Key Events This Extremely Busy Week: Fed, ECB, Inflation, GDP, And Earnings Galore

Image Source: Pixabay

One week down, 207 to go of Trump 2.0 and what have we learnt so far?

According to DB's Jim Reid, it’s hard to say we’ve learnt too much, even with the best part of a hundred executive orders already signed. The market has been relieved that tariffs haven’t been issued on “day one” as previously promised but its only five days until the February 1st date Trump suggested could be the point he puts tariffs on Mexico, Canada and China. So that will be the gorilla in the room this week. In addition, he’s ordered departmental reviews of existing trade practises with an April 1st deadline. So no news on tariffs isn’t necessarily good news. Yesterday Columbia was the latest to feel the wrath of Mr Trump as he ordered an emergency 25% tariff on the country, to be doubled in a week, over the country's refusal to allow two planes of undocumented migrants returning from the US to land. However, in the early hours of this morning, the US removed the threat after the Colombian leader agreed to grant entry to US military flights deporting migrants. This 12 hour incident feels like a template for how the US will now deal with its foreign policy issues.

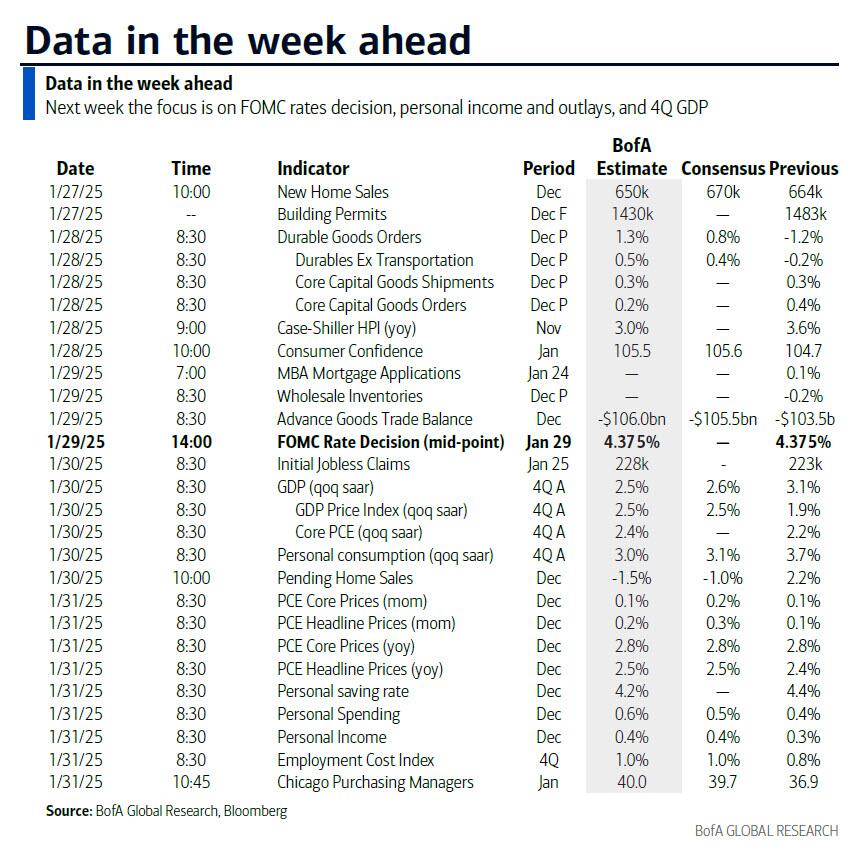

Outside of Trump watching, there’s a lot going on this week with rate meetings from the Fed and Bank of Canada (Wednesday), and the ECB (Thursday); inflation data in Europe (Thursday/Friday), US (core PCE Friday), Japan (Tokyo CPI Thursday), and Australia (Wednesday); and Q4 GDP in the US, Germany, France, Italy and Euro Zone (Thursday). If that wasn’t enough, earnings season starts to take off in both the US and Europe with 102 S&P 500 and 53 Stoxx 600 companies reporting with four of the Magnificent 7 (Microsoft, Meta and Tesla on Wednesday, and Apple on Thursday) being the obvious highlight. In the AI world there's been a lot of chatter in the last few days around Chinese firm DeepSeek's announcement that it's produced an open-source AI model that rivals some of the US tech giant's equivalents for a fraction of the costs and using less sophisticated chips. As this story builds, NVDA is down a whopping 18%, translating in a record market cap loss of $600 billion, driving the S&P 500 down -2%. These are big moves for this time of day. It will be interesting if this story gets momentum and whether the Mag-7 loses some of their luster.

