Bitcoin Price Analysis: BTC/USD Grapples With Support Ahead Of FOMC

BITCOIN PRICES LACK MOMENTUM AHEAD OF FOMC

After a tumultuous Q2, Bitcoin has entered Q3 with lackluster motion as prices continue to consolidate around the $20,000 mark.

Since the beginning of the year, heightened geopolitical risks and a shift in sentiment (caused by rate hikes, war, and a gloomy economic outlook) has weighed on digital assets, driving Bitcoin back towards levels last seen in December 2020.

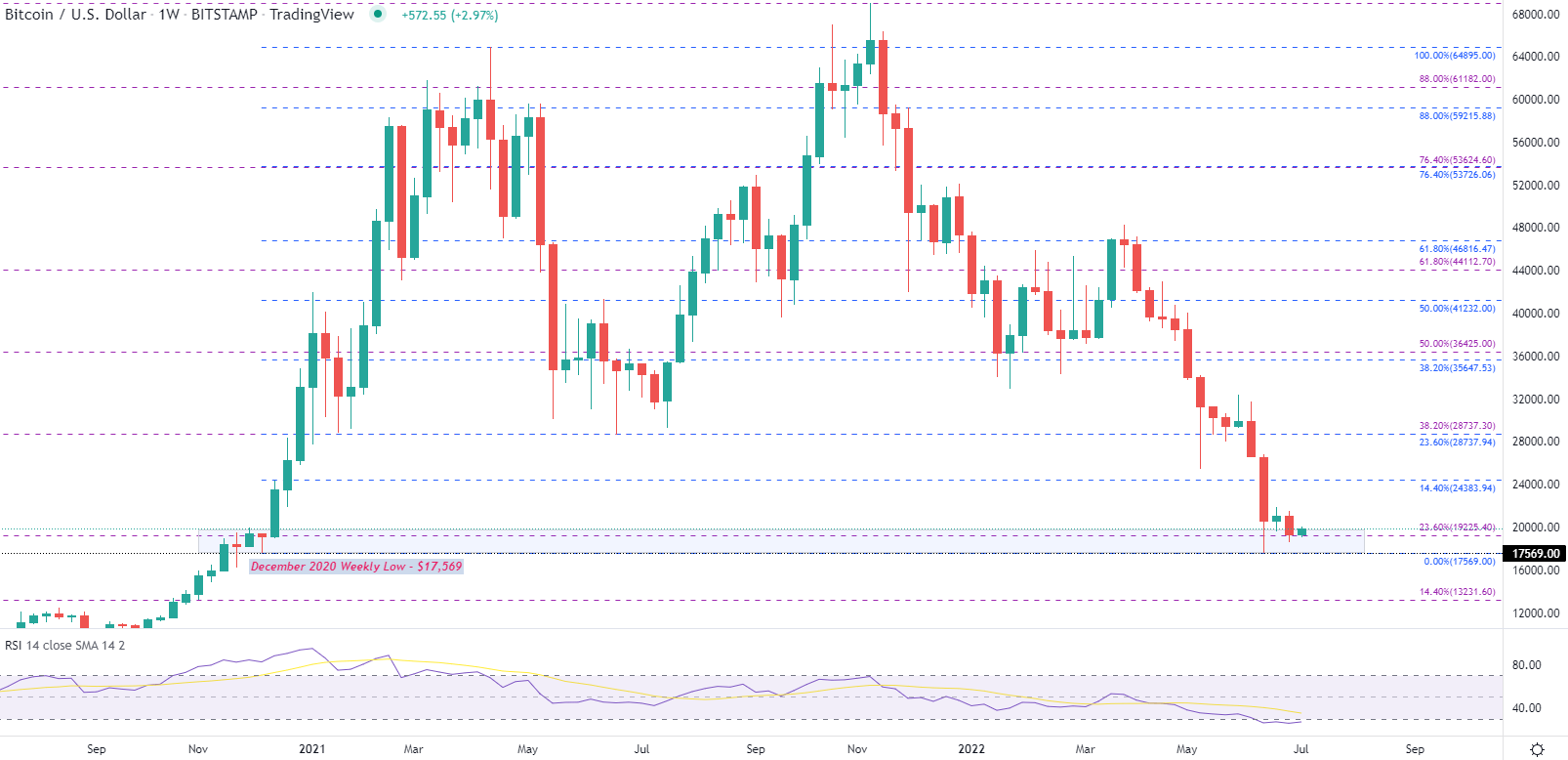

As illustrated on the weekly chart below, BTC/USD has often experienced large price swings, gaining traction once a clear direction has formed. By using Fibonacci levels from historical moves, both technical and psychological levels have provided support and resistance over time, often assisting in fueling momentum once a break of the range occurs.

BITCOIN TECHNICAL ANALYSIS

After falling below $18,000 on June 18th, bears were able to drive prices to $17,592 in an effort to retest the December 2020 low at $17,569. Failure to break below this level allowed buyers to drive prices higher before running into a wall of resistance at $21,000. While bulls and bears continue to trade sideways, the weekly RSI (Relative Strength Index) has fallen below 30, threatening oversold territory.

Bitcoin (BTC/USD) Weekly Chart

(Click on image to enlarge)

Source: TradingView, Chart by Tammy Da Costa

With a negative correlation existing between BTC/USD and interest rates, mounting price pressures and an influx of stimulus (throughout the Covid-19 pandemic) has forced the Federal Reserve to raise rates more aggressively than initially expected, reducing the appeal of speculative assets.

