A Strong Economy And Easier Lending Standards Are Fueling The Bull Market

Summary

- Business shows its optimism with its investments.

- Credit conditions are easing.

- The business cycle is on a strong upswing – good news for equities.

In my earlier articles, I showed how the business cycle reflects business decisions. As such, it is the outcome of all the quantifiable and unquantifiable events as experienced by business people.

Their major goal is to have the right products at the right time in the right quantity on the shelves ready for consumers. The challenge is to have the correct level of inventories. Excessive inventories compared to sales negatively impact earnings. Low inventories compared to sales translate in lost sales.

These changing decisions about adding to inventories when business improves and reducing inventories when business slows down are the major forces behind changes in the business cycle and the prices of most assets. In my latest article, “An Indicator That Assesses Which S&P 500 Sectors Are Likely To Outperform”, I discuss in detail this point.

The above graph shows the business cycle as reported in each issue of The Peter Dag Portfolio Strategy and Management available on peterdag.com. Its current trend is up, reflecting a stronger economy.

Every upswing of the business cycle has been associated with the process of restocking depleted inventories. A decline in the business cycle, on the other hand, reflects the business decision to reduce inventories due to slower demand.

These changes of the business cycle drive commodities, interest rates, and the performance of cyclical or defensive sectors, including bond prices.

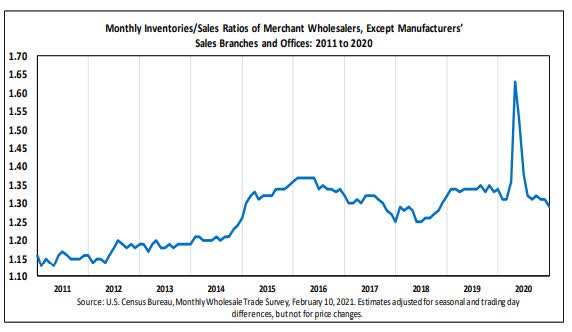

The latest inventory to sales ratio released by the Census shows a sharp decline in the ratio. This is another bullish trend for the economy. It means sales are rising much more rapidly than inventories. Business will be forced to produce more goods to replenish inventories.

The outcome is increased production, purchases of more raw materials (commodity prices are likely to keep rising), more hiring (employment in the crucial manufacturing sector will keep rising), and more borrowing to finance the manufacturing activity (placing upward pressure on interest rates).

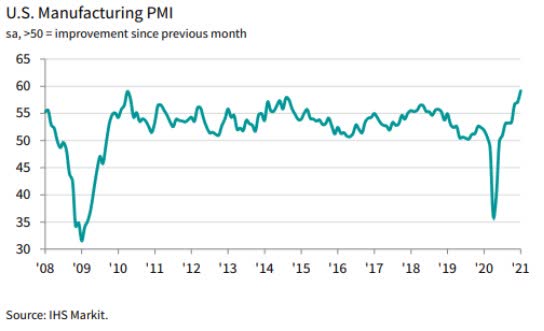

The above indicator confirms this is exactly what is happening. The US survey of manufacturing (Markit) shows the percentage of purchasing managers responding positively soared to 59.2. This measure is one of the strongest among the developed economies. Taiwan’s index was 60.2. the Netherlands reported 58.8. China’s index was 51.5. The global index finished at 53.5.

This is good news for manufacturing and overall employment in the US. Manufacturing is doing well and this sector is aggressively producing the goods the nation needs.

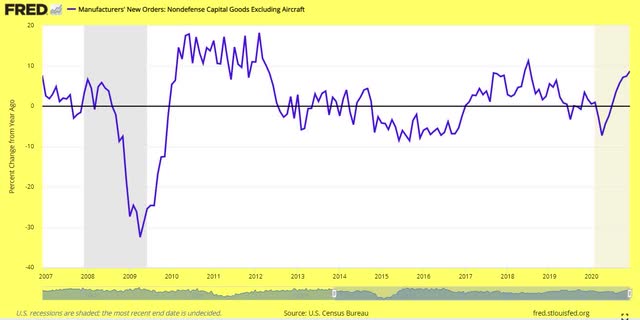

Business optimism is also reflected by new orders for capital investments, soaring 8.7% y/y (see above chart). This investment is crucial to increase productivity – to produce more with less – and increase the growth and wealth of the country.

All this could not be possible, of course, without the help of the banking system.

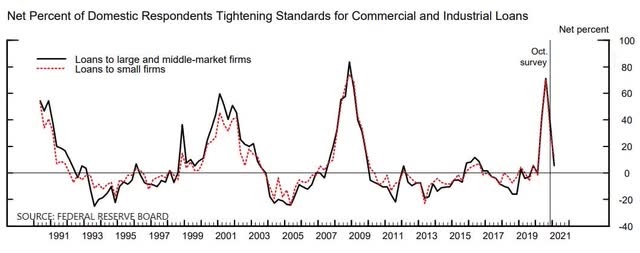

The latest survey of the Fed about measures of supply and demand for commercial and industrial loans shows lending officers easing aggressively lending standards (see above chart). This is an important trend because it confirms credit conditions are improving. This effort to ease credit will further support an already strengthening economy.

Another reliable feature of this index is every major bull market started when the net percentage of lending officers easing credit declined from above 50% - as in the past few months. On the other hand, a major market pause took place following an increase of the net percentage of lending officers tightening lending standards decisively above 0%.

The point. Business is doing well with the US being a major source of global growth. Business will also be supported by ample liquidity. These conditions have always been present during a major bull market in stocks.

Disclosure: I am long SPY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more