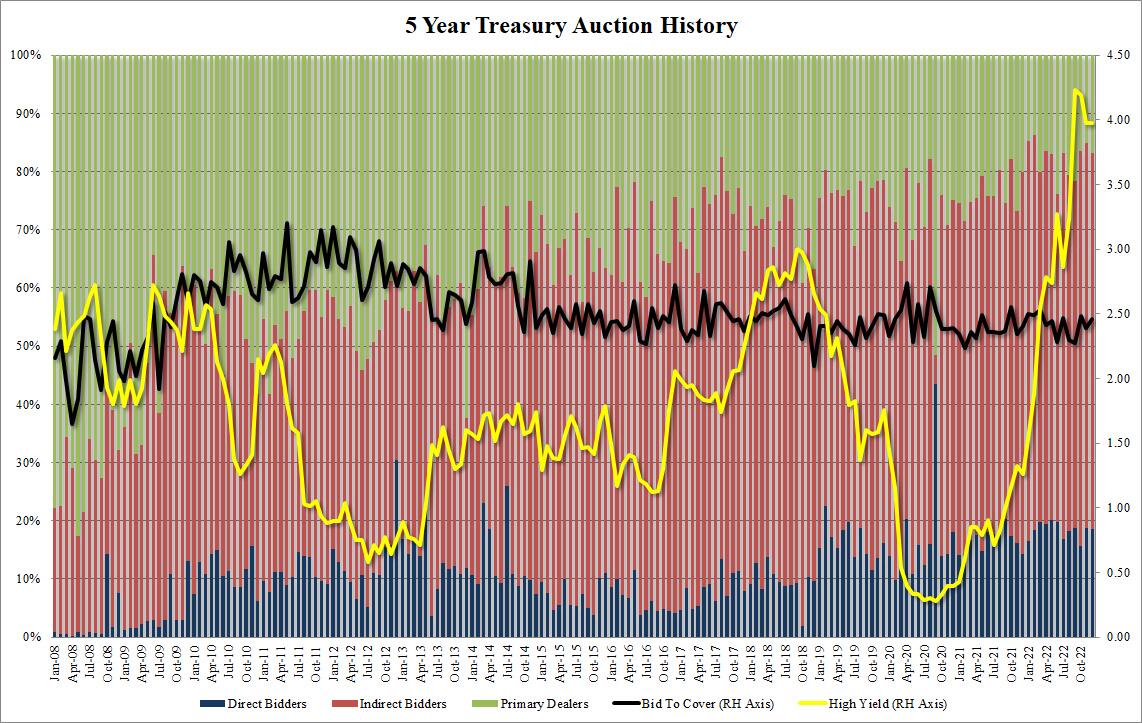

The high yield of 3.973% tailed the When Issued 3.965% by 0.8bps; ironically the December auction was almost a carbon copy of November when the 5Y paper priced at 3.974% and tailed by 0.7bps. With the tiny decline in yield, this was the lowest 5Y auction yield going back to August.

The bid to cover of 2.46 rose from last month's 2.39 and was above the six-auction average of 2.36 if largely in line with the tight range the BTC has seen over the past 8 years.

The internals were also not too bad, with foreign buyers taking down 64.5%, down from 66.2% in November, but above the 63.0% recent average. And with Directs awarded 18.6%, or right on top of recent auction results, Dealers were left holding 16.9%, above last month's 15.1% if below the recent average of 19.1%.

Overall, this was a solid, if not stellar auction, which saw solid buyside demand although the intraday blowout in yields was probably responsible for the modest tail; that said there was barely any market reaction to the auction confirming it came in largely in line with expectations.

(Click on image to enlarge)

More By This Author:

US Home Prices Tumbled For 4th Straight Month In October

NIO Slides 6%, Guides Q4 2022 Deliveries Lower Hours After CEO Warns Of "Challenging" Start To 2023

Fed Fight: Biden's BLS Lashes Out At Philly Fed Over Million-Job Revision

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more