2025 Rewind: Bitcoin Hits $126K As ETFs, Institutions Power Bull Run

Image Source: Pixabay

Bitcoin’s journey in 2025 was nothing short of spectacular. The year saw BTC climb from around $87,600 in January to a historic all-time high of $126,200 on October 6.

Institutional adoption, ETF inflows, and macroeconomic trends all played a role, cementing Bitcoin as the undisputed king of digital assets for the year.

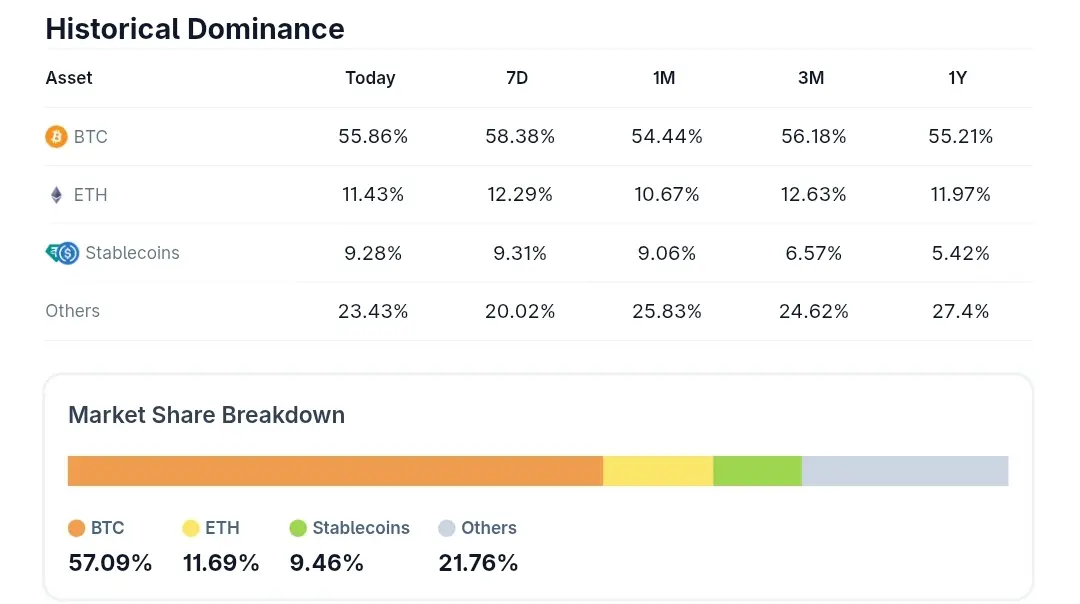

The peak didn’t last, however and Bitcoin pulled back, trading around $83,800 to $90,400 by early December. Bitcoin is surprisingly trending towards a -5% loss for the year, despite the all-time high in October. On the bright side, Bitcoin’s dominance is holding strong at roughly 57% of the digital asset market.

(Click on image to enlarge)

BTC 1Y Chart Source: Yahoo Finance

October’s perfect storm: what propelled Bitcoin to $126K

October saw Bitcoin surge to $126K as multiple factors came together. U.S. spot Bitcoin ETFs saw record inflows, with $3.2 billion entering in a single week, while BlackRock’s iShares Bitcoin Trust added $177 million.

Global uncertainty, including fears of a U.S. government shutdown, pushed investors toward scarce digital assets. As BTC approached previous highs, buying momentum built on itself, and by mid-October, $140K call options were in high demand.

The rally pushed crypto’s total value past $4.29T, up 23% this year. Bitcoin DeFi TVL jumped 12x to $7.5B, with analysts eyeing 300x growth.

Tracking the price journey: month by month in 2025

Bitcoin’s path through 2025 was full of ups and downs, with steady gains punctuated by key spikes. Below is a month-by-month look at closing prices, showing how BTC moved from January toward November:

| Month | Close Price (USD) |

|---|---|

| Jan | $102,405.03 |

| Feb | $84,373.01 |

| Mar | $82,548.91 |

| Apr | $94,207.31 |

| May | $104,638.09 |

| Jun | $107,135.33 |

| Jul | $115,758.20 |

| Aug | $108,236.71 |

| Sep | $114,056.08 |

| Oct | $109,556.16 |

| Nov | $90,394.31 |

| Dec | $87,535.83 |

Bitcoin’s peaks: all-time highs in 2025

Bitcoin didn’t just move steadily; it set multiple interim highs before the October ATH.

Bitcoin’s 2025 Key Highs:

- Early 2025: BTC reclaimed and surpassed late‑2024 highs, topping around $108K in January.

- Mid‑Year Rally: Momentum picked up through May and July, with temporary peaks above $110K and $122K.

- Late Summer: Bitcoin touched roughly $124K intraday in mid‑August.

- All‑Time High: October 5–6 marked the year’s highest price at $126,200.

Source: CoinGecko

2026 outlook: trading at $89K, analysts eye $143K–$400K

Bitcoin closed 2025 with roughly 57% of the crypto market, leading thanks to institutional adoption, BTCFi products, staking, and corporate treasuries. After peaking near $126K in October, it has settled around $87K to $89K.

(Click on image to enlarge)

Source: CoinGecko

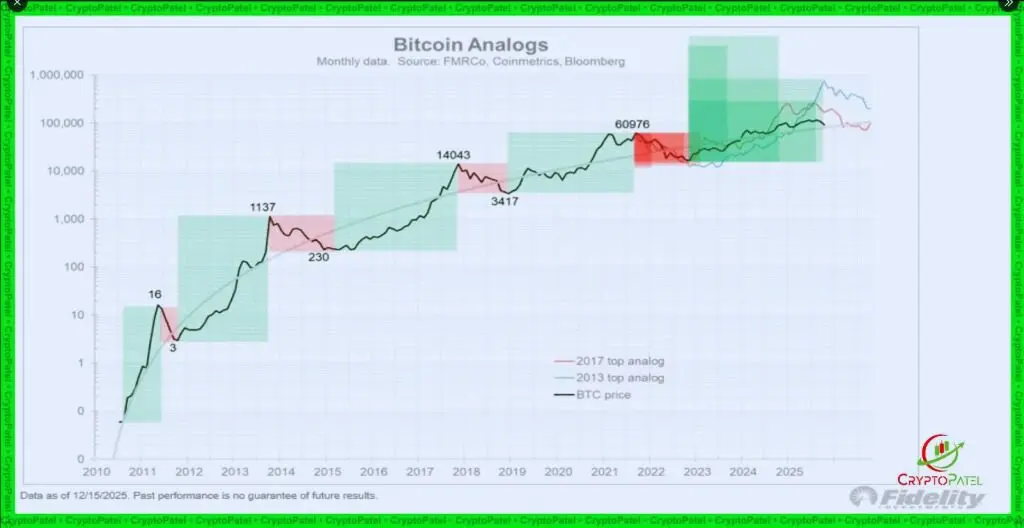

Looking ahead, Citi projects a baseline of $143K for 2026, while more bullish views see $250K–$400K if ETF adoption continues. At the same time, cautionary voices like Fidelity’s Jurrien Timmer noted the high could mark a cycle top, with a potential pullback to $65K–$75K in 2026.

(Click on image to enlarge)

Source: CryptoPatel X

Despite fluctuations, Bitcoin’s October peak reinforced its role as the cornerstone of the crypto market and a strategic hedge in uncertain financial times.

More By This Author:

2025 Rewind: Stablecoin Usage Explodes As Overall Market Hits $300B

Bitcoin, Ethereum ETFs Face December Pullback With $1.13B In Outflows

Will The Bull Market Continue To Charge In 2026?