A Recession Is Coming: Yield Curve Indication

Image Source: Pixabay

That’s the title of a GJ Collins article on SeekingAlpha today — but it’s not what you think it means…

The resolution of the inverted 10-year and 3-month yield curve usually signals a recession down range.

Well if inversions precede recessions, then this kind of makes sense, although the question is then how much do dis-inversions precede recessions (or do they occur during the recession)?

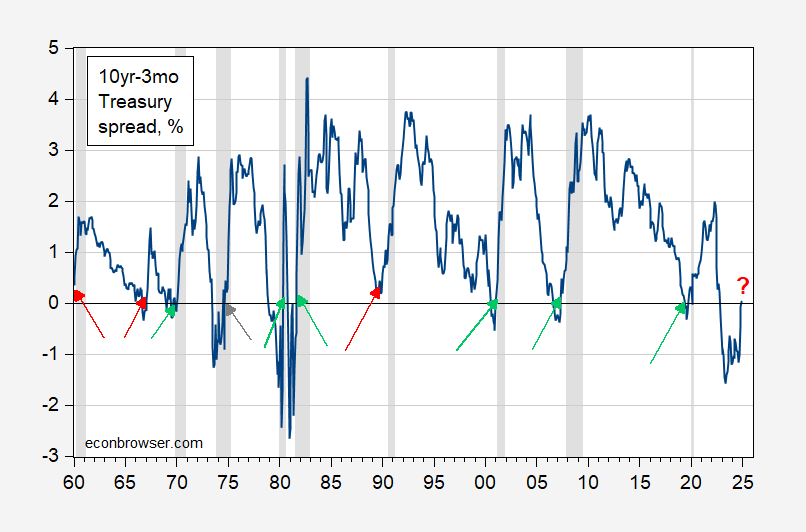

To evaluate this formally, consider the 10yr-3mo term spread from 1960 onward.

Figure 1: 10yr-3mo Treasury term spread, % (blue). NBER defined peak-to-trough recession dates shaded gray. Green arrows indicate events consistent with disinversion signal. Red arrows indicate events not consistent. Source: Treasury via FRED, NBER, and author’s calculations.

I create a disinversion dummy taking on a value of 1 in the first month the spread is positive after being in the negative range. Hence, increases in the spread when no inversion has taken place do not register a 1 value for the dummy.

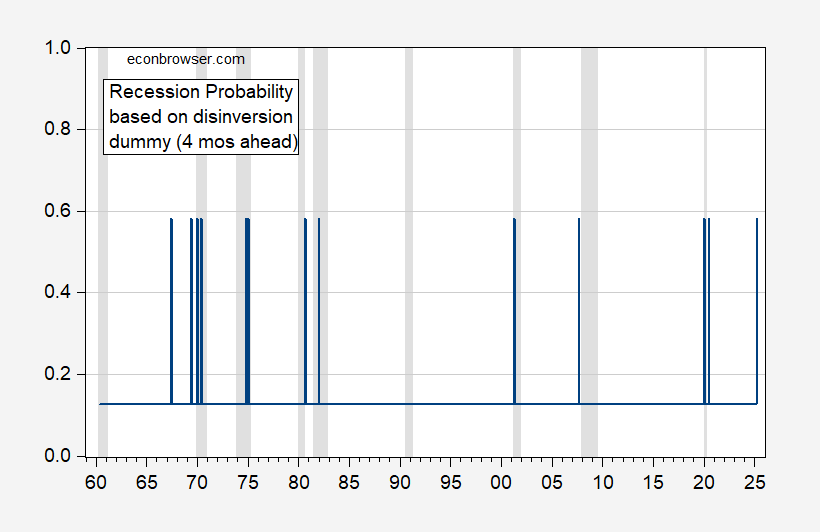

The maximal pseudo-R2 is obtained for a spread of 4 months, over the 1960-2024 period (assuming no recession took place in 2024) is about 0.023. Using this specification (a probit on a binary dummy) yields these recession probabilities.

Figure 2: Estimated recession probabilities using 4 month lead of recession on disinversion dummy (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

The 1960-61 and 1990-91 recessions are missed (although a 10yr-2yr disinversion might catch the latter), while a recession is predicted for April 2025. Of course, if the inversion failed to predict the 2024 recession, is there reason to believe the disinversion will predict well?

More By This Author:

The American People On The Incipient TariffsCBO On The “Trump 10/60 Tariffs”

Administration Forecast Vs. FT-Booth, SPF Vs. Nowcast