A Look At The Last 35 Years Of New Cutting Cycles

Image Source: Pexels

The stock market model for the day is plus or minus 0.50% and then a rally after 2pm. However, with the S&P 500 being up 6 straight days into the Fed meeting, much of the energy has already been used and the study has been reduced to a coin flip. Additionally, a potential set up for a decline may be in play after the Fed meeting.

The FOMC is going to cut interest rates for the first time since March 2020 during the height of the COVID Crash. They began raising rates almost exactly two years later in March 2022 which was roughly 18 months after I began pleading for it to head off the potential inflation I saw coming down the pike.

Today’s meeting has an unusual amount of ambiguity to it. Typically, there is strong consensus one day out about the magnitude of the raise or cut. Not so now. I believe the Fed will cut by 0.25% and they should cut by 0.25%. I vehemently disagree with those who believe a 0.50% cut is warranted, especially with stocks near all-time highs and the economy weakening but not weak. Let’s hope they don’t send the wrong message to the markets.

I saw a group of senators sent Fed Chair, Jay Powell, a letter imploring him to reduce rates by 0.75% today. I literally laughed out loud. That’s either political grandstanding or ignorance or perhaps both. It was inappropriate when former President Trump publicly criticized the Fed. No politician should do that. It’s wrong and undermines the institution. Regardless of what the FOMC does today, as critical of the Fed as I am, I absolutely do not believe their actions will be politically motivated.

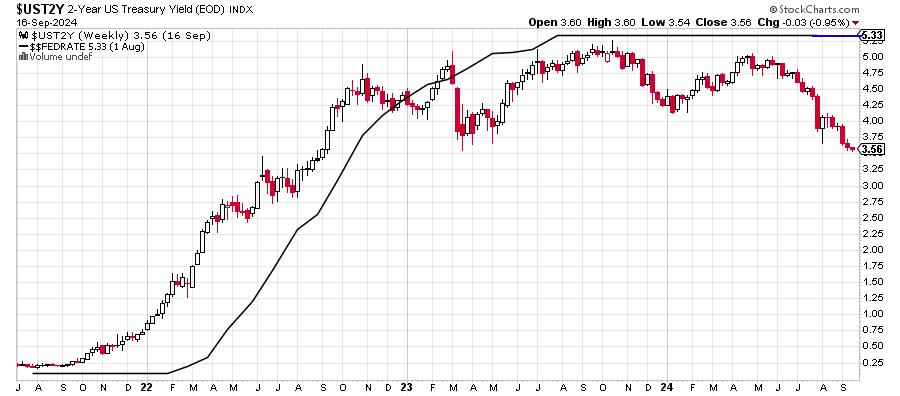

Below is my favorite Fed day chart which shows the 2-Year Note and the Federal Funds Rate. The 2-Year is the best leading indicator out there. It is now roughly 1.75% below the Fed Funds Rate which means the market is expecting a whole lot of cuts coming in the next 12 months. That’s a bit of a head scratcher for me without recession, but something to keenly watch into 2025.

Today marks the end of the longest rate hike cycle since 2007 and 1981 before that. I decided to go back and see how the stock market performed after rate hike cycles became rate cuts.

