EUR/USD Price Forecast: Global Instability Limiting Euro Upside

Euro Fundamental Backdrop

With little in the way of market-moving events over the weekend, global market including the euro has been left at the mercy of market sentiment. The situation in Ukraine and decisions by Russia could weigh negatively on the Eurozone should energy flows into the region be cut. The economic calendar is similarly light this week (see below) giving precedence to recessionary fears leading up to Wednesday’s commencement of high-impact events. This being said, the morning's news helped bolster euro bets after hawkish comments from Deutsche Bank’s CEO around hiking rates quicker than expected while talks around the anti-fragmentation tool are primed to be the talk of the town over the next few weeks. Should the ECB manage to clarify or agree on a path forward regarding ‘anti-fragmentation’, this could be extremely bullish for the euro.

From a dollar perspective, quarter/half-yearly flows buoyed the greenback last week which may see some short-term reprieve for the euro, while we may see muted price action today due to the Independence Day holiday in the U.S.

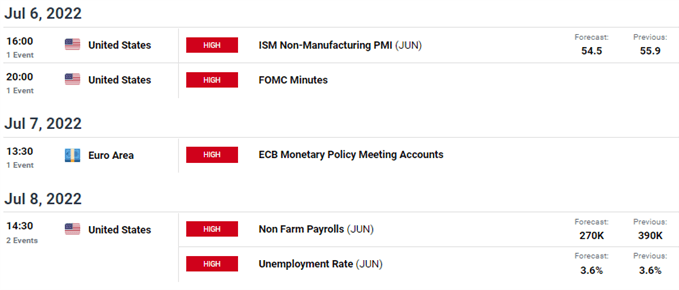

EUR/USD Economic Calendar

Source: DailyFX economic calendar

Technical Analysis

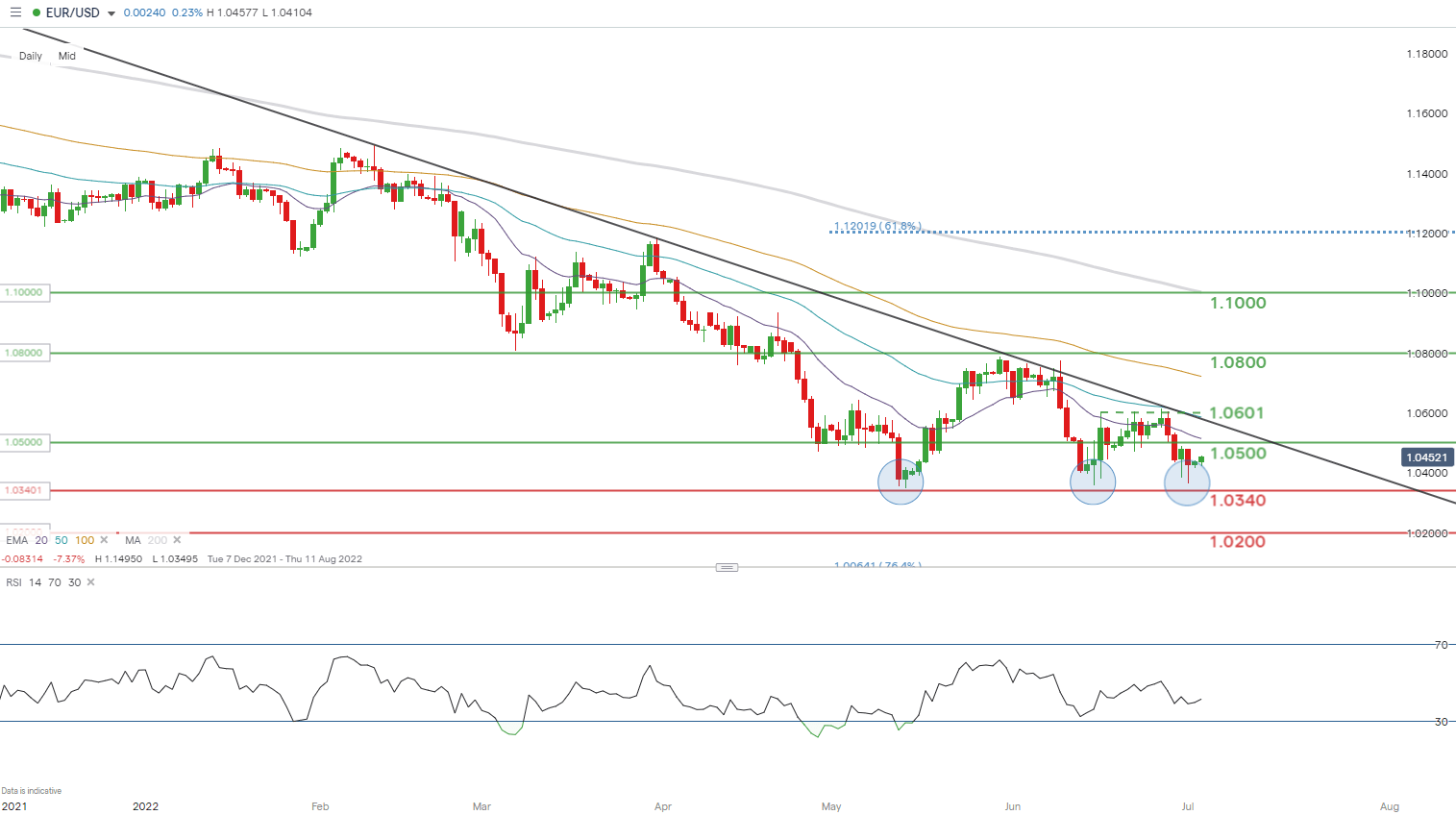

EUR/USD Daily Chart

Chart prepared by Warren Venketas, IG

Price action on the daily EUR/USD chart shows bulls once again defending the key area of support around the 1.0340 (January 2017 swing low). This key inflection point could mark the start of an extended move lower with the formation of the recent descending triangle pattern which will require a confirmation break below support. A rejection would thus occur if we see a breakout above triangle resistance coinciding with the 1.0601 swing high.

Resistance levels:

- Trendline resistance (black)/50-day EMA (blue)/1.0601

- 20-day EMA (purple)

- 1.0500

Support levels:

- 1.0340

- 1.0200

IG Client Sentiment Data: Bearish

IGCS shows retail traders are currently LONG on EUR/USD, with 70% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a downside bias.

More By This Author:

Australian Dollar Forecast: US/China Trade War Tariff Review On AnniversaryJapanese Yen Q3 2022 Forecast: Will a Weak Yen Push the BoJ into Action?

Bullish Japanese Yen - Peak Rates And Oil To Benefit Battered JPY

Disclosure: See the full disclosure for DailyFX here.