Bitcoin: Undervalued Digital Assets - Revisited

I have been bullish on Bitcoin (BTC-USD) and the broader digital asset segment for some time now. In fact, Bitcoin and key altcoins have been a staple of our diversified portfolio since the start of 2019. Now, Bitcoin and many other digital assets have appreciated substantially in recent months. However, the Fed's balance sheet along with the U.S.'s monetary base continues to balloon. Also, blockchain wallets continue to grow at a rapid pace, signaling robust user growth, and increasing adoption. Furthermore, this bull market still has very strong momentum, and prices are likely to climb notably higher before the current wave peaks.

Image Source: Pexels

Revisiting

It has been close to 11 months since my "Bitcoin, Altcoins, and Higher Prices" article was released. Some key factors relative to further price appreciation I mentioned included the U.S.'s rapidly expanding monetary base along with the Fed's balance sheet, very strong blockchain wallet growth, seemingly depressed valuations in the digital asset space, as well as other elements.

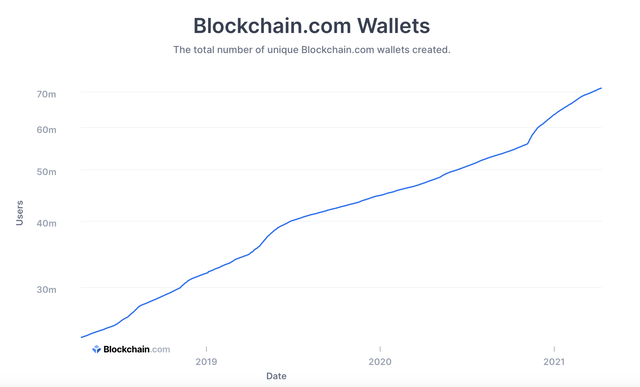

Looking back, blockchain wallet users were approaching 50 million around that time. Now we are at over 70 million, which should come out to about a 50% YoY surge, staggering.

3-Year Chart

Source - Roughly a 50% YoY spike, and about a 200% move in just 3 years.

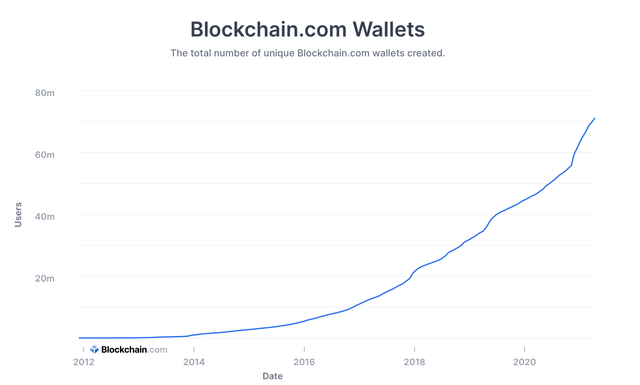

Long-term Chart

We can see the rapid growth on this long-term chart. In fact, as the blockchain enterprise segment's popularity increases, growth seems to be accelerating. This implies that notable growth is likely to continue going forward, and should persist regardless of any future corrections or bear market cycles in the digital asset space.

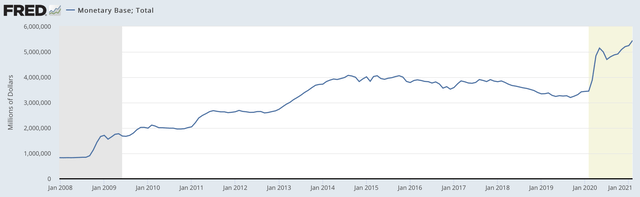

Monetary Base

We were just approaching $5 trillion in the U.S.'s monetary base around one year ago, and now we're looking at around $5.5 trillion and climbing. The "debasing" of the fiat currency continues, and we can see it in the Fed's balance sheet as well.

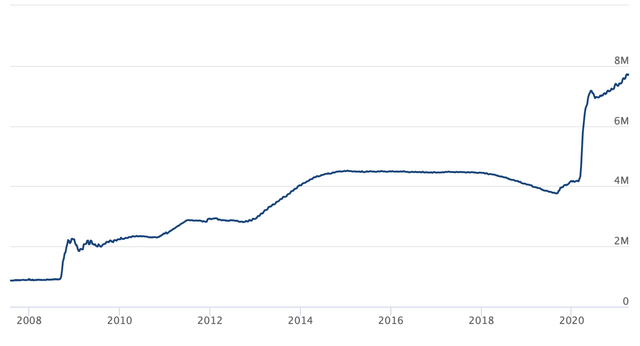

Fed's Balance Sheet

Similar image in the Fed's balance sheet, as we were looking at about $7 trillion around a year ago, and are now approaching $8 trillion. Furthermore, we can see about a nine-fold increase in the Fed's balance sheet since around 2008. This is quite massive, and it illustrates just how distorted the current monetary order has become. Central banks can essentially manipulate, expand, and devalue fiat currencies at will, something that cannot be done with Bitcoin, and with other truly decentralized digital assets.

