Coming Bitcoin Halving + 9 New Spot Bitcoin ETFs = Record High Bitcoin Price

Image Source: Pixabay

Introduction

The halving of Bitcoin mining rewards, anticipated to occur in April, has historically been associated with heightened investor interest and major price increases in the value of the cryptocurrency. This article provides some background on this halving event, information on 9 spot Bitcoin ETFs that came on the market this past January, and Bitcoin's projected price by mid-2025.

What Is Bitcoin Halving?

According to an explanation here, Bitcoin halving is designed to control the supply of new Bitcoin entering circulation.

- Bitcoin operates on a decentralized network where transactions are verified and added to the blockchain ledger by miners. These miners are rewarded with Bitcoin for their computational efforts, which in turn introduces new coins into circulation.

- The term “halving” refers to the scheduled reduction by half of these mining rewards. By reducing the rate at which new Bitcoin are created, halving creates scarcity and limits the total supply of Bitcoins that will ever exist. This controlled supply is a fundamental aspect of Bitcoin’s design and contributes to its appeal for many investors.

- Halvings occur approximately once every four years, and they are expected to continue until the year 2140, when the amount of Bitcoin in circulation is forecast to reach its maximum supply.

- The previous Bitcoin halvings occurred in November 2012, July 2016, and May 2020. Historically, the price of Bitcoin has increased immediately prior to, as well as after, these halving events as shown in the table below.

Bitcoin Halving History

| Bitcoin Halving Event | Price on Halving Day | Price 150 days later |

|---|---|---|

| 2012 | $12.35 | $127 |

| 2016 | $650.53 | $758.81 (+166%) |

| 2020 | $8821.42 | $10,943 (+224%) |

| (Source: cointelegraph.com and munKNEE.com) | ||

Debut of 9 New Spot Bitcoin ETFs

While likely just a coincidence, the January debut of an additional 9 spot Bitcoin ETFs on January 11th and the anticipated upcoming halving event in April has added a second supply-reducing dynamic for Bitcoin at the same time and, given the digital asset’s price action to date in 2024, it’s clear it’s benefiting from those scenarios. Below is a list of the referenced spot Bitcoin ETFs. Their January 11th to date (i.e. YTD) price returns are almost identical but when their expense ratios are taken into consideration there is a small variation in their net price appreciations and they are ranked accordingly in descending order below. In addition, their assets under management (AUMs) are noted:

- ARK 21Shares Bitcoin ETF (ARKB): UP 69.5% Net YTD; $2.6B AUM

- VanEck Bitcoin ETF Trust (HODL): UP 69.5% YTD; $292M AUM

- Franklin Bitcoin ETF (EZBC): UP 69.5% YTD; $193M AUM

- Invesco Galaxy Bitcoin ETF (BTCO): UP 69.4% YTD; $384M AUM

- Valkyrie Bitcoin Fund ETF (BRRR): UP 69.4% YTD; $297 AUM

- WisdomTree Bitcoin Fund (BTCW): UP 69.4% YTD; $63M AUM

- Bitwise Bitcoin ETF (BITB): UP 69.3% YTD; $1.9B AUM)

- iShares Bitcoin Trust (IBIT): UP 69.1% YTD; $13.0B AUM

- Grayscale Bitcoin Trust ETF (GBTC): UP 67.8% YTD; $27.1B AUM is converting to a spot ETF from a Trust to provide a lower expense fee which will increase its net return and make it more competitive to its peers.

- Fidelity Wise Origin Bitcoin Fund (FBTC): UP 54.0% YTD; $8.4B AUM

What's Next For Bitcoin?

Beyond providing a boost to Bitcoin prices, the above ETFs are bringing more institutions into the crypto market and broadening the audience for digital assets among advisors and previously apprehensive retail investors. Indeed, some analysts believe there’s more in store regarding the upside. As of late Monday, Bitcoin was higher by 7% over the past week and trading around $72,600 and the research firm, Bernstein, believes that Bitcoin can ascend to $150,000 by the middle of 2025, meaning it would more than double from current levels.

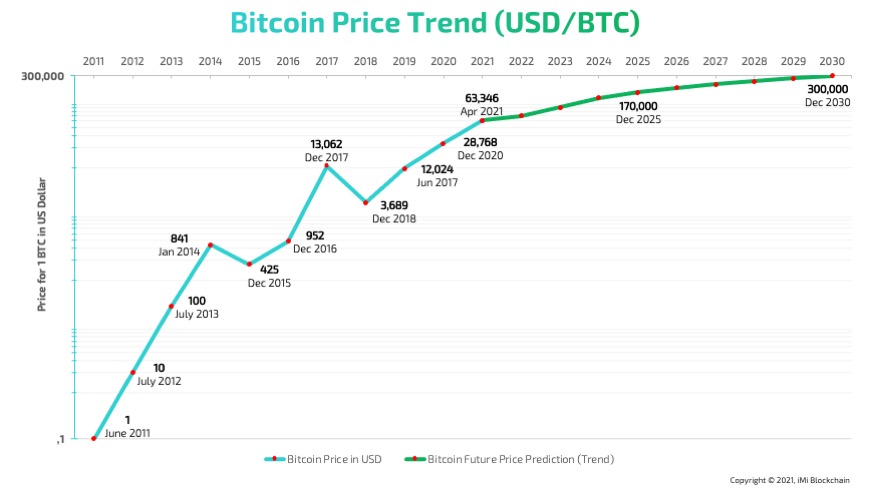

Below is a logarithmic scaling of historical BTC prices and future price predictions from imiblockchain.com that suggests that Bernstein's projection has some merit:

More By This Author:

Psychedelic Compound-Based Drug Stock, Mind Medicine, Up 56% Last Week

Our 7 Largest Cannabis MSO Stocks Dropped 7.1% Last Week

Cannabis Company Green Thumb Has Bounced Back From A Rocky Q4

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more