Affordability, Illustrated

Image Source: Pexels

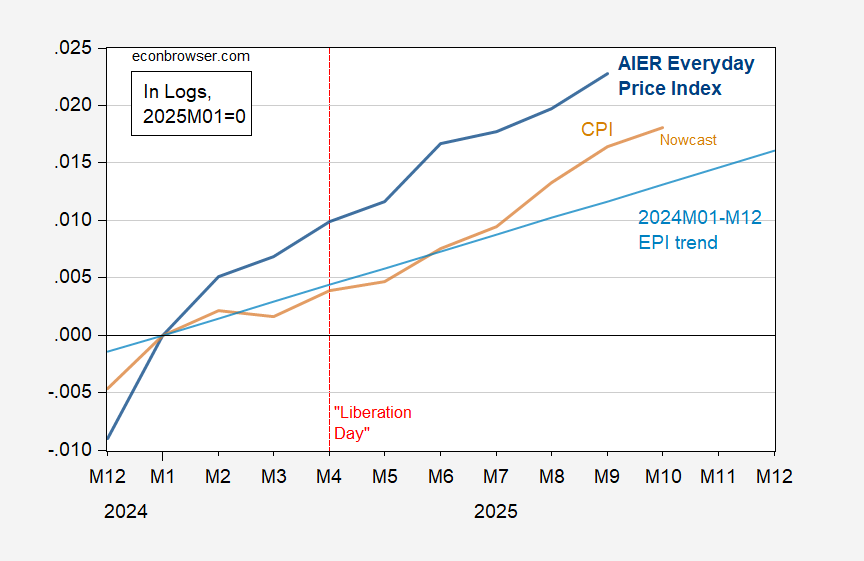

The AIER’s Everyday Price Index vs. 2024 stochastic trend, and CPI:

Figure 1: American Institute for Economic Research (AIER) Everday Price Index (EPI) (bold blue), 2024M01-M12 stochastic trend (light blue), and CPI all urban (tan), all in logs, 2025M01=0. October CPI observation is Cleveland Fed nowcast. Source: AIER, BLS, Cleveland Fed (accessed 11/11) and author’s calculations.

As of September, EPI has risen 0.6 percentage points more than the CPI, and EPI has risen 1.1 percentage points more than the 2024 stochastic trend. On an annualized basis, EPI has risen by 0.9 percentage points faster than CPI, and 1.5 percentage points faster than the stochastic trend.

Here’s a description of the AIER’s EPI:

The EPI tracks a subset of prices from the broader Consumer Price Index (CPI) reported by the Bureau of Labor Statistics (BLS). The CPI includes prices of all goods and services purchased by a typical urban consumer. The EPI, in contrast, includes only goods and services purchased on a day-to-day basis that cannot be easily postponed or foregone.

These include everyday items such as food, utilities, fuel, prescription drugs, telephone services, etc. The EPI excludes infrequently purchased items, such as cars, appliances, furniture, or apparel. Purchases of such products can be planned for or postponed, eliminating unexpected shocks to household budgets. The EPI also excludes the cost of housing, which can be contractually fixed for at least several months (in the case of rents) or several decades (in the case of mortgage payments). Even a dramatic change in home prices does not translate into an immediate jump in rents or mortgage payments the way, say, an oil price increase translates into higher gasoline prices.

Who would ’a thunk it, raising tariffs and deporting thousands of undocumented (and recently “de-documented) and documented workers would raise prices faced by ordinary Americans?

More By This Author:

The Trump Agenda And The Housing Stock“Until We Hear Brazil Get Mentioned, I Wouldn’t Get Excited”

Truflation’s “Strategic Adviser”: BLS Should “…Expand The Use Of Public-Private Partnerships”