Bitcoin And Crypto: Fraud Or The Future?

Few issues divide well-respected investors as much as cryptocurrency. To hear many classic value investors tell it, crypto is Bernie Madoff with the added dimension of wasting electricity and facilitating seedy criminal activities. Others, including many famed macro investors like Paul Tudor Jones, Stan Druckenmiller, and Dan Loeb, believe we are in the early innings of a new, transformative asset class—one that will cut out the traditional rent-seeking financial middlemen, directly connect economic actors and expand financial services to the far reaches of the globe. The range of predicted outcomes is staggering.

As we dig further into the crypto ecosystem, the complexity (and potential) becomes apparent. Whatever your initial impression, an approximately $2 trillion asset class should be approached with interest, respect and humility.

In this article, I aim to answer four discrete questions:

- Is Bitcoin a Ponzi scheme?

- Does Bitcoin threaten the U.S. dollar?

- What is the most interesting aspect of Bitcoin for speculators?

- What are our preferred Bitcoin risk management/timing tools?

In a May column for the New York Times, Paul Krugman racked his brain, wondering “Why are people willing to pay large sums for assets that don’t seem to do anything?” Krugman concluded that Bitcoin was a Ponzi scheme powered by “technobabble” and “libertarian derp.” Essentially, the Ponzi scheme argument boils down to Bitcoin having no true use case.

From our perspective, crypto—blockchain technology more broadly—has a number of potential use cases. Yet, the core Bitcoin use case is wealth mobility. More specifically, Bitcoin seems to be the perfect instrument for cross-border transfers of large sums of wealth. It is no coincidence that China and other countries with capital controls dominate Bitcoin mining globally. Where there is wealth trapped behind capital controls, Bitcoin demand will be close behind.

History is filled with examples of assets that derived value from their ability to clandestinely transfer wealth across borders. Diamonds, artwork, precious metals, rare books and other “collector’s items” all act as stores of value that can surreptitiously cross jurisdictional boundaries. Bitcoin is the logical evolution of this demand.

Consider the following:

- Proof of work ensures Bitcoin cannot be forged

- At a $750 billion market cap, liquidity abounds

- Digital transportation makes even diamonds seem comparatively cumbersome ($10 million of gold weighs just under 500 lbs)

Countries with capital controls—like China, India and South Korea—have been at the vanguard of Bitcoin suppression. Anyone who fails to see a legitimate use case for Bitcoin has not put themselves into the shoes of a citizen of such jurisdiction. In developed markets, stable banking and property rights are taken for granted. Across the globe, however, these conditions remain the exception.

Does Bitcoin Threaten the U.S. Dollar?

Others attribute supernatural power to Bitcoin and argue that if allowed to grow, it will overtake the U.S. dollar. The upshot is that Bitcoin is too dangerous to the U.S. government and, thus, will be snuffed out by regulators. As stated, we see legitimate use cases for crypto, however, we think there is virtually zero chance that crypto will displace the U.S. dollar.

Rather than viewing Bitcoin as competition for the U.S. dollar and fiat currencies, we think it is more properly viewed as competition for (or an adjunct to) gold. In fact, counterintuitively, we view Bitcoin as supportive of the U.S. dollar. If Bitcoin facilitates asset leakage from more draconian jurisdictions (e.g., China), then these assets may find a new home. Countries with stable currencies and strong private property rights could benefit from these Bitcoin-facilitated outflows. In other words, the end goal is not to convert the Chinese yuan into Bitcoin, but to get it into a more stable jurisdiction of choice. Bitcoin is a conduit for these transactions. Attractive markets (like the U.S.) are the destination.

Does this mean we see no regulatory risk? No, it doesn’t. With an emerging asset class, there is always the risk of a regulatory misstep. However, regulation, in general, should not be feared. Rather, regulation may equal acceptance. It clears the path for institutional adoption. While crypto is inching closer to this outcome, it is not there yet. In any event, we view Bitcoin as a negative for countries that impose strict capital controls on their citizenry and a positive for more laissez-faire jurisdictions. Bad regulation is a risk, but proper regulation could facilitate mass adoption.

Broadening Adoption

As speculators, Bitcoin interests us because it is a new asset undergoing mass institutional adoption. It is quantitatively interesting as a result of its portfolio diversification benefits (low relative to other major assets), short-term trend following properties, and long-term mean reversion character. In short, it marches to its own beat with a secular tailwind at its back.

While Bitcoin is generally uncorrelated to other assets and does boost portfolio returns, there is no evidence that it provides any hedge to equities.

