ADP Implied Private NFP, Philly Fed Early Benchmark, Etc.

Image Source: Pixabay

In general, not good news. Using the relationship in (log) first differences implies slight gain in private NFP:

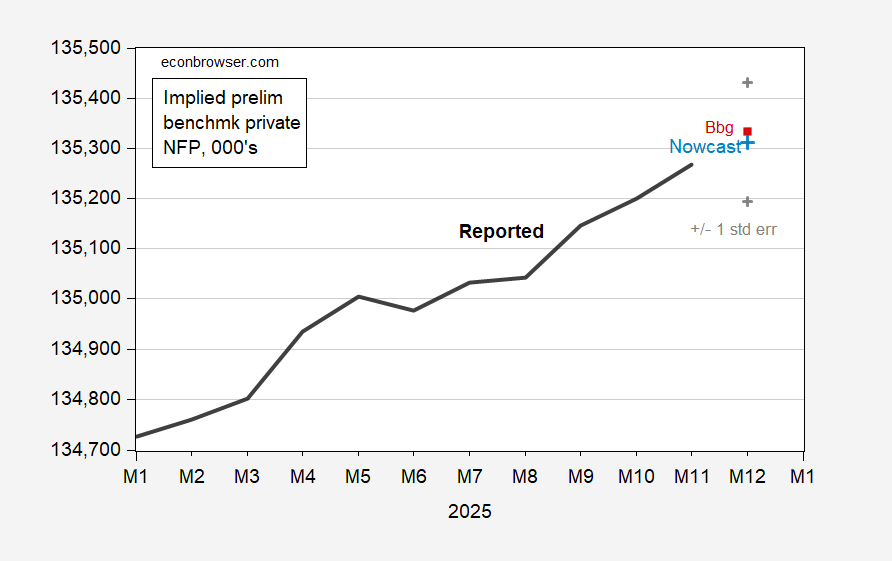

Figure 1: Private nonfarm payroll employment, implied preliminary benchmark (bold black), nowcast based on first differences regression on ADP (light blue +), +/- 1 std error (gray +), and Bloomberg consensus (red square), all in 000’s, s.a. Source: BLS, ADP, and author’s calculations.

Bloomberg consensus is for +64K private NFP, vs. regression nowcast of +44.5K. The prediction interval is quite large, so a negative reading is quite possible.

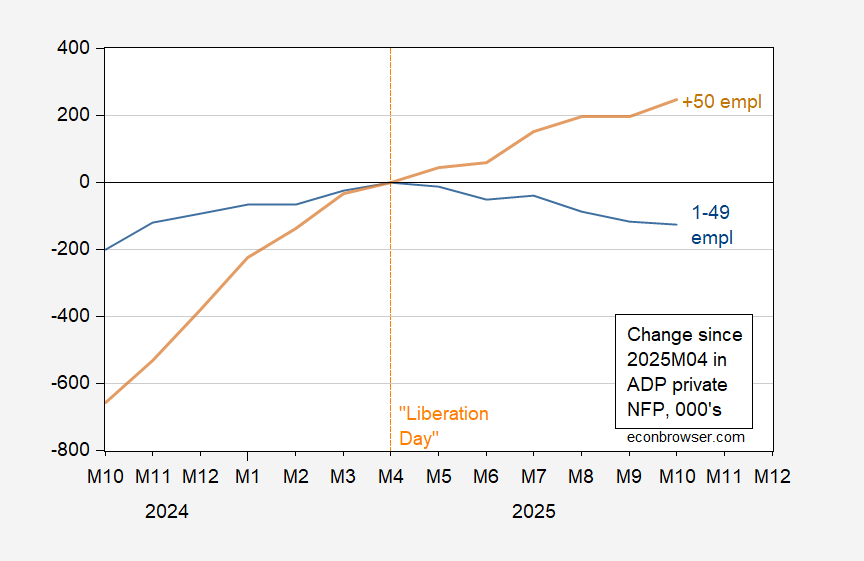

For me, the most interesting point is that April 2025 seems to be the high-water mark for small firm employment; since then, cumulative employment has been driven by firms with more than 50 workers.

Figure 2: ADP Employment in firms with greater than 50 workers (tan), and less than 50 (blue), both relative to 2025M04. Source: ADP via FRED, and author’s calculations.