In theory the main event this week would normally be the Fed but most economists expect a relatively quiet meeting with no rate move and limited guidance about future policy decisions. While Chair Powell may not rule out a March cut as he did last January, the broad signals from the meeting should confirm that such a cut is not likely with Powell possibly emphasizing the underlying strength of the economy and signs of stabilisation in the labour market that would require patience in removing further restriction. When asked about Trump’s policies and their impact on inflation expect Powell to play a straight bat and say that the committee wont prejudge policies in advance (even though they clearly have been doing just that).

After the Fed we get Q4 US GDP on Thursday (consensus expects 2.7%), and then the core PCE deflator on Friday, which is expected to rise from 0.1% to 0.2% in December which should keep the YoY rate at 2.8%. The employment cost index (ECI) is also out on Friday and this will be a key release for the Fed as more subdued labour market pressure has given them comfort in recent months.

(Click on image to enlarge)

Over in Europe, the ECB is expected to deliver another 25 bps cut on Thursday taking the policy rate to 2.75% and see the description of the policy stance unchanged relative to December. The ECB will also release its bank lending survey tomorrow and the consumer expectations survey on Friday. Optimism is creeping back into Europe this year and the December 2025 ECB contract has gone up from 1.56% in early December to 2.07% on Friday implying less than four cuts from here. Much of course will depend on the extent that Europe is in the Trump crossfire and so far the market is relieved that nothing specific was announced last week but note that Trump on at least two occasions called out the European Union and said at his virtual Davos address that the EU treats the US "very unfairly" and "very badly". So it would be wise to brace yourself for more news on this front.

Elsewhere in Europe, this week the focus will also be on flash January CPIs starting with Spain on Thursday. Prints for Germany and France are due Friday, with Eurozone-wide numbers out a week today. DB economists expect headline and core Eurozone HICP to decline by 0.1pp to 2.3% YoY and 2.6% YoY. Their forecasts for Spain, Germany and France are 2.38%, 2.79% and 1.85%, respectively. Don't forget the GDP prints in Germany, France and the Eurozone on Thursday, as well as Sweden on Wednesday. Other highlights include the Ifo survey in Germany today as well as Sweden's Riksbank rates decision on Wednesday.

The day-by-day week ahead calendar is at the end as usual with a fuller list of key events, including the main earnings to be realised.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 27

- Data: US December Chicago Fed national activity index, new home sales, January Dallas Fed manufacturing activity, China January PMIs, December industrial profits, Japan December PPI services, Germany January Ifo survey, France Q4 total jobseekers

- Central banks: ECB's Lagarde, Holzmann, Kazimir and Vujcic speak

- Earnings: AT&T, Nucor, Ryanair

- Auctions: US 2-yr Notes ($69bn), 5-yr Notes ($70bn)

Tuesday January 28

- Data: US December durable goods orders, January Conference Board consumer confidence index, Dallas Fed services activity, Richmond Fed manufacturing index, Richmond Fed business conditions, November FHFA house price index, France January consumer confidence

- Central banks: ECB's bank lending survey, ECB's Villeroy speaks, BoJ minutes of the December meeting

- Earnings: LVMH, SAP, RTX, Stryker, Boeing, Lockheed Martin, Chubb, Starbucks, Atlas Copco, Royal Caribbean Cruises, General Motors, Sartorius

- Auctions: US 2-yr FRN ($30bn), 7-yr Notes ($44bn)

