What, Me Worry? - Addendum

In our latest article “What, Me Worry” we highlighted that complacency in the equity markets, as measured by implied volatility (VIX), is at levels rarely seen. On its own this is not breaking news, but it is very strange when contrasted with the palpable concerns over the coming election and more general market risks such as weak economic growth, extreme valuations, corporate earnings recession and various geopolitical worries. We ended the article asking investors to consider employing equity insurance which looks cheap in the context of the risky environment.

The VIX is an equity volatility index that uses put and call option pricing to calculate an implied level of future volatility. Upon researching specific VIX insurance strategies, we noticed something that caught our attention and further strengthens the case for adding VIX exposure.

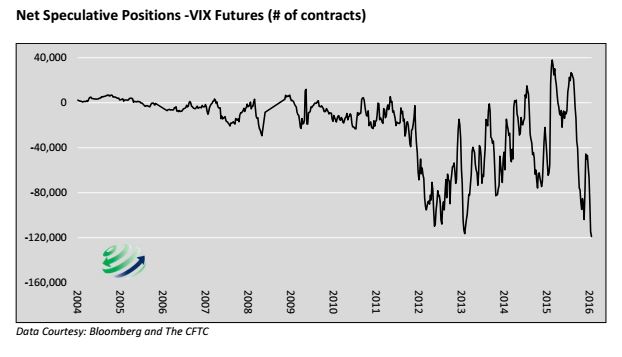

All futures and commodities exchanges release data on the contract volumes and positioning. As one can see in the graph above, net speculative positions in the VIX futures contracts are at record levels of short exposure. In other words, speculators betting on a VIX decline outnumber those betting on an increase in volatility by the largest margin in at least twelve years. A normalization of this positioning could quickly occur and in a disorderly fashion due to the extreme positioning of speculative traders. If this were to occur it would likely add to downside pressure on equity prices.

The current low level of implied volatility may be justified, and the political and economic environment that concern us may turn out to be benign. However, given the potential for market damaging events, the historically low price of insurance, the limited downside of the VIX and the massive net short VIX positions we simply ask one question: What is the harm in acquiring some cheap insurance to protect against downside risk?

Disclosure: Opinions expressed herein are current opinions as of the date appearing ...

more