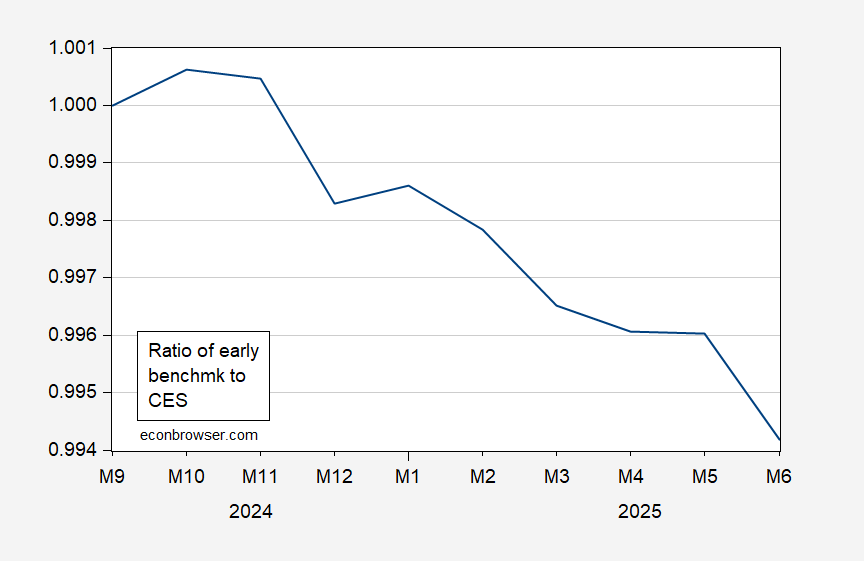

One particularly interesting report is that the ratio of early benchmark employment to CES-reported employment has fallen.

Figure 3: Ratio of early benchmark sum of states to CES reported sum of states employment. Source: Philadelphia Fed and author’s calculations.

Applying this ratio to overall nonfarm payroll employment means that there is a big implied drop in employment in June 2025.

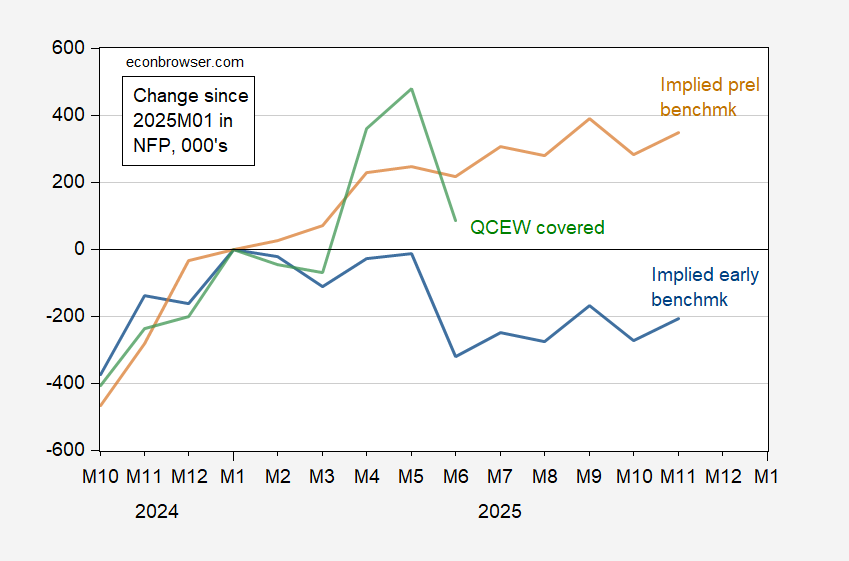

Figure 4: Change since January 2025 in implied early benchmark nonfarm employment (blue), implied preliminary benchmark nonfarm employment (tan), and QCEW covered employment seasonally adjusted by author (green), all in 000’s, s.a. Implied benchmark applies the ratio of early benchmark to CES reported employment up to 2025M06, and iterated reported NFP thereafter. Implied preliminary benchmark uses 2025M03 value, and iterated reported NFP thereafter. QCEW covered is seasonally adjusted by author using Census X-13 (in logs). Source: BLS via FRED, BLS, Philadelphia Fed, and author’s calculations.

If either implied early benchmark or QCEW covered are more accurate, then we are past the recent peak in employment.

More By This Author:

ADP Private NFP Employment Below Consensus, Large Firm Flat, Mfg DownAuto Loans Further Deteriorate

Russian GDP In Question