Awaiting August Consumption And Personal Income

Image Source: Pexels

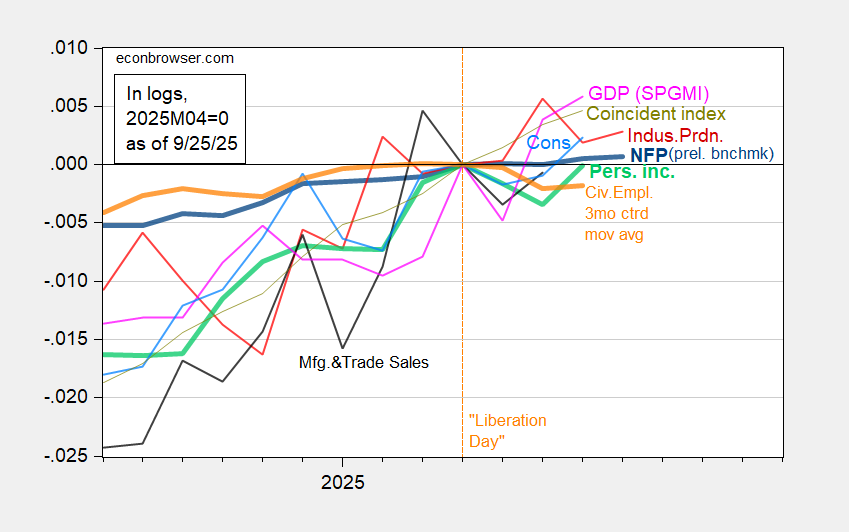

Nonfarm payroll employment, personal income essentially flat, civilian employment down, since 2025M04 (“Liberation Day” month).

Figure 1: Implied preliminary benchmark NFP (bold blue), industrial production (red), personal income ex-current transfers (bold light green), manufacturing and trade industry sales (black) monthly GDP (pink), civilian employment, 3 month centered moving average of smooth population controls version (bold orange), consumption (light blue), and coincident index (chartreuse), all in logs 2025M04=0 (normalized to “Liberation Day”). Source: BLS via FRED, BLS, and Federal Reserve, BEA, Census, Philadelphia Fed via FRED, SP Global Market Insights (9/2/2025), and author’s calculations.

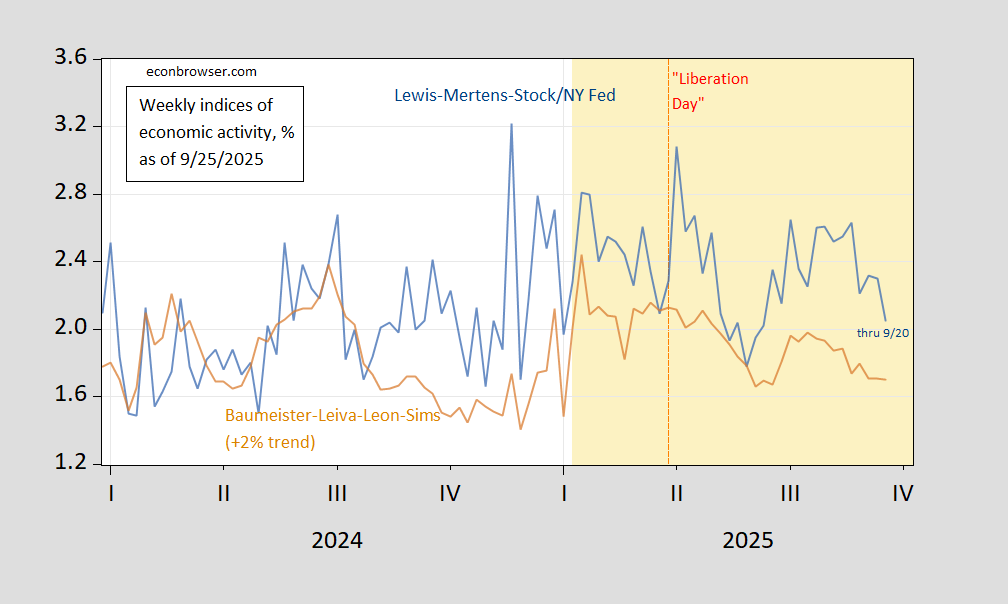

High frequency indicators suggest a slowdown in mid-September (which is end of Q3).

Figure 2: Lewis-Mertens-Stock WEI (blue), and Baumeister-Levia-Leon-Sims WECI plus trend growth of 2% (tan), both in %. Source: Dallas Fed via FRED, Weekly State Indexes.

Given the Q2 3rd GDP release, likely that real consumption will rise in August. Still, that’s backward-looking, while the WEI and WECI indicate deceleration in September.

More By This Author:

Everyday Prices (Still) Going Up – And Big Mac For Me, But Not For TheeSix Measures Of Nonfarm Payroll Employment

Stephen Moore Remains Blithely Detached From Reality: Tax Cut Impact