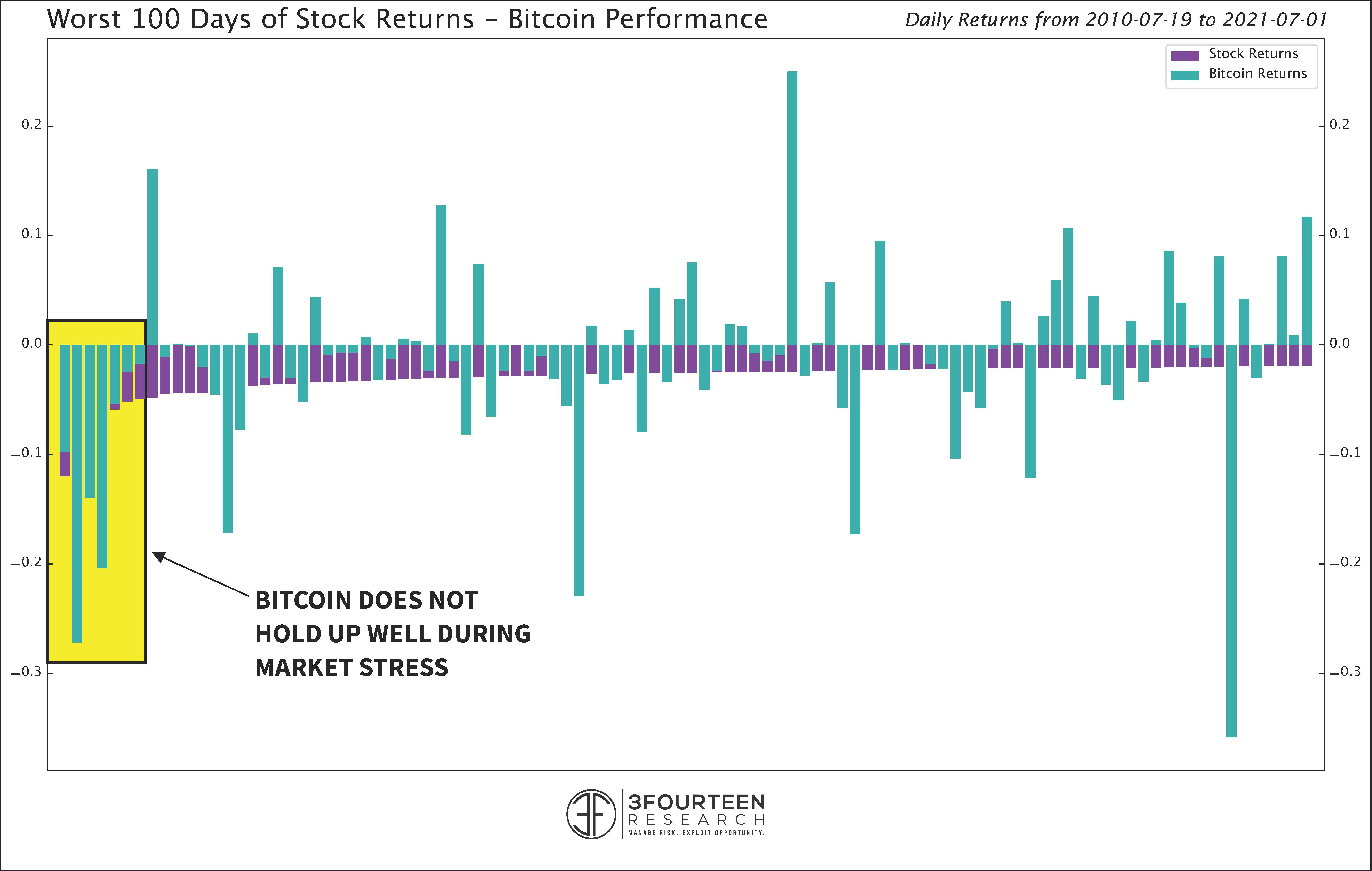

In figure 1, we plot the 100 worst equity days1 (purple bars) and Bitcoin’s returns (blue bars) on these days. Bitcoin was down on 61 of these 100 days, and on the absolute worst days (far left) Bitcoin loses big.