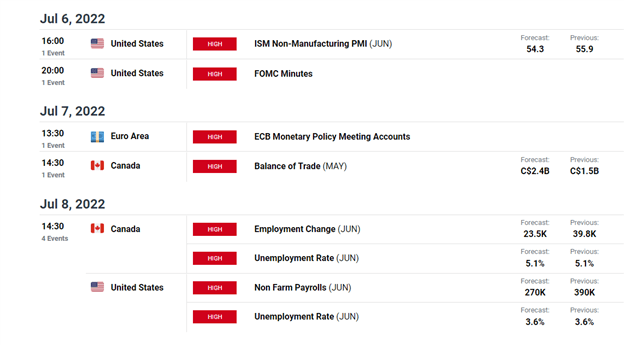

As the projected economic growth outlook remains rather bleak, Bitcoin prices have celebrated the US holiday in the green, treading cautiously just above $19,000. With the FOMC Minutes and NFP data on this week’s economic docket, fundamentals may assist in driving prices out of the $18,000 - $22,000 range.

DailyFX Economic Calendar

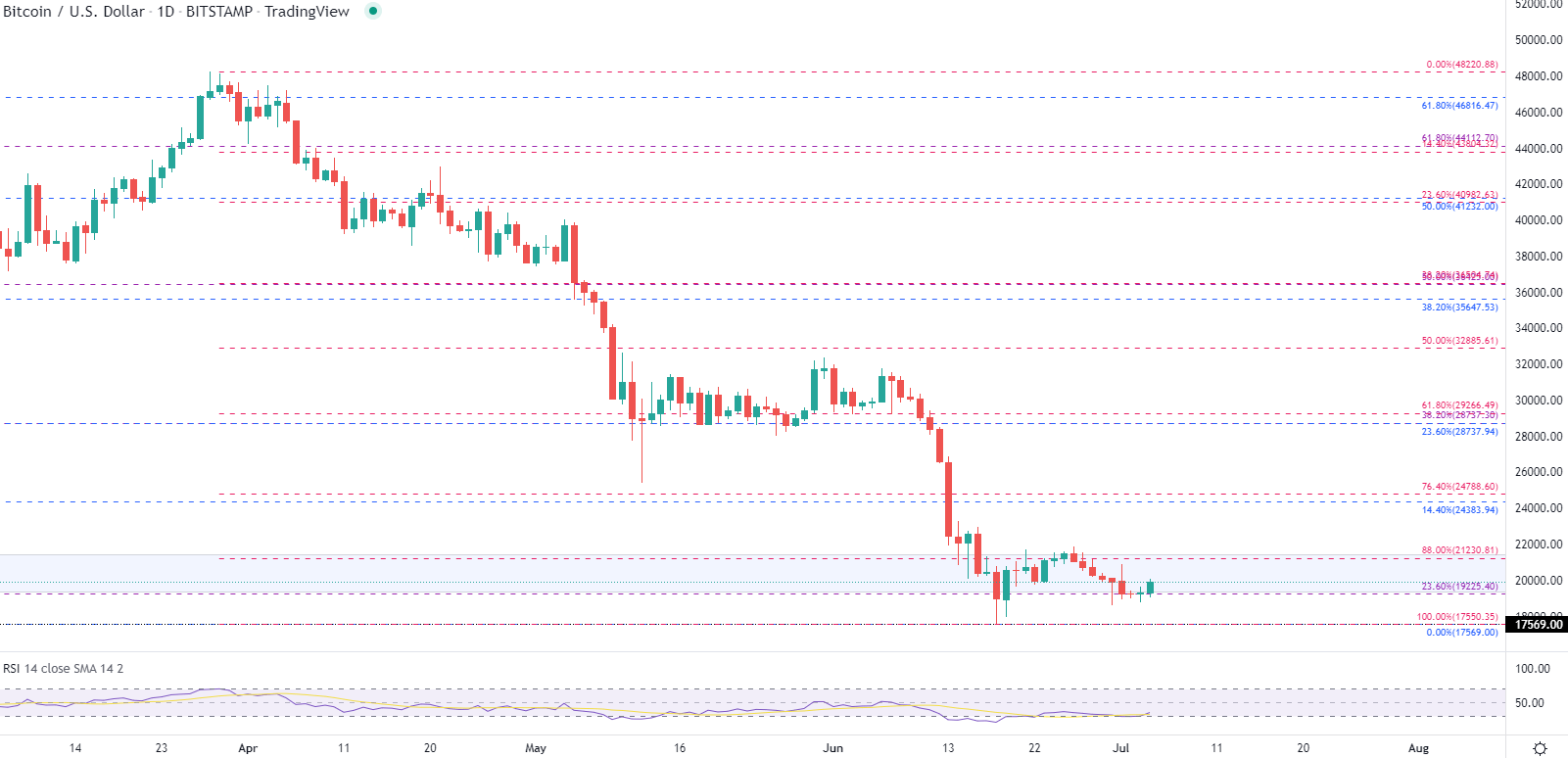

Meanwhile, on the Daily chart, the $19,225 Fib has provided an additional layer of support with a break below $19,000 opening the door for a retest of the June low at $17,592. If both these levels are broken, the next big level at the 14.4% Fib at $13,321.

Bitcoin (BTC/USD) Daily Chart

(Click on image to enlarge)

Source: TradingView, Chart by Tammy Da Costa

More By This Author:

GBP/AUD May Unwind Losses as BOE/RBA Implied Rate Paths Come Together

GBP/USD Outlook: Sterling Cements Key Technical Level Ahead Of FOMC

EUR/USD Price Forecast: Global Instability Limiting Euro Upside

Disclosure: See the full disclosure for DailyFX here.