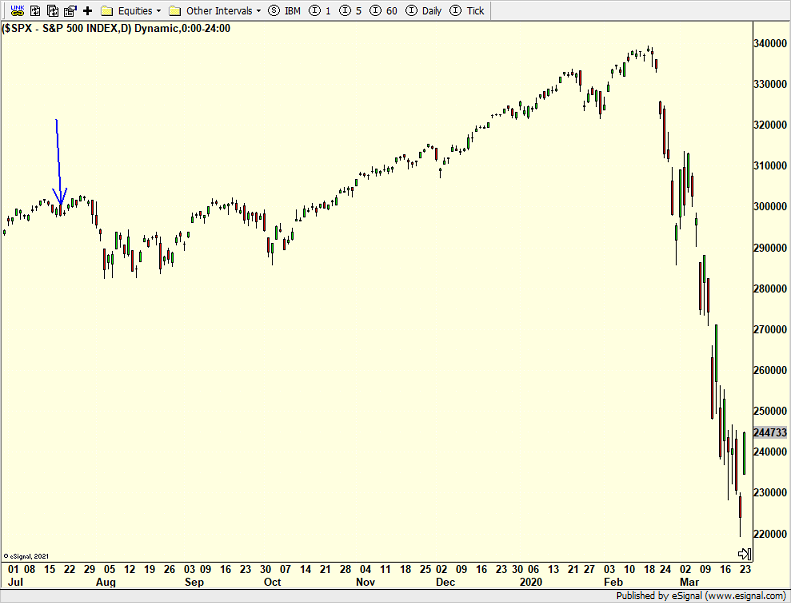

Below is 2019. After a multi-month pullback, stocks roared higher into the February 2020 peak ahead of COVID.

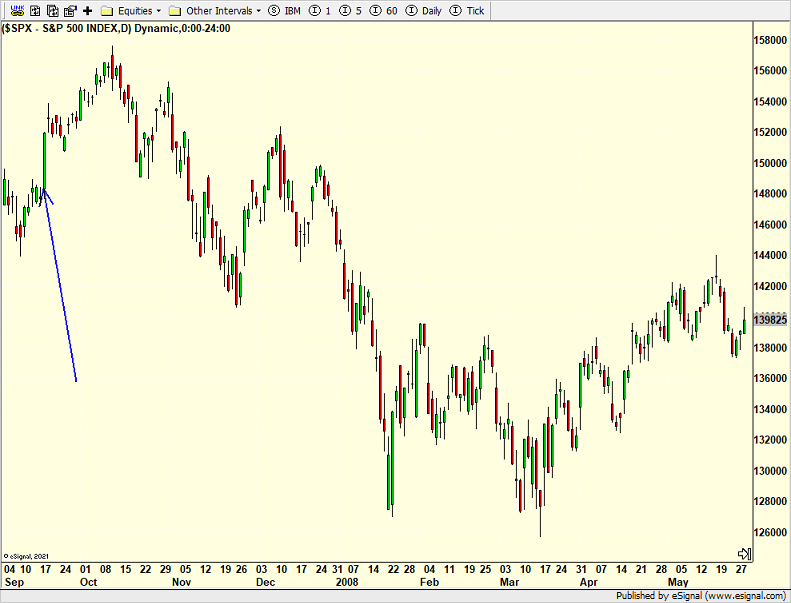

2007 is next. While the cut was initially celebrated, it led to the bull market peak and then a 20% decline in Q1 2008. We all know what happened after that in 2008.

2001 is below. The Dotcom Bubble had already burst in 2000 but Alan Greenspan continued to raise rates which was another in a long line of horrible decisions. The 2001 cut was initially celebrated and then stocks resumed their two year plus bear market.

1995 is next and that’s the analog the masses are hanging their hats on. It was arguably the only elusive soft landing of the modern era. With stocks at all-time highs after a horrid 1994 for bonds, the Fed began to cut rates in July which fueled the early stages of the tech bubble. 1995 was the greatest and easiest investing year of my 35-year career.

Finally, 1989 is below. Stocks chopped around for a month, soared and then saw a mini-crash in October as the leveraged buyout boom abruptly ended, followed by the end of Kidder Peabody in early 1990.

I intentionally excluded the Fed’s new cutting cycle on October 19, 1987 as that was the stock market crash with the Fed forced to respond. Recall that newly appointed Fed Chair, Alan Greenspan, aggressively hiked rates in the months leading up to the crash and then Treasury Secretary, James Baker, famously announced that the U.S. would not defend the dollar.

Maybe you can find a consistent takeaway from recent history. I really couldn’t. I guess you could say that with the exception of 1995, there was no rush to buy stocks.

Markets have run hard and fast into the meeting. If we see some euphoric reaction, I would think it will be a selling opportunity for a trade.

On Monday we bought PEY. We sold TQQQ. On Tuesday we sold FDX, SOXL, RYSIX, QID, NUGT, GDX, EALT, RYRHX, RYHRX and some RYZAX and NVDA.

More By This Author:

Small & Mids Offer “Value” HereWas It Just A Bounce From The August Mini-Crash?

Friday Was All About Window Dressing & Month-End Mark Up

Please see HC's full disclosure here.