Bitcoin Crypto Price News Today - Wednesday, July 9

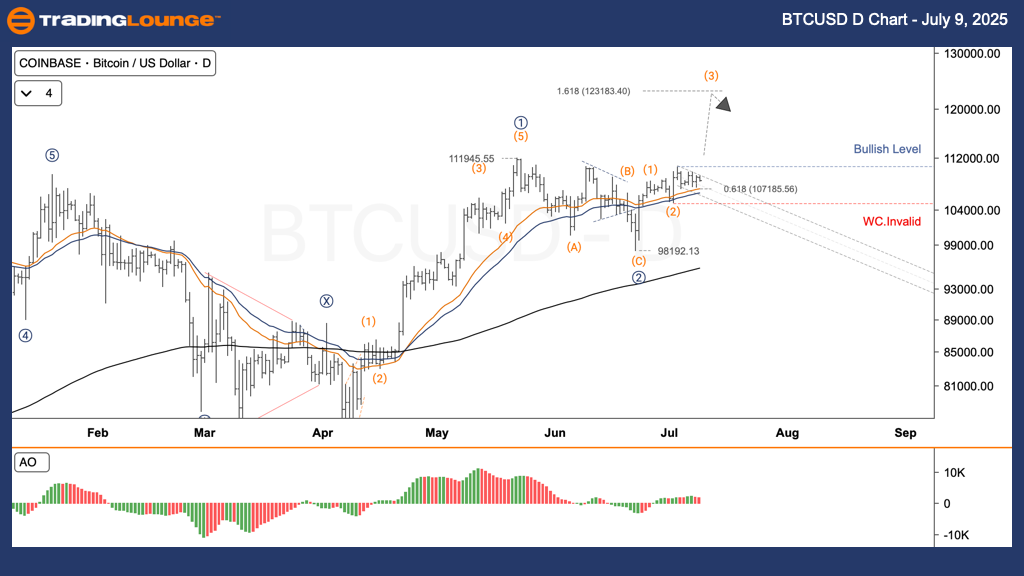

Elliott Wave Analysis – TradingLounge – Daily Chart

Asset: Bitcoin / U.S. Dollar (BTCUSD)

BTCUSD Elliott Wave Technical Analysis

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 3

Direction: Next higher degrees expected to continue upward.

Bitcoin (BTCUSD) Trading Strategy

After BTC surpassed $110,590 to complete wave (1), it's now consolidating in wave (2) ABC, with sub-wave C testing a key support level before wave (3) likely resumes to the upside.

Trading Strategies

For Short-Term Traders (Swing Trade):

- Aggressive Entry: If BTC falls into the $107,200–$106,300 zone and shows a bullish reversal signal (e.g., bullish engulfing pattern, RSI divergence).

- Conservative Entry: Wait for confirmation with BTC closing above $110,600, indicating wave (3) has resumed.

Wave Count Invalidation:

- Invalidation Level: $105,149.53

- If BTC drops below this price, the wave count becomes invalid.

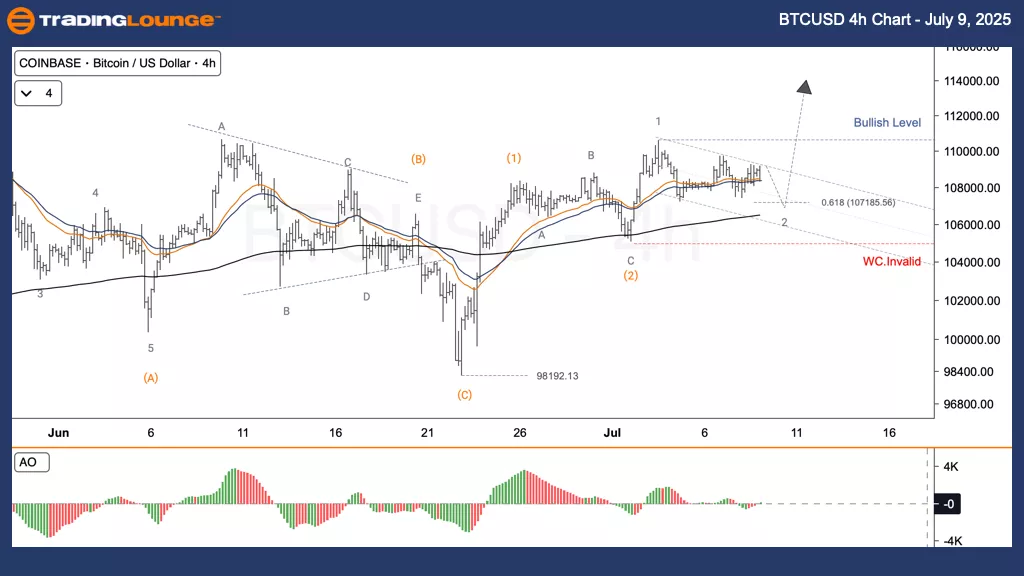

BTCUSD Elliott Wave Technical Analysis (4H Chart)

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 3

BTC Price Outlook:

Post the breakout above $110,590, the asset has entered an ABC corrective phase for wave (2). Sub-wave C is testing crucial support. A rebound from this area is likely to begin wave (3) higher.

Trading Strategies – Summary

For Short-Term Traders (Swing Trade):

- Aggressive Entry: Enter between $107,200–$106,300 if a bullish pattern appears.

- Conservative Entry: Confirm breakout above $110,600 to enter.

Invalidation Point:

- $105,149.53 – Falling below this invalidates the current wave count.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Technical Forecast: Unibail‑Rodamco‑Westfield

U.S. Stocks: The Walt Disney Co. - Tuesday, July 8

Elliott Wave Technical Analysis: British Pound/U.S. Dollar - Tuesday, July 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more