Wednesday January 29

- Data: US December advance goods trade balance, wholesale inventories, Japan January consumer confidence index, Italy January consumer confidence index, manufacturing confidence, economic sentiment, Eurozone December M3, Australia December CPI, Sweden December GDP indicator

- Central banks: Fed's decision, BoC decision, Riksbank decision

- Earnings: Microsoft, Meta, Tesla, ASML, T-Mobile US, ServiceNow, IBM, Danaher, Lam Research, Volvo, MSCI, Advantest, Lonza, Teradyne

Thursday January 30

- Data: US Q4 GDP, December pending home sales, initial jobless claims, UK December net consumer credit, M4, Japan January Tokyo CPI, December jobless rate, job-to-applicant ratio, retail sales, industrial production, Germany Q4 GDP, December import price index, France Q4 GDP, December consumer spending, Italy Q4 GDP, December unemployment rate, November industrial sales, Eurozone Q4 GDP, January economic confidence, December unemployment rate

- Central banks: ECB's decision, BoJ's Himino speaks

- Earnings: Apple, Visa, Mastercard, Roche, Blackstone, Thermo Fisher, Shell, Caterpillar, Comcast, Sanofi, UPS, ABB, KLA, Intel, Altria, Cigna, Atlassian, BBVA, Baker Hughes, Valero, CaixaBank, Dow, Nokia, Southwest Airlines, BT, Evolution

Friday January 31

- Data: US December PCE, personal income, personal spending, January MNI Chicago PMI, Q4 employment cost index, UK January Lloyds Business Barometer, Japan December housing starts, Germany January CPI, unemployment claims rate, December retail sales, France January CPI, December PPI, Italy December PPI, hourly wages, Canada November GDP

- Central banks: Fed's Bowman speaks, ECB's December consumer expectations survey, survey of professional forecasters

- Earnings: Exxon Mobil, AbbVie, Chevron, Novartis, Eaton, Hitachi, Keyence, Colgate-Palmolive, Charter Communications

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the Q4 advance GDP report on Thursday and the employment cost index and core PCE inflation reports on Friday. The January FOMC meeting is this week. The post-meeting statement will be released at 2:00 PM ET on Wednesday and will be followed by Chair Powell’s press conference at 2:30 PM ET.

Monday, January 27

- 10:00 AM New home sales, December (GS +3.0%, consensus +2.4%, last +5.9%)

Tuesday, January 28

- 08:30 AM Durable goods orders, December preliminary (GS -3.0%, consensus +0.5%, last -1.2%); Durable goods orders ex-transportation, December preliminary (GS +0.3%, consensus +0.4%, last -0.2%); Core capital goods orders, December preliminary (GS +0.2%, consensus +0.3%, last +0.4%); Core capital goods shipments, December preliminary (GS +0.2%, consensus +0.2%, last +0.3%): We estimate that durable goods orders declined 3.0% in the preliminary December report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast 0.2% increases for core capital goods orders and shipments, reflecting mixed global manufacturing data.

- 09:00 AM FHFA house price index, November (consensus +0.4%, last +0.4%)

- 09:00 AM S&P Case-Shiller 20-city home price index, November (GS +0.3%, consensus +0.3%, last +0.3%)

- 10:00 AM Conference Board consumer confidence, January (GS 105.0, consensus 105.6, last 104.7)

- 10:00 AM Richmond Fed manufacturing index, January (consensus -12, last -10)

Wednesday, January 29

- 08:30 AM Advance goods trade balance, December (GS -$104.0bn, consensus -$105.0bn, last -$102.9bn)

- 08:30 AM Wholesale inventories, December preliminary (consensus +0.2%, last -0.2%)

- 02:00 PM FOMC statement, January 28-29 meeting: As discussed in our FOMC preview, we do not expect the January FOMC meeting to offer much new information. The statement might note that the labor market appears to have stabilized but is unlikely to provide strong guidance about the March meeting or the timeline for further cuts. In the press conference, we will listen for hints about whether the further decline in inflation we expect in coming months could open the door to rate cuts, how strongly the leadership feels that the current level of the funds rate is still “meaningfully restrictive” and not an appropriate stopping point, and how the FOMC intends to navigate uncertainty about potential tariff increases now and their impact on prices later.

