Bitcoin Halving Is Happening Saturday; What Could It Mean For Its Future Price?

Image Source: Pixabay

Introduction

The halving of Bitcoin mining rewards is set to happen this Saturday and such action has historically been associated with heightened investor interest and major price increases in the value of the cryptocurrency. This article provides some background on this halving event, and Bitcoin's projected price going forward.

What Is Bitcoin Halving?

Bitcoin halving is designed to control the supply of new Bitcoin entering circulation:

- Bitcoin operates on a decentralized network where transactions are verified and added to the blockchain ledger by miners. These miners are rewarded with Bitcoin for their computational efforts, which in turn introduces new coins into circulation.

- The term “halving” refers to the scheduled reduction by half of these mining rewards. By reducing the rate at which new Bitcoin are created, halving creates scarcity and limits the total supply of Bitcoins that will ever exist.

- Halvings occur once every four years, and they are expected to continue until 2140, when the amount of Bitcoin in circulation is forecast to reach its maximum supply.

- Following simple supply and demand analysis, each halving decreases supply, and is commonly believed to be a driver for increased price.

What Has Happened In Past Halvings, and What Can We Learn?

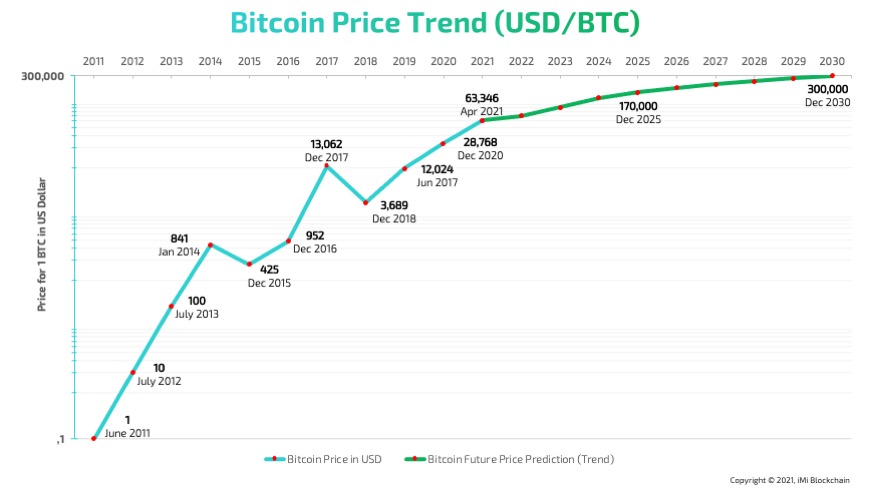

As illustrated in the graph below, Bitcoin’s 1st halving occurred in early 2012, when the Bitcoin ecosystem was small, fragile, and volatile. See source here.

Following a long sideways market in 2012, the 1st halving was followed a few months later by a significant bull market; smashing new all time highs and setting Bitcoin up for an explosive end to 2013, crossing $1,300.

4 years later Bitcoin was again in a long sideways market...but began to build strong momentum ~6 months later leading to the unprecedented 2017 run.

Today, for a 3rd time, we are in the midst of a long sideways market leading into the halving although 2019 did see a mini run in the middle which has since tapered off.

Co notes (see here) that:

- this time round "it is notably different from past halvings given that the crypto ecosystem has significantly matured.

- [On one hand,] crypto services have made it simple to buy, hold, and use Bitcoin, giving easy access to anyone who wants exposure while,

- on the other hand, it’s also much easier to bet against Bitcoin and go short (via margin, futures, and derivatives). This was difficult in 2016, and completely absent in 2012.

- Compared to 2016...most people have at least heard of Bitcoin, and a number of institutions have developed an internal perspective on this asset class so [Co asks if] the halving is priced in [and replies that] there are generally two schools of thought:

- yes, the halving is a byproduct of Bitcoin’s public and well-known economic model. All public information is priced-in to efficient markets, and this is no different and

- no, the halving is a narrative more than anything else, and may influence demand more than supply by driving increased awareness and adoption.

What Will Happen During, and After, the Next Halving?

Anyone predicting the future is ultimately guessing, so we’ll have to wait and see. At a minimum, the coming halving should produce a strong current of Bitcoin press, opinions, and theories.

Below is a logarithmic scaling of historical BTC prices and future price predictions from imiblockchain.com:

What Prices Are Forecast For Bitcoin?

- James Butterfill, head of research at CoinShare, anticipates a significant price surge following the recent approval of Bitcoin ETFs (see here) and the halving event suggesting that Bitcoin could soar to $80,000 amidst these developments.

- Antoni Trenchev, co-founder of the cryptocurrency exchange Nexo, projects a price target of $100,000 in 2024.

- Financial institution Standard Chartered also forecasts Bitcoin reaching the $100,000 mark in the same timeframe.

- Seth Ginns, managing partner of CoinFund, suggests that Bitcoin could skyrocket to an astounding $500,000 in 2024.

When Should Investors Enter the Market?

- Should they seize the opportunity to buy Bitcoin before the halving, anticipating a potential price surge driven by supply scarcity and increased demand or wait until after the halving, betting on historical patterns of post-halving price appreciation?

Conclusion

Time will tell. Stay tuned for future developments.

More By This Author:

Update: Israeli Stocks On U.S. Exchanges Have Outpaced Nasdaq And S&P 500 Since October 7/23

AI Is Shaping The Future Of Smartphones

These 10 "Low PEG Ratio" AI Stocks Have Out-Performed The Sector Almost 10-Fold YTD

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more