Valuation Wise

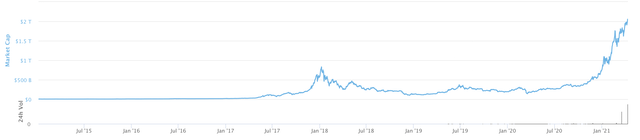

It was much easier to argue for undervaluation a year or so ago when the cryptocurrency complex sported a market cap of about $200 billion and not $2 trillion like it does now. We also can see that the total market cap of all digital assets in circulation is more than double that of the previous top in early 2018. However, to put things into context, there are more than 9,000 different cryptocurrencies now, nearly twice as many as there were during the peak in 2018. Also, while $2 trillion may seem like a great deal of money, it is less than the value of just one very successful technology company, Apple (AAPL).

How Much Money?

If we look at all the "money" in the world, we can see that Bitcoin and the digital asset segment still have relatively small market shares. Despite the segment's appreciation over the last year, we can see that even by today's market value, all the digital assets combined are worth only around one year of the world's military spending, or just about one half of one year of the U.S.'s Federal budget deficit. There are single companies that are worth more, or close to as much. All of the world's gold is worth about 5 fold more, the broad monetary base is worth roughly 50x as much, all of the global debt is worth around 125 times as much, and derivatives, about 500 times more. So, we can see that in the greater scheme of things the expanding digital asset segment is still worth far less than many other asset segments, and likely has a lot more growth in the years ahead.

Looking at Some of Our Favorite Names

Since our price check around 11 months ago, Bitcoin and other digital assets in our portfolio/watchlist have appreciated considerably.

For example:

Bitcoin's market cap has appreciated from $163 billion to $1.125 trillion, an increase of 590%.

Ethereum (ETH-USD): from $23 billion to $249 billion, an increase of 982%.

Uniswap (LTC-USD): from $2.8 billion to $16.7 billion, an increase of 496%.

Cardano (ADA-USD): from $1.4 billion to $42 billion, an increase of 2,900%.

Stellar (XLM-USD): from $1.3 billion to $13.5 billion, an increase of 938%.

Monero (XMR-USD): from $1 billion to $6.1 billion, an increase of 510%.

Tronix (TRX-USD): from $968 million to $9 billion, an increase of 830%.

Ethereum Classic (ETC-USD): from $782 million to $2.3 billion, an increase of 194%.

NEO (NEO-USD): from $695 million to $4.4 billion, an increase of 533%.

DASH (DASH-USD): from $695 million to $2.8 billion, an increase of 310%.

IOTA (MIOTA-USD): from $540 million to $5.6 billion, an increase of 937%.

Atomic Coin (ATOM-USD): from $482 million to $4.75 billion, an increase of 885%.

Zcash (ZEC-USD): from $420 million to $2.5 billion, an increase of 495%.

VeChain (VET-USD): from $267 million to $8.55 billion, an increase of 3,100%.

We see that many names have moved up notably, some by 500%, and some by over 1,000%. After such notable run-ups, it is more difficult to make a case for these digital assets being undervalued. Nevertheless, this does not mean that there isn't considerable upside remaining while the current bull cycle persists.

The Bottom Line

The bull market in Bitcoin and in digital assets, in general, is alive and well. Extremely easy monetary policy is causing the Fed's balance sheet along with the U.S.'s monetary base to inflate notably. Such monetary policy in The U.S. and in other major economies is essentially causing the dollar and other fiat currencies to debase, which makes Bitcoin and other inflation-resistant digital assets appear more attractive. Additionally, the roughly $2 trillion valuation for the entire cryptocurrency complex is relatively small when compared to other major asset classes such as global stocks, global debt, money supply, or derivatives. Also, we have not seen a blowoff top in the digital asset market, nor have prices gone noticeably parabolic yet. Therefore, the current bull run is likely to continue, and based on our models, Bitcoin should hit a high of around $100-150K before this wave peaks.

Risk Factors

Bitcoin is a very volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other negative elements could impact Bitcoin's popularity and thus affect BTC's price negatively.

Therefore, for investors with low to mild risk tolerance, perhaps a position size of 3-5% of total portfolio holdings may be appropriate. For investors with higher risk tolerance, a position size of 10% or more of total portfolio holdings may make sense.

Please keep in mind that no one knows exactly how Bitcoin's future will play out. The digital asset could be worth a lot more than it is now several years down the line or it could be worth a lot less if negative elements begin to materialize surrounding the digital asset market.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss ...

more