Thursday, January 30

- 08:30 AM GDP, Q4 advance (GS +2.6%, consensus +2.7%, last +3.1%); Personal consumption, Q4 advance (GS +3.1%, consensus +3.2%, last +3.7%); Core PCE inflation, Q4 advance (GS +2.49%, consensus +2.5%, last +2.2%): We estimate that GDP rose 2.6% annualized in the advance reading for Q4, following +3.1% annualized in Q3. Our forecast reflects continued strength in consumption (+3.1%, quarter-over-quarter annualized) and a rebound in residential investment (+4.5% vs. -4.3% in Q3) which more than offset a slowdown in both business fixed investment (+1.5% vs. +4.0% in Q3) and exports growth (+1.2% vs. +9.6% in Q3). We estimate that the core PCE price index increased 2.49% annualized (or 2.80% year-over-year) in Q4.

- 08:30 AM Initial jobless claims, week ended January 25 (GS 225k, consensus 225k, last 223k); Continuing jobless claims, week ended January 18 (consensus 1,910k, last 1,899k): We estimate that initial claims edged up by 2k to 225k in the week ended January 25, reflecting a continued boost from the wildfires in Los Angeles County and a slight boost from residual seasonality.

- 10:00 AM Pending home sales, December (GS -3.0%, consensus -0.5%, last +2.2%)

Friday, January 31

- 08:30 AM Employment cost index, Q4 (GS +0.8%, consensus +0.9%, last +0.8%): We estimate the employment cost index rose by 0.8% in Q4 (quarter-over-quarter, seasonally adjusted), which would lower the year-on-year rate by two tenths to 3.7% (year-over-year, not seasonally adjusted). Our forecast partly reflects the deceleration in the Atlanta Fed’s wage tracker. We also expect a second straight quarter of slower ECI growth among unionized workers—following 1.6% increases on average in 2023Q4-2024Q2 (SA by GS, not annualized)—and slower ECI benefit growth—which reset higher in the first half of the year (0.8% vs. 1.0% on average in H1). On the positive side, we expect slightly firmer compensation growth for incentive-paid occupations after it underperformed broader compensation growth in Q2 and Q3.

- 08:30 AM Personal income, December (GS +0.4%, consensus +0.4%, last +0.3%); Personal spending, December (GS +0.4%, consensus +0.5%, last +0.4%); Core PCE price index, December (GS +0.16%, consensus +0.2%, last +0.1%); Core PCE price index (YoY), December (GS +2.79%, consensus +2.8%, last +2.8%); PCE price index, December (GS +0.25%, consensus +0.3%, last +0.1%); PCE price index (YoY), December (GS +2.55%, consensus +2.5%, last +2.4%): We estimate personal income and personal spending increased by 0.4%, in December. We estimate that the core PCE price index rose by 0.16% in December, corresponding to a year-over-year rate of 2.79%. Additionally, we expect that the headline PCE price index increased by 0.25% from the prior month, corresponding to a year-over-year rate of 2.55%. Our forecast is consistent with a 0.18% increase in our trimmed core PCE measure.

- 08:30 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver a speech addressing the economic outlook and the outlook for mutual and community banks at the Northern New England CEO Summit in Portsmouth, New Hampshire. Text is expected. On January 9th, Bowman said she supported the FOMC’s decision to lower the fed funds rate in December because “it represented the Committee’s final step in the policy recalibration phase” but noted that she “could have supported taking no action at the December meeting.” Bowman also said that her estimate of the neutral rate was “higher than before the pandemic” and that the FOMC “should be cautious in considering changes to the policy rate as we move toward a more neutral setting.”

- 09:45 AM Chicago PMI, January (consensus 40.0, last 36.9)

Source: DB, Goldman

More By This Author:

59% Of Americans Don't Have Enough Savings For A $1,000 Emergency: Report

"Nervousness" Ripples Across Coffee Market As Prices Hit Fresh Record Highs

Futures Dip To Close Best Inauguration Week For S&P Since Reagan

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more