The Federal Reserve Stays On Its Interest Rate Escalation Track

As is often the case, U.S. Fed policy is having a major impact on global financial developments. In view of the fully employed American economy and firming inflation, the Fed seems securely on track to continue raising interest rates over the next two years.

The tightening of U.S. monetary policy compared with other advanced economies should continue to strengthen the US dollar on world markets.

On June 13th the Fed’s FOMC Committee voted to raise the target range for the federal funds rate by 25 basis points to between 1.75% and 2%.

All eight voting members of the FOMC voted in favor of the rate hike. The latest announcement represented the seventh-rate hike since late 2015 when the Fed first began raising rates from virtually zero.

At its last meeting, Fed experts projected that inflation would likely overshoot its 2% target faster than previously thought, prompting it to raise its forecast for interest rate increases this year. Officials also indicated that they plan to raise interest rates two more times this year for a total of four hikes.

The Fed has stated on several occasions that it will stay the course in terms of normalizing its interest rates. Indeed, one official has indicated that the federal funds rate may have to climb a bit higher than the so-called neutral rate, because the (then) 3.8% unemployment rate was extremely low, which suggests an overheating of the economy may be coming.

In addition, there was a notable change in the language of the Committee’s June statement. The Fed removed expression indicating that it expected the U.S. economy to grow at a pace warranting only "gradual" rate increases.

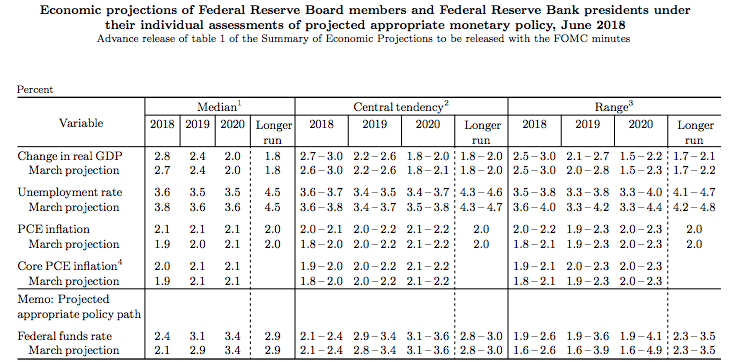

The Fed also updated its forecasts for economic growth and inflation. As the statistics in the following table indicate, officials raised the GDP growth projections for this year to 2.8% from an earlier previous projection of 2.7%. The Fed projects the U.S. economy to grow 2.4% in 2019, 2% in 2020, and 1.8% over the long run.

The Fed’s projections are realistic and are substantially weaker than the White House's forecast of 3% growth in 2021, suggesting the Fed is less optimistic about the boost from tax cuts.

The Fed also anticipates that inflation will overshoot its 2% target this year; in March, officials saw that happening only in 2020.

Examining the data in the following table, and focusing on the median projections, one can see that the Fed officials lowered their median expectation for the unemployment rate this year to 3.6% from 3.8% in March. The Fed also reduced its projections for the unemployment rate in 2019 and 2020 to 3.5% from 3.6%. Over the longer run, Fed officials still expect the unemployment rate to be 4.5%.

Inflation also received a small boost in the Fed’s median projections, with officials now expecting that core PCE inflation, the Fed’s preferred inflation reading which strips out the more volatile costs of food and gas, to be around 2% this year. The Fed maintained its view that core PCE inflation would be 2.1% in each of the next two years.

Disclosure: None.

I actually think the Fed was considering loosing up on the rate increases pushing them further out but its hands were tied by Trump's statements which could be inferred as interfering with the Fed's decision making. The projections show that they are predicting weaker growth and if the trade war further escalates may see still further weakening and inflation rising. We will see how they will cope with that if it happens.

I do think the Fed has room to spread out the rate increases a bit from here if the dollar holds up.

Interesting. Didn't realize that could have such an impact.