5Y Auction Stops Thorugh With Largest Direct Award In 12 Years

90 minutes after a mediocre 2Y auction hit the tape, the Treasury sold $70BN in 5Y paper in the day's second auction to start the Fed-abbreviated week, which also sees a 7Y sale tomorrow before the FOMC on Wednesday.

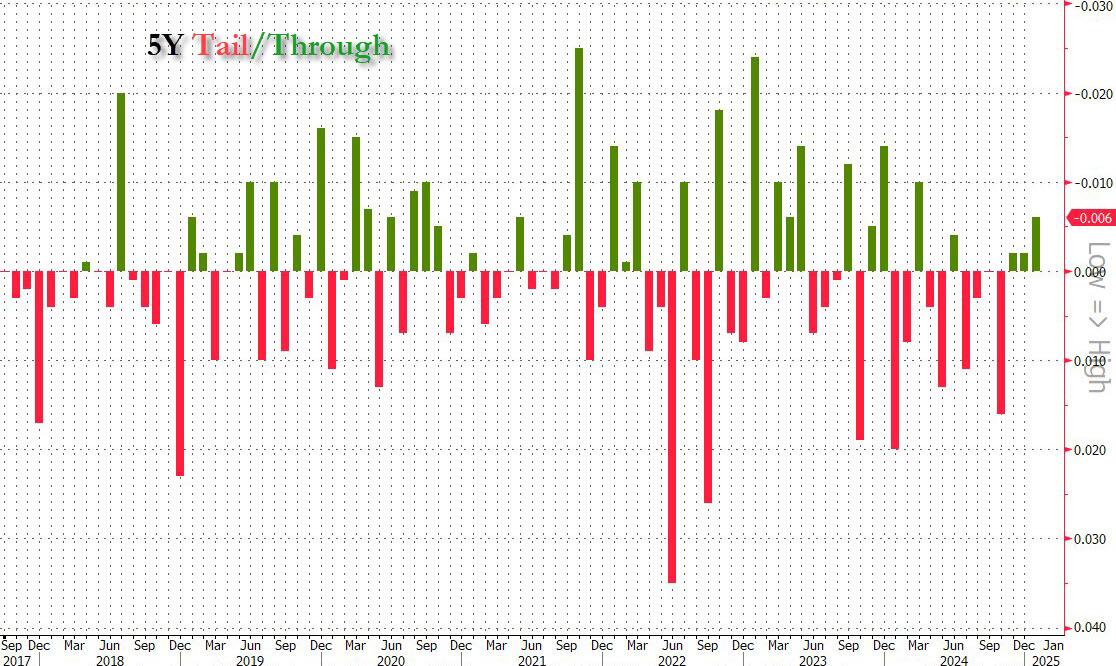

The auction stopped at a high yield of 4.330% which was down from 4.478% in December, and also stopped through the When Issued 4.336% by 0.6bps - this was the third consecutive through auction in a row and followed 4 consecutive tails as sentiment has clearly improved toward the belly of the curve.

(Click on image to enlarge)

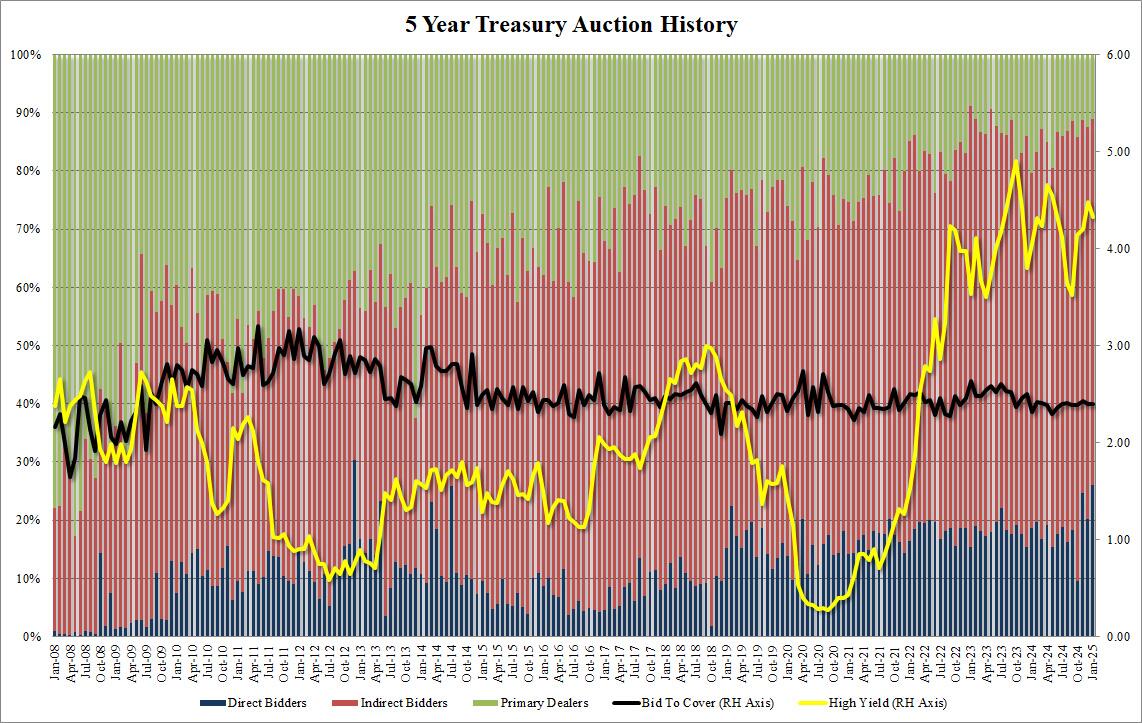

The Bid to Cover was unchanged, at 2.40, exactly where it was last month, exactly where the six-auction average is, and where it has been within +/- 5bps since June!

The internals were slightly weaker with Indirects awarded 62.80%, down from 67.3% and the lowest since Jan 2024 (this could be some odd seasonal quirk). And with Directs awarded 26.1%, the most since Dec 2012, Dealers were left with just 11.1%, the lowest since May 2023.

(Click on image to enlarge)

Overall, a solid, and certainly stronger auction, than the 2Y this morning and not surprisingly we have seen yields drip by about 1-2 bps since the results, but it is safe to say that other much more important things are behind the move in rates today than today's auctions.

More By This Author:

Key Events This Extremely Busy Week: Fed, ECB, Inflation, GDP, And Earnings Galore

59% Of Americans Don't Have Enough Savings For A $1,000 Emergency: Report

"Nervousness" Ripples Across Coffee Market As Prices Hit Fresh Record Highs

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more