Figure 1: Bitcoin Performance on Worst 100 Days of Stock Returns

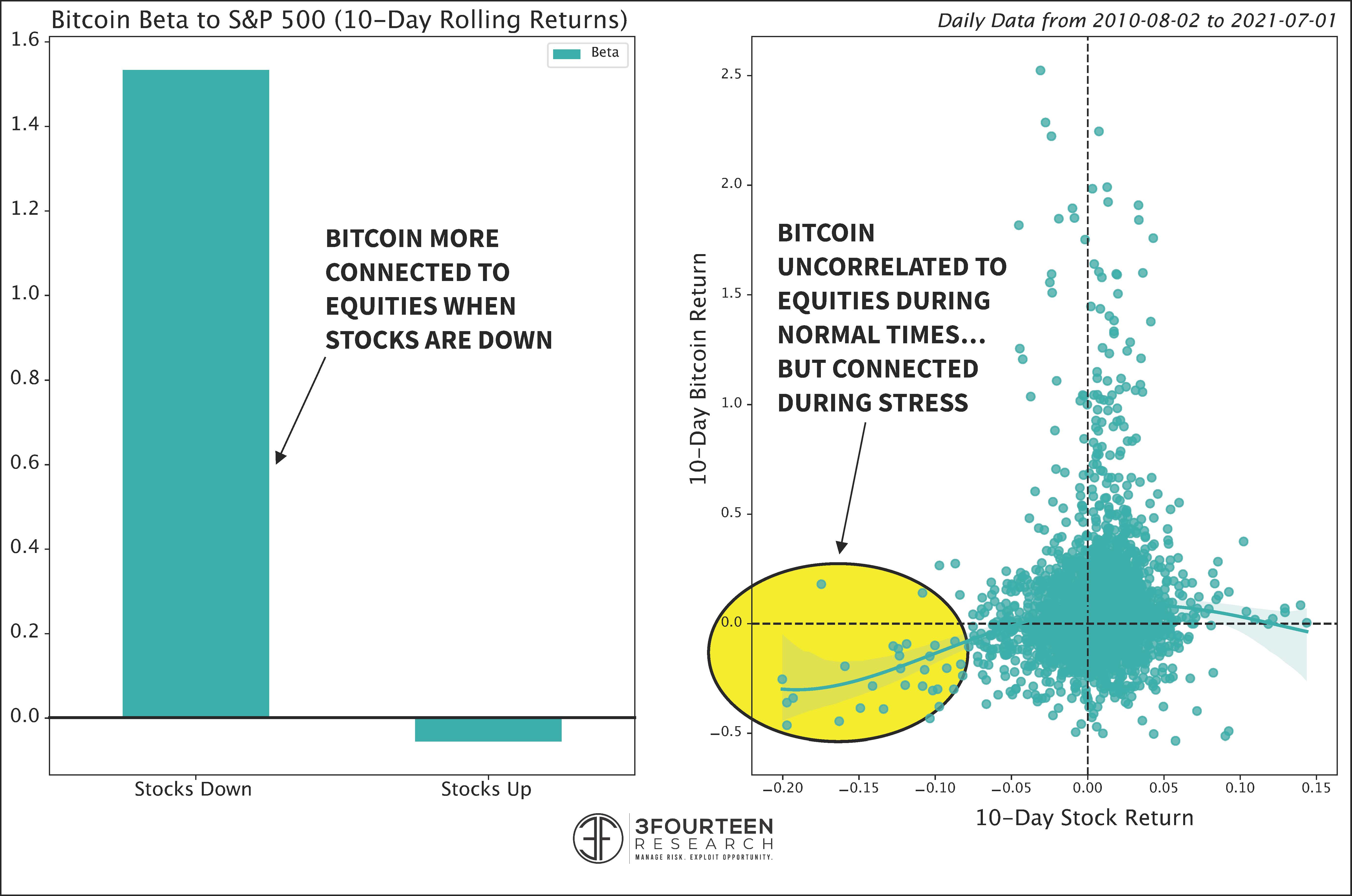

On the days equities are down, Bitcoin’s market beta is 1.5, as seen in figure 2. On up days, Bitcoin’s beta is slightly negative. Finally, the scatter plot (bottom right) compares 10-day returns for stocks and Bitcoin. During periods of equity extremes (especially to the downside) Bitcoin seems to follow the mood of the market.

Figure 2: Beta of Bitcoin vs. Stocks

So, Bitcoin may not be an equity hedge. Why, then, has it managed to receive the label of an “uncorrelated” asset? Two reasons: first, on most days, Bitcoin and the stock market move independently. It appears only during periods of acute stock market stress that the relationship shows up (see figure 2). Given the systemic nature of the equity market (i.e., equity market stress infects almost every other asset), this is not surprising. Second, Bitcoin can go through its own periods of stress, or exuberance, without seeming to impact the stock market.

Tactical Indicators

Academic research is emerging, and our testing confirms, that traditional trend following strategies work well as crypto risk management tools.

For tactical investors, 314 Research is providing some new modeling work that can help cut drawdowns substantially and preserve upside.

Underlying this model is a mix of:

- Trend breadth

- Time series slope calculations

- Raw momentum

- Flows into and out of Bitcoin as determined by its cumulative volume

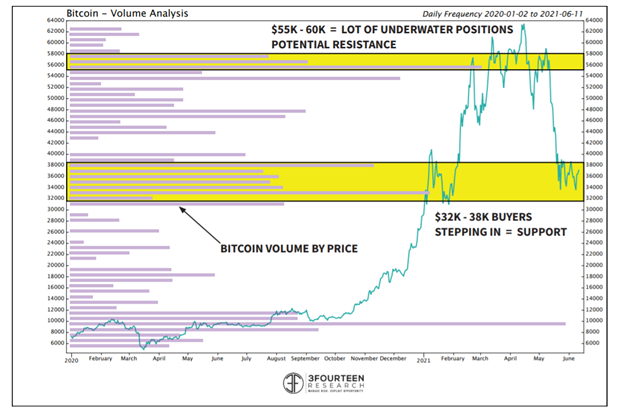

In our testing, we have found bitcoin's price corresponds to its flow and volume data. One way we use volume data is to calculate the amount of volume that has taken place at different prices. This is known as “volume by price.” In the chart below, we calculate Bitcoin’s current volume by price. At present, we see a large volume block in the $32,000–$38,000 range acting as support. If Bitcoin is able to bounce from current levels, the volume block at $55,000–$60,000 is likely to act as resistance.

Figure 3: Bitcoin Volume Analysis

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more